Greenium or green-premium refers to the savings an issuer of a green bond realises on the associated coupon payment because the bond is green. Green bonds are debt instruments that fund specific projects/activities categorised as 'green' under national or international green taxonomies.1 Such activities may include renewable energy projects, electric buses, and energy efficiency initiatives. Each bond has an issuer, i.e., those who want to raise money with a promise of a regular fixed payment and investors, i.e. those who provide that money with a promise of a regular fixed income. The logic behind a greenium is that because of the appeal of sustainability, green bonds attract investors who are ready to forego some of their returns and accept lower payments (called a lower yield). Further, long-term green projects are associated with a reduction in both physical and financial risk. Thus, investors settle for lower returns, making green projects financially attractive for the issuers of these debt instruments.2

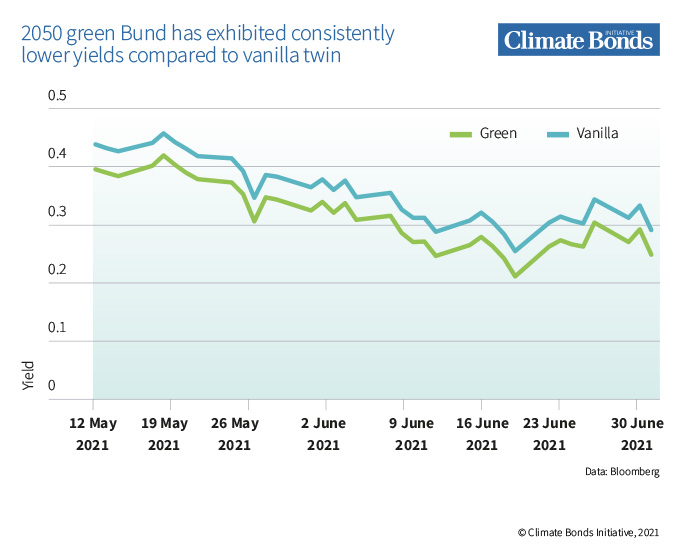

The graph below showcases the differences in yield between a German green bond of USD 7.3 billion, scheduled to mature in 2050, and a comparable, conventional twin – between May to June 2021.

Figure 1: The 2050 green bond has exhibited consistently lower yields compared to the vanilla twin

Source: Climate Bonds Initiative (2021)3

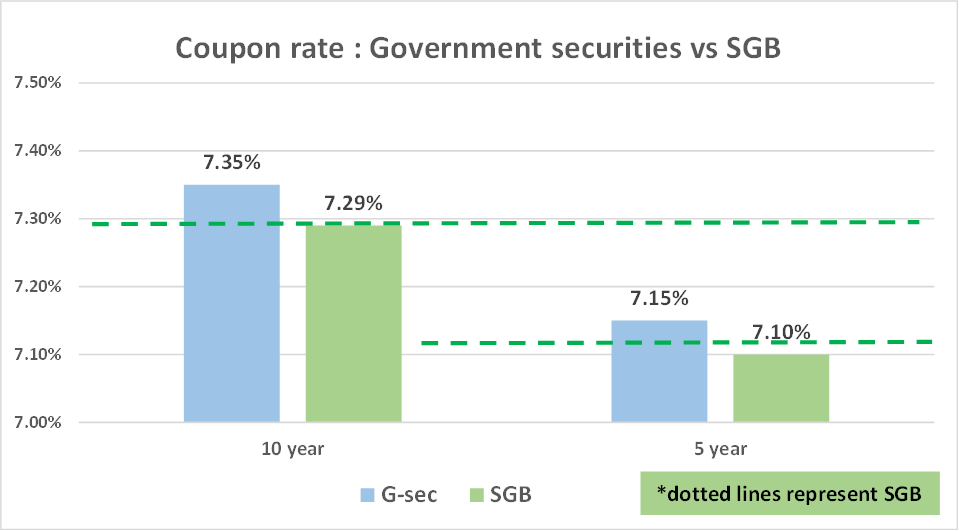

Two recent issuances of sovereign green bonds in India in 2023, with maturity periods of 10 years and 5 years each, were marked by lower yields of 6 bps and 5 bps. What does this mean? This means that, compared to lending in the case of similar benchmark non-green sovereign bonds (often known as government securities), with the same maturity period of 10 years and 5 years, respectively, these two issuances had coupon rates that were lower by 6 bps and 5 bps. Or, in simpler words, in the case of these two green bonds, the issuer (the government) makes interest payments at a rate that is lower by 0.06% and 0.05% than their G-sec counterparts.

The graph below puts things in perspective for the recent issuances.

Figure 2: Difference between coupon rates of SGB and G-sec

Source -CEEW-CEF Compilation

Though there is an ongoing debate on whether green bonds realise a greenium, historically, a greenium between 2 to 75 bps has been observed across issuances. For example, in Egypt, green bonds have traded at a premium of 75 bps.4 However, green bonds often realise no greenium. Further, a few experts argue that studies on this topic compare non-comparable groups of bonds.5 These experts believe that the lower yield of green bonds could be due to a distinction in the investor base, e.g., since investors in these bonds are intrinsically inclined towards green projects and thus settle for a lower yield, it could be a potential source of statistical bias. However, a recent European Central Bank (ECB) paper analysed bond yields in the Eurozone from 2016 to 2022 and found a statistically significant greenium of 4 bps.6

What drives the greenium?

