Large corporations are transitioning from 'grey to green' energy. Infosys, Mahindra & Mahindra, Tata Motors, and Dalmia Cement are a few of the Indian-headquartered companies that have committed to transitioning to 100 per cent renewable (RE) electricity consumption. As of August 2020, India's construction, infrastructure, automotive, and textile companies have been leading consumer segments for RE, procuring more than 165 MW of RE (WBCSD 2021). Thus, the demand for renewables among large consumers has been steadily rising.

However, states are making direct RE procurement tougher

Large commercial and industrial (C&I) consumers are moving to renewable open access and captive generation to reduce their power purchases from the grid. They are also the best-paying consumers for a distribution licensee (discom); and in the current regime of cross-subsidisation, discoms would not like to lose out on revenue from these consumers.

Cross-subsidy surcharge exemption for captive power plants, banking (where generators inject power into the grid and are permitted to withdraw that power when required), and exemptions on other charges (transmission, wheeling, etc.) are the main policy tools that influence direct RE procurement. Recent trends indicate a tightening of the policy environment for direct RE procurement. For example, Andhra Pradesh has already discontinued banking while Karnataka is likely to follow suit. Maharashtra tried to impose an additional surcharge of INR 1.25/kWh on group captive projects (WBCSD 2021). Haryana Electricity Regulatory Commission (HERC) has introduced a reliability charge of INR 1.5/kWh on solar power bought by open-access consumers and increased banking charges to INR 1.5/kWh.

Haryana – a case study

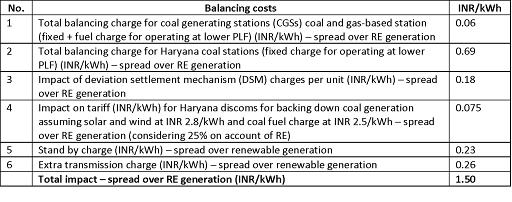

Haryana’s discoms, through the Haryana Power Purchase Centre (HPPC), have submitted that RE integration costs them INR 1.5/kWh (HERC 2021a). The contributing factors cited by the discoms are listed in Table 1. As indicated, this calculation accounts for the impact of all RE procurement, including that by discoms and other direct buyers. The specific cost implications of open access and banking are not stated.

Table 1 Snapshot of the breakup of reliability costs submitted by the HPPC to the HERC

Source: Order of the HERC dated 27 April 2021 in the Matter of HERC (Terms and Conditions for Determination of Tariff from Renewable Energy Sources, Renewable Purchase Obligation and Renewable Energy Certificate) Regulation, 2021, for the Control Period from FY 2021–22 to FY 2024–25.

Direct procurement of solar power is no longer viable in Haryana

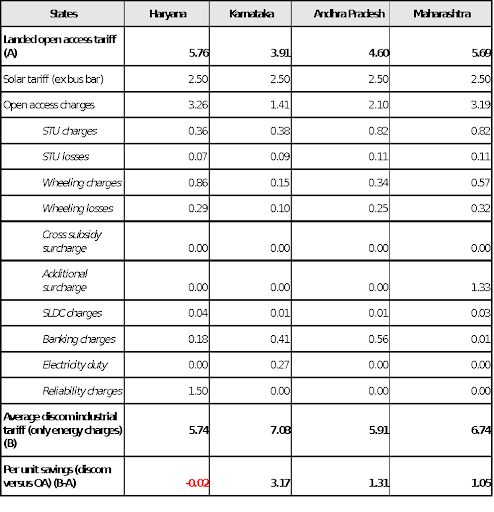

CEEW-CEF used its recently launched advanced open access calculator to calculate the landed costs for solar power sourced through intra-state open access in four states (Table 2). With the imposition of reliability charges and increased banking charges, transitioning to open-access RE becomes unviable for C&I consumers in Haryana.

