Context

Counterparty risk associated with delay/default in regular payments by distribution companies is one of the most critical risks for power producers. Nearly 88% of the power offtake from power producers in India happens through long-term tie-ups[1] with distribution companies. Traditionally, discoms in India, are owned by state and have been suffering due to leakages in transmission and distribution system, poor collection efficiencies, tariff controls etc.

Power producers enter into power purchase agreements (PPA) with the discoms for sale of power on key contractual terms such as tenure, tariff, billing and payment security mechanism. However, the poor financial health of the discoms raises the price at which power producers can raise capital due to the risk on receivables. Further, delays in payment to power producers has serious cash flow implications for power producers, hurting their long term business viability. To reduce both, the perception and the quantum of this risk for investors, the government has ensured multiple levels of payment security in renewable energy PPAs, such as letter of credit, default escrow agreement, payment security fund, tripartite agreement and state government guarantee. This is called a payment security mechanism. Following list briefly describes each:

- Letter of credit: A letter of credit (LC) is a standard document offered by banks (typically against a fee to be paid by Discom) guaranteeing the beneficiary of payments (SPD) up to total amount of the letter (typically 1.1 times average monthly energy bill raised by SPD to Discom). LC can be invoked if Discom defaults on its payment.

- Default escrow agreement: An Escrow is a legal concept in which a financial instrument or an asset (in this case, Discom’s cash flows) is held by a third party (typically a bank) on behalf of two other parties. A default escrow agreement is signed between the power producer and discom for an amount typically equivalent to the LC.

- Payment security fund: It is a capital reserve that provides interest-free capital to its beneficiary in case of default in payments by any discom (typically equivalent to three months of payment for energy sale to discom).

- Tripartite agreement: Under this agreement, in the case of default by state-owned discoms, the central government can withhold financial assistance payments to the state governments. Past experience with tripartite agreement shows that it plays a strong deterrent role against defaults/ delays by Discoms. Tripartite agreement is specifically applicable to PPAs signed between power producers and SECI[2].

- State government guarantee: In case of PPAs signed directly between power producers and state discoms, a fixed amount maybe guaranteed by the state government as an alternative to tripartite agreement.

Relevance & Impact

Payment security mechanisms have had a positive impact in improving the credit rating of renewable energy projects and in ensuring certainty of payments from state discoms. In February 2017, SECI was made a beneficiary of a tripartite agreement between the Government of India, state governments and RBI. NTPC has been beneficiary to such a tripartite agreement since 2002. ICRA (a credit rating agency) enhanced the credit rating of SECI from AA- to AA+, with the tripartite agreement providing additional security against payment default by discoms. Thus, a payment security mechanism (tripartite agreement in this case) can also be an effective mechanism to reduce or forego additional risk premiums reducing lending rates for renewable energy projects.

Who should care

- Renewable energy developers and investors

- Discoms

- Credit rating agencies

- Policy makers

Case study

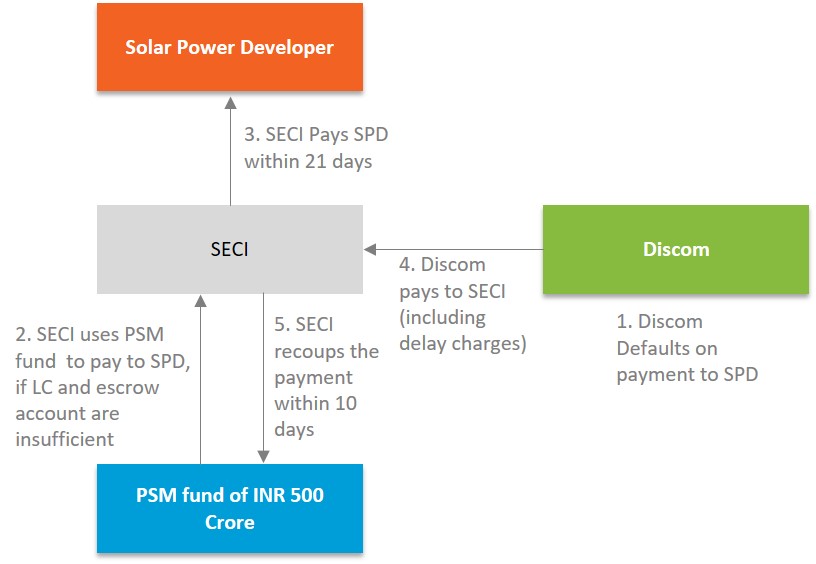

Figure 1 briefly explains how a payment security mechanism works with the help of an example of SECI’s payment security fund for VGF scheme under JNNSM[3]. The arrows marked with numbers represent the sequence of events for the use of PSM to cure default by a discom.

Figure 1: SECI's PSM for VGF Scheme under JNNSM

Note: PSM can only be accessed if Letter of Credit (LC) and Default Escrow Agreement are insufficient to cover for the default.

In case, the default by a Discom persists (that is, it does not pay to SECI) for more than six months from due date, SECI may invoke the tripartite agreement. In this case of default by Discom and persistence of non-replenishment of LC and escrow account, SECI also has a right to divert the generated solar power to sell to a third party.

References

- [1] Source: Report on Short-term Power Market in India, 2017-18. www.cercind.gov.in/2018/MMC/AR18.pdf

- [2] Solar Energy Corporation of India (SECI) is a central aggregator that bids out solar capacity, procures power from power producers and sells it to discoms

- [3] https://mnre.gov.in/sites/default/files/webform/notices/sec.pdf