Indian corporates are increasingly committing to emissions reduction targets, with eight of India’s top ten companies by market capitalisation setting net-zero targets for between 2030 and 2050 (Net Zero Tracker, 2022). Some notable Indian companies that have committed to net-zero targets include Reliance Industries, Infosys, Hindalco, UltraTech Cement, Dalmia Cement, State Bank of India, Mahindra & Mahindra, JSW Steel, AB InBev, Mahindra & Mahindra, and Coal India. Enabling access to cheap capital at scale will play a critical role in helping companies achieve these targets. As pointed out in a recent paper by the Council on Energy, Environment and Water (CEEW), India’s net-zero targets will require investments of about USD 10.1 trillion between 2020 and 2070. The ensuing search for attractively priced capital at scale has led many Indian firms to access the international sustainable bond markets. Sustainable or ESG (environmental social governance) bonds are broadly of two types:

- Use of proceeds bonds, and

- Sustainability-linked bonds.

The capital raised from ‘use of proceeds’ bonds is required to be directed towards green, social, or sustainability (combination of green and social) projects or transition activities (see Box 1). Examples of qualifying projects include those pertaining to renewable energy, green buildings, clean transportation, access to essential services, energy efficiency, pollution prevention, and affordable housing. An example of a qualifying transition activity is the decarbonisation of the hard-to-abate aviation industry by switching to low-emission jet fuel.

Source: “Green, Sustainability, and Social Bonds for COVID-19 Recovery,” Asian Development Bank, February 2021. Access here: https://www.adb.org/sites/default/files/publication/678191/green-sustainability-social-bonds-covid-19-recovery.pdf

Use of proceeds bonds are quite different from sustainability-linked bonds (SLBs), as the former can only be utilised to finance the kinds of projects/activities listed in Box 1 above. For the latter, the use of the proceeds from the bond is not a determinant. Instead, a company issuing SLBs targets future improvements in predetermined key performance indicators (KPIs) and sustainability performance targets (SPTs). The KPIs are derived from the United Nations' 17 Sustainable Development Goals (for example, to increase the amount of renewable energy used by a company). The company need not demonstrate that the proceeds of the SLB have played a role in the actual improvement of those indicators or targets. It is given the flexibility to use the proceeds for general corporate expenses as long as the SPTs are achieved.