Table 2: State-wise open access charges for a solar, captive industrial consumer

Source: CEEW-CEF Open Access Landed Cost Calculator

Reviewing agreements with older plants and tying up with younger plants can save costs

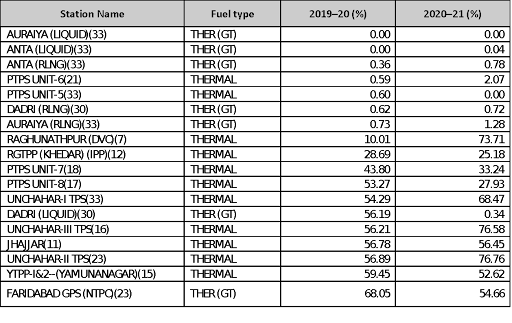

Per the data provided by Haryana discoms, almost 55 per cent (INR 0.82/kWh) of the cost of RE integration is incurred because of backing down thermal power plants and their fixed costs payments. In this context, it is useful to examine Haryana’s thermal fleet and power procurement trends. Table 3 demonstrates that multiple thermal plants have negligible utilisation. The low scheduling of these plants cannot be solely because of RE generation, which was only 0.4 per cent of total long-term procurement in 2017–18 (HERC 2019).

As of December 2021, Haryana’s long-term tied-up coal capacity with central and state generation stations was 8,338 MW. Including gas, hydro, and nuclear, this goes upto 10,874 MW. As per load dispatch centre data analysed from June 2019 onwards, the typical peak demand for the state during October to April was in the range of 4,800 to 7,250 MW. This implies that fixed costs are high on account of the low utilisation of these plants for most of the year. Therefore, in this scenario, reviewing the power purchase agreements (PPAs) with older plants and tying up with younger plants can drive up plant load factors, reduce fixed costs, and potentially reduce total variable costs for the state discoms.

Table 3: Declared generation as a percentage of scheduled generation for 2019–20 and 2020–21 for selected plants in Haryana’s portfolio

Source: Authors’ analysis based on data from MERIT portal

Note: (1) Dispatch data from the MERIT portal is ex-ante. The actual procurement may be higher or lower.

(2) Age of the plants in years is indicated in parentheses.

(3) THER (GT) = Gas stations.

Open-access or distributed RE projects, while posing costs to the discoms, can also be beneficial

Distributed generation systems have benefits like avoided power purchase costs, avoided fixed costs, reduced distribution charges and losses, deferred capital expenditure, etc. Replacing existing generation capacity with distributed generation can lead to avoidance of expensive power purchases and has the potential to reduce the average power purchase cost (APPC). For FY 2022, HERC has approved an average power purchase cost (APPC) of INR 5.44 per kWh (INR 4.06 plus INR 1.38 of inter-state, intra-state transmission charges and state load despatch centre (SLDC) charges) for conventional plants.

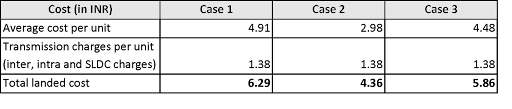

There are several candidates that qualify as expensive coal capacity. For example, as approved for FY22, there are nine coal plants – Koderma TPS, Unchhahar TPS III, Unchhahar TPS IV, Mejia TPS, Unchhahar TPS I, Unchhahar TPS II, Raghunathpur TPS, Kahalgaon I STPS, and Farakka STPS, with an average cost of more than INR 4 per kWh. Out of these, Unchhahar TPS I, Unchhahar TPS II, Kahalgaon I STPS, and Farakka STPS are 25 years or older. Table 4 below shows the landed per unit cost of these power plants.

- Case 1: Fixed cost plus the variable cost of the above nine plants.

- Case 2: Only variable cost of the above nine plants.

- Case 3: Fixed plus variable costs of the above four plants that are 25 years or older.

Table 4: Landed cost for the most expensive coal capacity

Source: Authors’ analysis

Note: All figures as per the approved power purchase quantum and charges for FY 2022 by the HERC.

Distributed solar plants embedded in the distribution network, close to load points, will be available to provide power at tariffs lower than the above landed costs, and will also save on transmission and distribution (T&D) losses. Additionally, discoms can avoid renewable purchase obligation (RPO) compliance costs of INR 2.2 per unit procured through open-access, assuming that these plants are availing banking and concessional wheeling (IEX 2022).

There is a case for Haryana to leverage short-term markets for RE trading

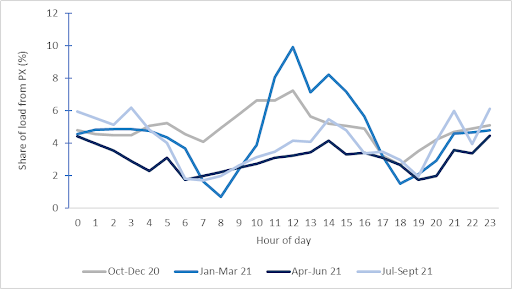

Further, Haryana discoms already transact on the short-term market. They purchase up to 10 per cent of their load from power exchanges (“PX”) on average (Figure 1). This presents a case for the state to explore offloading the surplus RE generation in power markets because it has a much higher capacity to sell/purchase from the PX compared to small RE generators.

