Context

The importance of addressing climate risks and accelerating inclusive and sustainable economic growth is becoming increasingly apparent in the global policy and regulatory discourse. In this context, businesses can contribute to the development of a sustainable economy by mitigating the negative impacts of their activities on the society and environment. Moreover, investors are increasingly recognising the importance of sustainable business practices and showing a growing interest in environmentally and socially responsible businesses.1 Additionally, there is some evidence to suggest that companies that prioritise sustainability and social responsibility tend to outperform their peers financially in the long term2.3, The growing interest of investors in sustainable business practices, and the subsequent significance of sustainability data, are making non–financial performance information increasingly important for investment decisions.4 Therefore, investors expect that, in addition to financial performance, companies provide comprehensive, reliable, consistent, and comparable sustainability data.5 Thus, disclosure of non–financial performance information in terms of environmental, social, and governance (ESG) parameters is becoming increasingly important for companies across the globe.

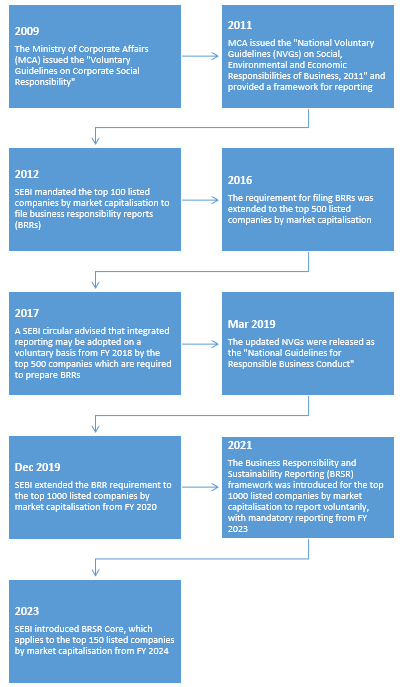

Businesses in several jurisdictions, including Malaysia, the United Kingdom, and the European Union, are now required to disclose their sustainability performance to ensure accountability and transparency,7,8, In line with these global developments and investors' interest around the world, policymakers and regulators in India have taken several steps to promote sustainability reporting. In 2021, the Securities and Exchange Board of India (SEBI) introduced a sustainability reporting framework called Business Responsibility and Sustainability Reporting (BRSR).

Figure 1: Evolution of sustainability reporting in India

Source: Author’s compilation.

What is BRSR?

Business Responsibility and Sustainability Reporting (BRSR) is a reporting framework under which the top 1000 listed companies (by market capitalisation) are mandated to disclose their ESG performance in a quantitative and standardised format from FY 2022–23 onwards.9 The obligated entities were initially encouraged to adopt the BRSR framework voluntarily in FY 2021–22.

The BRSR framework seeks disclosures against nine principles of the “National Guidelines on Responsible Business Conduct” (NGBRCs), issued by the Ministry of Corporate Affairs (MCA) in 2019.10 Each principle includes indicators that are categorised as essential and leadership. It is mandatory for obligated entities to report on the essential indicators, whereas reporting is voluntary for the leadership indicators.

The MCA proposed two BRSR formats for disclosures11:

- BRSR Comprehensive – This format is mandatory for obligated entities to use for reporting their ESG performance.

- BRSR Lite – This format is encouraged to be adopted by non-obligated entities that do not have prior experience in sustainability reporting. The BRSR Lite format is a pared-down version of the BRSR Comprehensive format as it includes fewer indicators under the nine NGBRC principles.

Both the BRSR formats comprise three sections12:

- General disclosures – This section reports basic information about the listed entity, such as its products and services, sites of operation, subsidiaries, and number of employees.

- Management and process disclosures – This section discloses the business policies and processes through which the entity aims to adopt NGBRC principles.

- Principle-wise performance disclosures – This section discloses the performance of the business with respect to the nine NGBRC principles.

To further strengthen the BRSR framework and enhance the reliability of ESG disclosures, SEBI introduced BRSR Core in 2023.13 This is a subset of BRSR and requires disclosure of a company’s performance against nine ESG attributes. Each attribute comprises select key performance indicators. It is a more stringent approach to sustainability reporting than BRSR as the disclosures under BRSR Core require reasonable assurance. Reasonable assurance refers to getting affirmation from a third party (assurance provider/auditor) that the information provided is correct. It ensures that the disclosures are reliable and credible, enhancing investor confidence in them.

