1. What is change in law?

Ideally, power purchase agreements (PPAs) are required to factor all the costs associated with compliance of current legal obligations in their tariff. Change in law risk pertains to the probability of unexpected changes in the legal/regulatory framework after the bids have been submitted. Recent examples of cases where the change in law clause in a PPA was invoked include the introduction of new taxes/duties such as GST and the safeguard duty on solar cells and modules.

2. Why is protection from change in law critical to improve the bankability of PPAs?

Unexpected changes in the legal/regulatory framework applicable for a power project could have a significant impact on the underlying cost assumptions of a project and render a project unviable. Such changes are more susceptible with respect PPAs, since PPAs are long-term contracts. Hence, it is imperative that a PPA addresses the risk of change in law and clearly identifies the party which will be liable for the contingencies on account of change in law, and the compensation mechanism for the same. A robust change in law provision is essential to enhance the bankability of PPAs.

3. The state of change in law under RE PPAs in India

3.1. A clear and comprehensive scope of change in law – must clearly include within its ambit all the laws that the parties are required to comply, state what will (and not) constitute a change in that law, the trigger date and the authorities which can authorise the change in law. Basis our review of available PPAs[1], recently issued PPAs have a comprehensive definition, however, some of the earlier PPAs which continue to be in force, have ambiguous and incomplete definitions – some include amendments but exclude the enactment of new laws or the obligation to acquire new clearances and permits. Some PPAs expressly disallow any change on grounds of change in taxes, rendering the clause inefficacious.

3.2. Clear and swift procedure for compensation - As per the Electricity Act, 2003, ERCs are required to approve any adjustments in tariff under a PPA. Most change in law clauses in RE PPAs do not set out any procedure to be followed by parties other than for the aggrieved party to directly approach the appropriate ERC. However, there have been inordinate delays in disposing of change in law petitions. Another factor is parties taking adversarial positions and unnecessarily contesting claims before the ERC. The process may be expedited by providing for parties to discuss and engage with the issue in a time bound manner, before approaching the ERC.

Additionally, to incentivise parties to expedite petitions, once a change in law petition has been filed, the liable party may be required to pay a part of the claim, in an escrow account, till litigation is pending. In case the claim is denied, the amount paid is required to be refunded with due interest.

3.3. Fair compensation

- Carrying costs- Intent of a change in law clause is to restore the affected party to the same economic position as if no such injury had been caused. Since there is a substantial time lag between the period when a change in law occurs and when it is approved by an ERC/paid by the liable party, the final amount should be adjusted in accordance with the time value of money (carrying costs). However, many PPAs do not expressly set out the principle of restitution to be applied when considering the relief for a change in law – in the absence of clear mention, carrying costs have been denied by judicial authorities.

- Extension in scheduled commercial operation date- Change in law events may have time implications on a project. A change in law event during the construction period (for e.g. the need to obtain a new permit/unreasonable delay in procuring a consent) could impact the scheduled milestones of the project. Most RE PPAs, only provide monetary compensation for change in law and therefore any impact on the timelines of a project due to a change in law event during construction period remains unaddressed. Accordingly, the relief for change in law during the construction period should also include suitable extension in the scheduled commercial operation date of the project.

- Minimum threshold for compensation- In order to avoid insignificant claims, a minimum threshold of impact may be included. This practise has been adopted in solar PPAs issued by GUVNL since 2017 and was also incorporated in the REWA PPA.

3.4. Absence of standard PPAs

Unlike thermal PPAs, there are no standardised wind/solar PPAs. Ministry of Power, in 2017 issued the competitive bidding guidelines for procuring power from grid connected solar and wind projects. However, the guidelines permit for deviations from its provisions with approval from the relevant ERC. In the absence of a standard PPA and the window to deviate from the competitive bidding guidelines, there have been some instances which defeat the objective of change in law:

- PPAs issued by TANGEDCO in 2017/18 specifically exclude the change in law provision. This has been approved by TNERC. Judicial precedents exist where parties have not been able to claim relief in the absence of a change in law clause.

- PPAs issued by GUVNL in 2018 account only for the impact on final output of energy or sale of electricity within change in law, clearly excluding the impact of change in law on CAPEX/OPEX. Notably, the latter is included in the PPAs issued by SECI / NTPC.

4. Case study: Safeguard Duty

On July 30, 2018, Ministry of Finance (MoF) issued a notification imposing safeguard duty (SGD) on solar panels imported from China and Malaysia. A 25 per cent duty is being levied during the first year. The duty rate will decline to 20 per cent for six months starting July 2019 and will be further reduced to 15 per cent for the last six months.

Table 1: Projects for which PPAs have been signed before 30 July 2018 |

Level of safeguard duty |

25% |

20% & 15% |

Capacities of modules (MW) |

5858 |

0 |

Source - CEEW CEF Analysis |

Projects bid out prior to this period had not accounted for this unforeseeable additional and could be rendered unviable if state commissions don’t approve the pass-throughs in tariffs. The notification from the Ministry of Finance did not make any clarification regarding whether the duty would be considered as a change in law event and hence a pass through under the executed PPAs. Therefore, the levy of the duty has resulted in great uncertainty for investors.

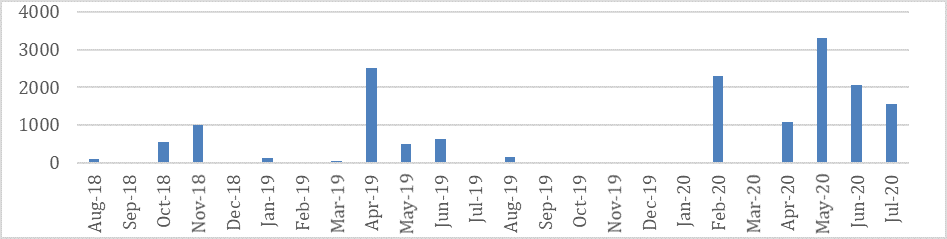

Figure 1: Module procurement during applicability of safeguard duty is concentrated in low-duty periods |

|

Source CEEW CEF Analysis |

Even in PPAs where imposition of a new tax/duty is within the scope of change in law, there is considerable anxiety since:

- regulatory approval will be required for pass through of the impact of SGD, which imparts subjectivity in the process;

- it is apprehended that loss-making distribution companies would resort to litigation and delay coughing up the extra money;

- delay in adjudication and payment of compensation will impact the cash flow of project developers.

References

- [1] Our analysis is limited by a review of 20 PPAs issued / executed by states / centre between 2010 - 2018. However, if we had access to more PPAs from different RE rich states across time, we would have liked to map a co-relation between the installed capacity of wind and solar power in different states with the evolution of PPAs. This information can also help us compare the different states and assess whether some states had more capacity installed as compared to others with more robust PPAs. We seek your support in sharing PPAs with us, for academic use only with a strict non-disclosure agreement in place.