Sustainable bonds market overview

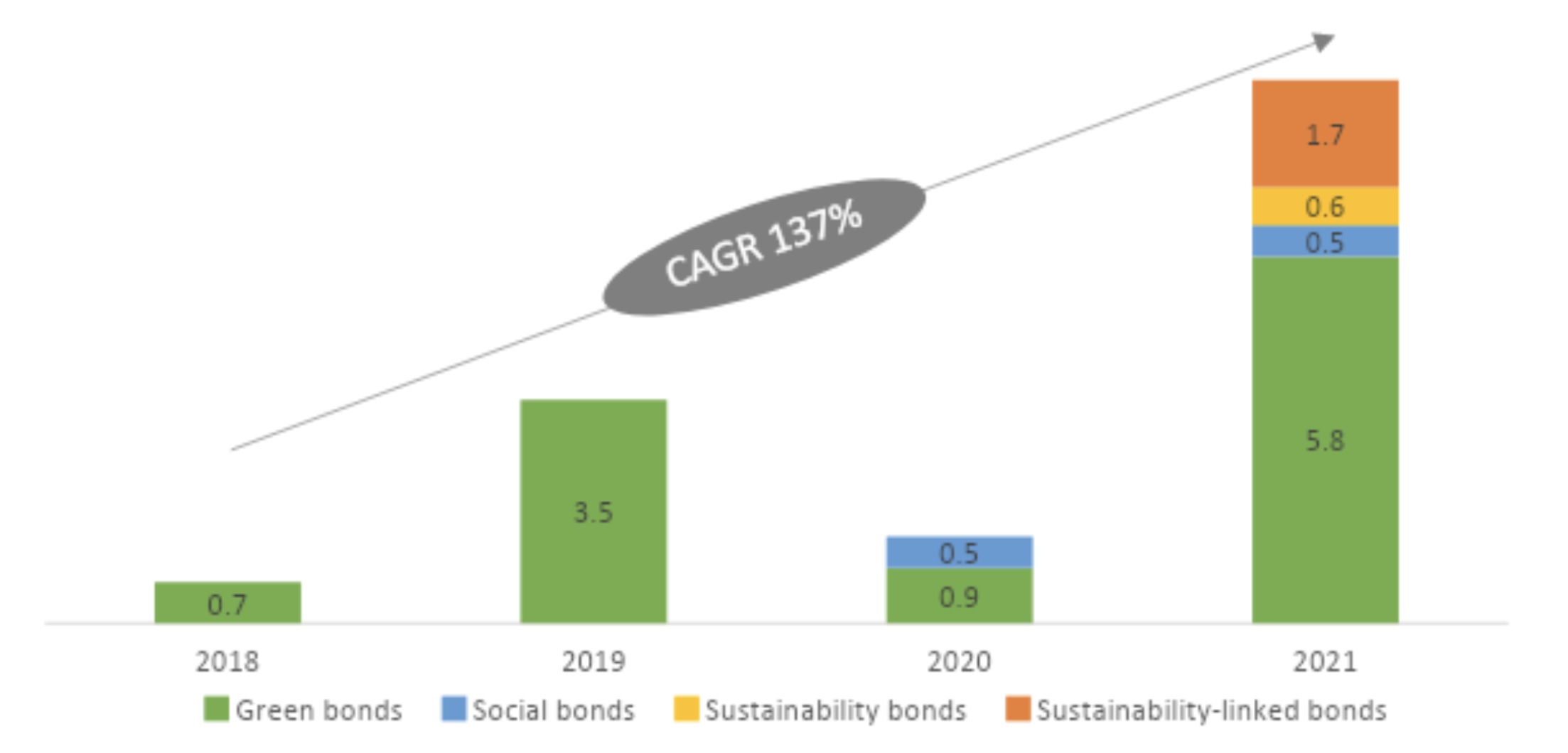

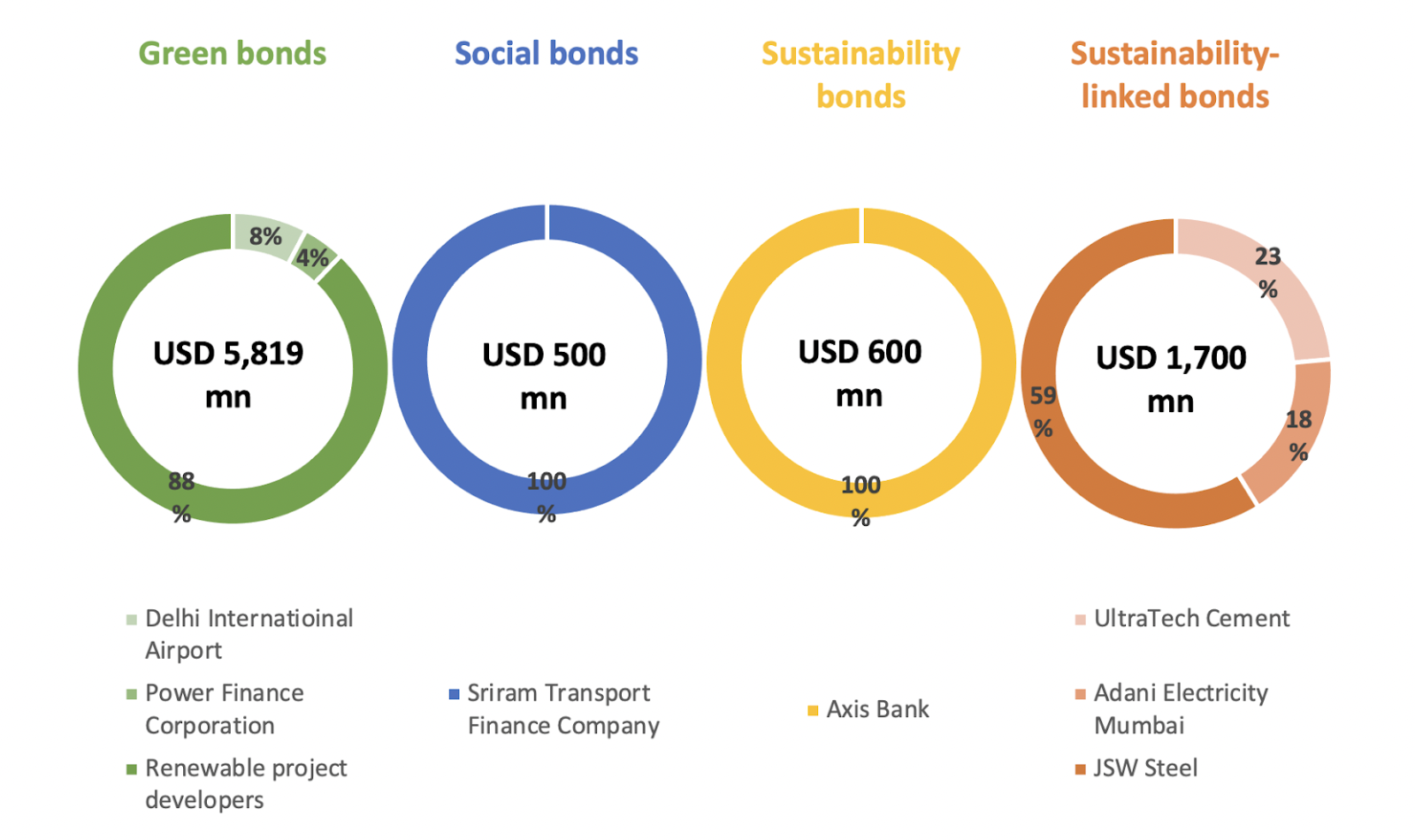

Given the strong appetite of global investors for paper backed by sustainability themes, Indian companies (mostly renewable energy (RE) project developers) have been tapping the international green bonds market, mostly to refinance their existing costlier debt. Indian companies are also foraying into newer segments beyond green including and are exploring social bonds, sustainability bonds, and SLBs (see Figure 1). The bond by Sriram Transport Finance Company (see figure 2) was the second of its social bond issuances (the first was in 2020). Its purpose was to raise capital to provide affordable finance to small road transport operators from underserved communities as well as to micro, small, and medium enterprises (Social Bond Annual Review, 2021). On the other hand, Axis Bank’s marquee sustainability bond issuance (see Figure 2) raised funds for a variety of green and social projects (Axis Bank Sustainable Financing Framework, 2021).

Figure 1: International sustainable bonds issuances by Indian companies (USD billion)

Source: CEEW-CEF research

Moving to sustainability-linked bonds, these too have gained popularity globally, particularly in the last couple of years. Not surprisingly, this segment also saw robust adoption by Indian companies in 2021. UltraTech Cement, JSW Steel, and Adani Electricity Mumbai issued SLBs worth USD 1.7 billion in 2021. For these bonds, the financing costs are typically linked to the achievement of targets defined by the company. If the company fails to meet the targets, financing becomes more expensive. In UltraTech Cement’s case, the