In addition to complying with BRSR, the top 150 companies (by market capitalisation) are mandated to report their sustainability performance in the BRSR Core format from FY 2023–24. The applicability of BRSR Core will gradually increase from 150 companies in FY 2023–24 to 1000 by FY 2026–27. In addition, the top 250 listed companies are mandated to disclose the ESG footprint of their value chain from FY 2024–25 and obtain assurance through third-party auditors on a comply-or-explain basis from FY 2025–26.

Who should care?

- Businesses and corporates

- Investors

References

- [1] Nelson, Mathew. 2020. “How Nonfinancial Reporting Is Driving Investment Decision-Making.” Ernst & Young, April 3. https://www.ey.com/en_gl/financial-services/how-nonfinancial-reporting-is-driving-investment-decision-making.

- [2] Eccles, Robert G., Ioannis Ioannou, and George Serafeim. 2014. “The Impact of Corporate Sustainability on Organizational Processes and Performance.” Harvard Business School. https://www.hbs.edu/ris/Publication%20Files/SSRN-id1964011_6791edac-7daa-4603-a220-4a0c6c7a3f7a.pdf.

- [3] Chen, Zhongfei, and Guanxia Xie. 2022. “ESG Disclosure and Financial Performance: Moderating Role of ESG Investors.” International Review of Financial Analysis 48. https://www.sciencedirect.com/science/article/abs/pii/S1057521922002472.

- [4] Nelson, Mathew. 2020. “How Nonfinancial Reporting Is Driving Investment Decision-Making.” Ernst & Young, April 3. https://www.ey.com/en_gl/financial-services/how-nonfinancial-reporting-is-driving-investment-decision-making.

- [5] Bernow, Sara, Jonathan Godsall, Bryce Klempner, and Charlotte Merten. 2019. “More Than Values: The Value-Based Sustainability Reporting That Investors Want.” Mckinsey, August 7. https://www.mckinsey.com/capabilities/sustainability/our-insights/more-than-values-the-value-based-sustainability-reporting-that-investors-want.

- [6] Bursa Malaysia. 2022. “Bursa Malaysia Enhances Sustainability Reporting Framework with New Climate Change Reporting.” https://www.bursamalaysia.com/sites/5bb54be15f36ca0af339077a/content_entry5c11a9db758f8d31544574c6/63312a2439fba20d86ba8e16/files/26Sept_2022_Bursa_Malaysia_Enhances_Sustainability_Reporting_Framework_With_New_Climate_Change_Reporting.pdf?1664169009.

- [7] Government of the United Kingdom. 2021. “UK to Enshrine Mandatory Climate Disclosures for Largest Companies in Law.” https://www.gov.uk/government/news/uk-to-enshrine-mandatory-climate-disclosures-for-largest-companies-in-law.

- [8] European Commission. 2017. “Commission Guidelines on Non-financial Reporting.” https://finance.ec.europa.eu/publications/commission-guidelines-non-financial-reporting_en.

- [9] SEBI. 2021. “Business Responsibility and Sustainability Reporting by Listed Entities.” Circular No. SEBI/HO/CFD/CMD-2/P/CIR/2021/562. Securities and Exchange Board of India. https://www.sebi.gov.in/legal/circulars/may-2021/business-responsibility-and-sustainability-reporting-by-listed-entities_50096.html.

- [10] MCA. 2019. “National Guidelines on Responsible Business Conduct.” Ministry of Corporate Affairs, Government of India. https://www.mca.gov.in/Ministry/pdf/NationalGuildeline_15032019.pdf.

- [11] MCA. 2020. Report of the Committee on Business Responsibility Reporting. Ministry of Corporate Affairs, Government of India. https://www.mca.gov.in/Ministry/pdf/BRR_11082020.pdf.

- [12] SEBI. n.d. “Business Responsibility and Sustainability Reporting Format: Annexure II.” Securities and Exchange Board of India. Accessed March 6, 2024. https://www.sebi.gov.in/sebi_data/commondocs/jul-2023/Annexure_II-Updated-BRSR_p.PDF.

- [13] SEBI. 2023. SEBI Board Meeting. Securities and Exchange Board of India. https://www.sebi.gov.in/media/press-releases/mar-2023/sebi-board-meeting_69552.html.