Overview

Viet Nam announced its intention to decarbonise its economy and achieve net-zero greenhouse gas (GHG) emissions by 2050 at COP26. The decarbonisation of the power sector, the largest source of Viet Nam’s energy-related emissions, is critical to the attainment of the net zero by 2050 goal. By minimising the financial burden on the offtaker, cost-competitive renewable energy (RE) tariffs can catalyse large-scale capacity addition and drive the sustained decarbonisation of the power sector. Curtailment risk, stemming from mismatches in the pace of transmission and generation capacity addition, is a prominent medium-term challenge facing both domestic and international investors which can become a barrier to low-cost RE capacity addition. The CEEW Centre for Energy Finance (CEEW-CEF) proposes a financial solution, the Viet Nam Grid Integration Guarantee (V-GIG), to mitigate this risk to achieve low-cost calibrated capacity addition, while Viet Nam prepares its grid for large-scale capacity addition.

Key Highlights

- To advance Viet Nam’s energy transition, the CEEW Centre for Energy Finance (CEEW-CEF) investigated the major risks facing RE deployment in the country with a view towards de-risking investments and clearing the path for cost-effective RE deployment. To do so, CEEW-CEF conducted one-on-one consultations with 21 organisations associated with the Vietnamese RE ecosystem.

- These consultations indicated that curtailment risk, the bankability of power purchase agreements (applicable to only international debt financiers) and land acquisition and permitting risks were the major challenges facing developers with the first two considered more serious than the third. CEEW-CEF decided to develop a solution to tackle curtailment risk, a prominent medium-term challenge facing both domestic and international investors, which can both slow the pace of and become a barrier to achieving low-cost RE capacity addition.

- Largely, curtailment risk is a function of the inadequate availability of transmission infrastructure (as of 2022) at key points from source to load in certain transmission corridors together with the absence of deemed generation or take-or-pay clauses in model PPAs. While stakeholders expressed confidence about Viet Nam’s long-term transmission strengthening plans to support RE deployment at scale, they expect execution delays in the near to medium term in setting up infrastructure to bridge the aforementioned transmission deficit, which is likely to worsen with additional generation capacity development plans.

- As a result, and despite there being plans in place for the strengthening of transmission infrastructure, both debt and equity investors expect some curtailment in the near to medium term for new projects. Project sponsors (equity) account for this risk by factoring in lower than optimal offtake, and thus, lower than optimal revenue projections in their financial models. On their part, project lenders (debt) generally account for this risk by extending debt at more onerous, or inferior, terms. Either way, from the perspective of equity investors, this translates to higher tariffs to meet a specific level of returns expectations.

Key Recommendations

- CEEW-CEF proposes a first-loss guarantee that safeguards investors against a defined level of curtailment (based on technical studies) stemming from potential mismatches in the pace of generation and transmission capacity addition. However, it is not a substitute for developing transmission capacity. It should be viewed as complementary to transmission capacity development to achieve low-cost calibrated capacity addition, while Viet Nam prepares its grid for large-scale capacity addition. It also builds upon near-term actions already undertaken by Vietnamese power-sector planners.