company aims to reduce its scope 1 CO2 emissions, a KPI measured in kg CO2 per ton of cementitious material (kg CO2/t.cem), by 22.1% from the 2017 baseline to 557 kg CO2/t.cem by March 2030 (ISS ESG, 2021). Failure to do so would invite a penalty on the USD 400 million issuance by increasing the bond coupon rate from 2.80% to 3.55% per annum. On the other hand, the proceeds from the SLB shall be used for refinancing existing rupee-denominated debt, ongoing capex, and general corporate purposes.

Figure 2: International sustainable bonds issuances by Indian companies in 2021 (Issuer details) (USD million)

Source: CEEW-CEF research

Financing the transition for hard-to-abate sectors with SLBs

Technologies exist to support the transition of large parts of the Indian economy, such as the electricity sector, where decarbonisation has been driven by mature technologies like solar PV and onshore wind turbines (GHG Platform India, 2018). However, the same is not true for hard-to-abate sectors such as aviation, shipping, heavy road transport, and energy-intensive industries such as iron and steel, cement, plastics, fertilisers, and aluminium. While key technologies with the potential to decarbonise these sectors do exist (e.g., carbon capture, energy storage, and green hydrogen), there is an urgent need to further develop and deploy these technologies. For these sectors, net-zero technologies are niche, with low performance and high costs, and therefore cannot compete with established processes (HSBC, 2020). There is also a lack of policy certainty and a well-defined incentive framework to accelerate technology deployment. This has left investors wary of the risks associated with such sectors.