In principle, bond premiums are driven by investor confidence. The same is true for the greenium as well. Broadly, the drivers of a greenium can be grouped into two categories:

Endogenous or internal factors, like the credibility of both the bond and the issuer, are potential drivers of the greenium. For instance, the premium could be higher for projects with a track record of success, proven credit-worthiness, or higher transparency in the use of proceeds. Simultaneously, issuers that exhibit a mix of good financial health and commitment to mitigate or de-risk long-term climate change risks might see a sizable greenium.7 In cases where financial institutions such as banks are the issuer, the same line of thought applies – e.g., banks that have signed up for the UNEP Financial Initiative are found to have an advantage in their cost of debt.8

Exogenous or external factors include the credibility of domestic capital markets, sovereign climate targets, commitments to encourage climate finance, and the adoption of regulatory practices. The International Capital Market Association (ICMA)’s framework principles enlist four key pillars in their Green Bond Principles (GBP) – use of proceeds, project evaluation and selection, management of proceeds and reporting.9 Strengthening these principles will lead to a vibrant green bond market and a healthy greenium. Volatility, on the other hand, drives the greenium down. Additionally, countries with official green taxonomies, green bond frameworks, or sovereign green/sustainability–themed bonds might command some greenium as well.10

Moving forward

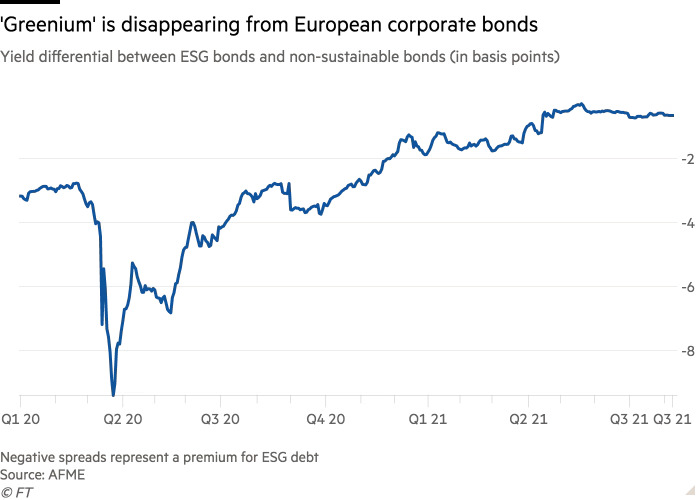

Ultimately, the greenium can help drive the expansion of the green bond market. As seen in the graph below, some claim that the greenium is shrinking.11 Unfortunately, the green bond market registered a y-o-y fall of 25% in FY 2022, ending at USD 450 billion in issuances.12

Figure 3: Financial Times analysis of disappearing greenium

Source - Financial Times

Though green bonds are increasingly becoming a source of capital for funding green infrastructure in line with national green infrastructure targets, much is left to be done. For example, Indian RE developers have tapped the green bond market to refinance loans worth USD 3.3 billion in FY 2021, but the general issues of low liquidity and credit rating constraints continue to loom.13

Countries like India, which require significant investments of over USD 10 trillion14 to realise their net-zero targets but which have comparatively small (USD 600 billion15) corporate bond markets, should push for reforms in financial regulations and practices to develop a strong green bond market in order to command a greenium. They should aggressively issue sovereign green bonds that signal the market towards these types of instruments. Sovereign bonds also have the additional advantage of low risk of default and pushing quantitative easing. Simultaneously, the investor base should be widened to include retail investors and foreign institutional investors (FII’s) in green bond markets. Another key intervention is to develop green taxonomies and incorporate ESG disclosure standards in business reporting so that investor demand for green thematic debt increases, giving issuers a higher probability of realising a greenium.16

Whether the greenium is driven by the appeal of sustainability or investor rationale is debatable but it is clear that emerging markets can take lessons from the playbook of existing issuances to exploit this advantage for their own prosperity

References

- [1] https://www.oecd.org/environment/cc/Green%20bonds%20PP%20%5Bf3%5D%20%5Blr%5D.pdf

- [2] https://link.springer.com/article/10.1007/s40822-020-00165-y

- [3] https://www.climatebonds.net/2021/09/greenium-remains-visible-latest-pricing-study

- [4] https://link.springer.com/article/10.1007/s40822-020-00165-y

- [5] https://www.sciencedirect.com/science/article/abs/pii/S0165410120300148

- [6] https://www.ecb.europa.eu/pub/pdf/scpwps/ecb.wp2728~7baba8097e.en.pdf

- [7] https://link.springer.com/article/10.1007/s40822-020-00165-y

- [8] https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4227559

- [9] https://www.icmagroup.org/assets/documents/Sustainable-finance/2021-updates/Green-Bond-Principles-June-2021-140621.pdf

- [10] https://www.ecb.europa.eu/pub/pdf/scpwps/ecb.wp2728~7baba8097e.en.pdf

- [11] https://www.businesstimes.com.sg/companies-markets/goldman-says-goodbye-greenium-esg-now-priced-all-debt

- [12] https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/global-green-bond-issuance-poised-for-rebound-in-2023-amid-policy-push-73931433

- [13] https://www.ceew.in/cef/system/market_handbooks/handbook_pdfs/000/000/004/original/CEEW-CEF_Market_Handbook_2020-21_12May21.pdf?1621353935

- [14] https://www.ceew.in/cef/solutions-factory/publications/CEEW-CEF-Investment-Sizing-India%E2%80%99s-2070-Net-Zero-Target.pdf

- [15] https://www.financialexpress.com/money/democratising-the-bond-market-to-fuel-the-next-step-in-indias-growth-journey/2932654/#:~:text=The%20bond%20market%20in%20India,%240.6%20trillion%20for%20corporate%20bonds.

- [16] https://timesofindia.indiatimes.com/city/indore/green-bond-oversubscribed-three-times-at-720-crore/articleshow/97934119.cms