Figure 1: Share of load purchased from PX

Source: Authors’ analysis based on data from Vidyut Pravah portal

Moving ahead

Given this context, key questions for state regulators and policymakers are:

- What are the opportunities that discoms need to tap and what role can play in cost-competitively meeting the needs of their high-paying consumers?

- How should fixed-cost implications be reduced such that discoms can utilise the gains to make C&I tariffs more attractive?

In conclusion, balancing the interests of all stakeholders is key to enabling corporate RE procurement through open access in Haryana as well as other states. Our recommendations to ensure the same are provided below.

Conduct systems-level analyses of costs and benefits of alternative procurement options:

Distributed RE within the state, utility-scale hybrid RE, demand response, and energy storage in near future have clear advantages for discoms. These benefits must be estimated. Savings on the cost of power procurement from expensive thermal plants can be significant as shown in Table 4. Compensation charges for the non-maintenance of the minimum technical limit (MTL) throughout the year can also be reduced. If discoms are able to reduce their fixed costs, the gains can be used to reduce cross-subsidies levied on C&I consumers, making tariffs attractive.

Review power procurement profiles and leverage short-term markets to reduce the impact of deviations:

Discoms must revisit their long-term portfolios and plan for the replacement of old and excess capacity with flexible supply options as mentioned above. These flexible options, along with accurate load forecasting, can enable discoms to use new market platforms such as real-time markets (RTM) and ancillary services (AS) strategically and cost-effectively.

Currently, Haryana has an installed capacity of only 40 MW of solar open-access-based captive projects. Hence, the Haryana discoms must make the impact data publicly available so that such impact may be understood by all stakeholders. Further, flexible supply- and demand-side options, and market platforms like the RTM and the proposed AS market, allow both generators and discoms to reduce procurement and balancing costs. The HERC, generators, discoms, and the HPPC need to mutually agree on the best transition pathway and share the costs and benefits of RE to become future-ready.

References

- IEX. 2022. “REC Data at Indian Energy Exchange (IEX).” Indian Energy Exchange. https://www.iexindia.com/marketdata/recdata.aspx.

- HERC. 2019. “Commission’s Order in Case No. HERC/PRO - 52 of 2018 & HERC/PRO - 53 of 2018 on True-up for the FY 2017–18, Annual (Mid-Year) Performance Review for the FY 2018-19, Aggregate Revenue Requirement of UHBVNL and DHBVNL and Distribution and Retail Supply Tariff for the FY 2019-20.” 7 March. https://herc.gov.in/WriteReadData/Orders/20190307a.pdf.

- HERC. 2021a. “Order of the HERC dated 27 April 2021 in the Matter of HERC (Terms and Conditions for Determination of Tariff from Renewable Energy Sources, Renewable Purchase Obligation and Renewable Energy Certificate) Regulation, 2021, for the Control Period from FY 2021–22 to FY 2024–25.” Haryana Electricity Regulatory Commission. https://herc.gov.in/WriteReadData/Orders/O20210427b.pdf.

- HERC. 2021b. “Commission’s Order in Case No. HERC/PRO - 77 of 2020 & HERC/PRO - 78 of 2020 on True-up for the FY 2019–20, Annual (Mid-Year) Performance Review for the FY 2020–21, Aggregate Revenue Requirement of UHBVNL and DHBVNL and Distribution and Retail Supply Tariff for the FY 2021–22.” Haryana Electricity Regulatory Commission, 30 March. https://www.herc.gov.in/WriteReadData/Orders/O20210330a.pdf

- Kabeer, Nitin. 2019. “Toyota Motor’s 87% of Power Needs at Karnataka Facility Sourced from Renewable Sources.” Mercom India (blog), March 27. https://mercomindia.com/toyota-motors-karnataka-facility-renewable-sources/.

- WBCSD. 2021. “Corporate Renewable PPAs in India.” Geneva: World Business Council for Sustainable Development. https://www.wbcsd.org/contentwbc/download/11241/165820/1.