The SLB market has seen success globally in recent years. However, it has so far done poorly in mitigating emissions in hard-to-abate sectors (HSBC, 2020). Companies in such sectors often need to undertake complex transformations to reduce their emissions, which include many incremental efficiency steps that may not be seen as “green”. For example, an airline company may use a green bond to finance research on biojet fuel, but investors may not be willing to accept the financing of a new, less carbon-intensive fleet of aircraft (HSBC, 2020).

Sustainability-linked finance (bonds) offer a solution to this problem. These bonds can be ideal for sectors that are energy-intensive, but which cannot go completely green in the short term as they do not have access to economically or technically feasible green alternatives. As companies have some flexibility around the use of the proceeds of these bonds, SLBs may be utilised to finance niche technology projects such as green hydrogen or carbon capture, as long as the defined sustainability targets are achieved.

They may also bring in more issuers and investors owing to such flexibility. Linkage to specific outcomes creates more accountability and transparency in financial markets. It also reduces the risk of ‘green washing’, where companies claim to be more environmentally friendly than they really are. On the flip side, high transaction costs due to stringent baselining, audit, and reporting requirements may deter companies from accessing the SLBs market.

Key enablers for unlocking in India

Mitigating the challenges identified, and unlocking access to finance for hard-to-abate sectors in India, requires policymakers to undertake interventions. They include:

- Policy certainty: Establishing clear pathways and policies for each hard-to-abate sector can provide clarity for issuers (companies) and investors, thereby lowering their risk perception.

- Standardisation: Standardisation around sustainability performance measures for hard-to-abate sectors can help drive down transaction costs for SLBs.

- Financial incentives: Tax incentives on SLBs, either for issuers or for investors, can help stimulate liquidity in the market, as would reducing the transaction costs through direct grants.

- Stranded asset write-offs: Early write-offs or decommissioning of assets could be incentivised through government policies or grants. In hard-to-abate sectors, such as the steel industry, switching from blast furnaces to hydrogen would require scrapping existing plant machinery before the end of its useful life.

References

- Axis Bank Sustainable Financing Framework. (2021, July). Axis Bank Sustainable Financing Framework. Retrieved from Axis Bank: https://www.axisbank.com/docs/default-source/default-document-library/axis-bank-sustainable-financing-framework.pdf

- Garg, S. R. (2021). Financing India’s Energy Transition Through International Bond Markets. Retrieved from The Council on Energy, Environment and Water: https://cef.ceew.in/solutions-factory/publications/financing-india-energy-transition-through-international-bond-markets

- GHG Platform India. (2018). GHG Platform India. Retrieved from GHG Platform India: http://www.ghgplatform-india.org/

- HSBC. (2020, June). Why Transition Finance Is Essential. Retrieved from HSBC: https://www.hsbc.com/insight/topics/why-transition-finance-is-essential

- ISS ESG. (2021, February 2021). "Second Party Opinion: Sustainability Quality of the Issuer and Sustainability-Linked Securities." Retrieved from ISS Corporate Solutions: https://www.isscorporatesolutions.com/file/documents/spo/spo-ultratech-20210203.pdf

- Net Zero Tracker. (2022, March 14). Net Zero Tracker. Retrieved from Net Zero Tracker: https://zerotracker.net/

- Social Bond Annual Review. (2021, October 27). Social Bond Annual Review. Retrieved from Shriram Transport Finance Co. Ltd.: https://cdn.stfc.in/common/Sustainalytics-STFC_Social_Bond_Annual_Review_2021-USD725mn.pdf

- Sustainable Bonds Insight. (2022, February 16). Sustainable Bonds Insight. Retrieved from Environmental Finance: https://www.environmental-finance.com/content/downloads/sustainable-bonds-insight-2022.html