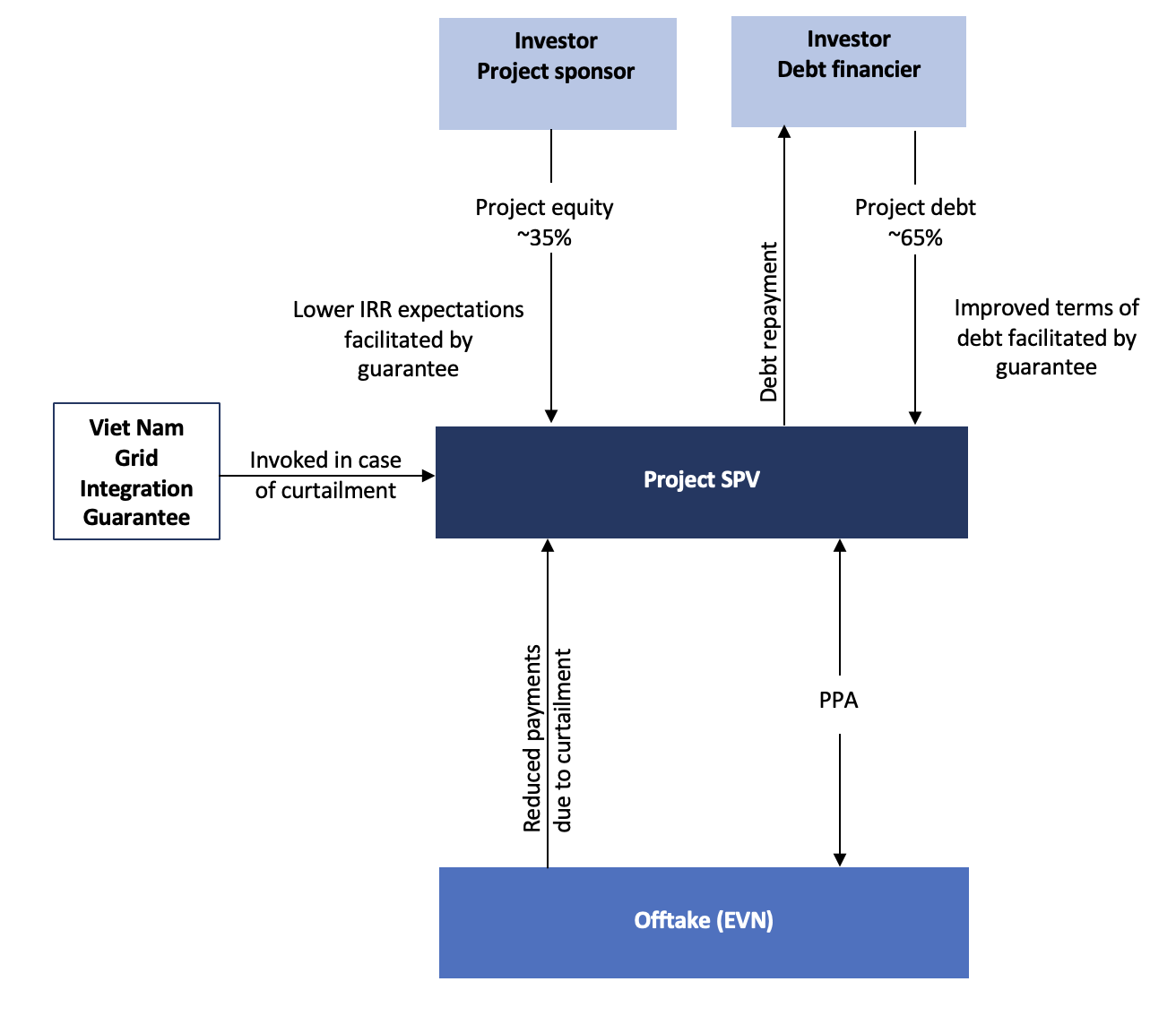

- In case of curtailment, the guarantee may be invoked to make up for a reduction in the special purpose vehicle’s (SPV) cash flows up to the defined limit of protection. In case of a timely upgrade of transmission capacity, there will be no curtailment (from delays in transmission upgrades), and the guarantee need not be invoked. However, regardless of whether or not the guarantee is invoked, its presence transfers curtailment risk from the financial models of investors and onto the pool of capital underwriting the guarantee. This gives comfort to financiers and allows them to offer superior terms of finance to RE projects, which in turn enables the realisation of lower tariffs.

Figure 1: Schematic representation of the Viet Nam Grid Integration Guarantee

Source: Authors’ analysis

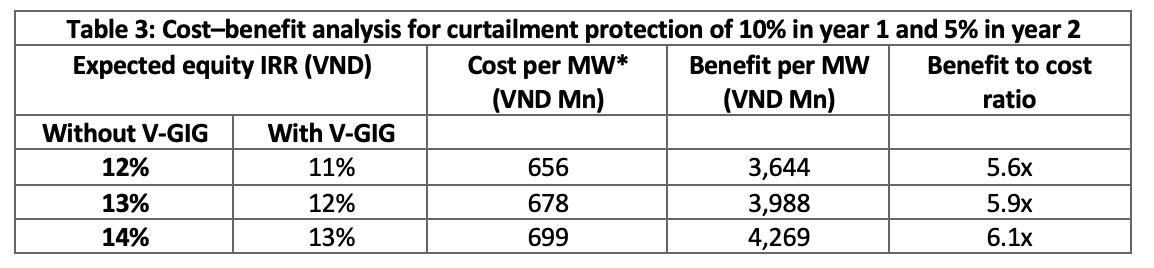

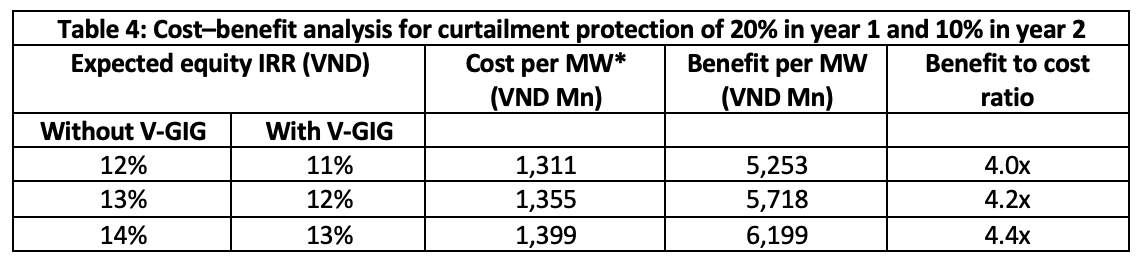

- Tables 3 and 4 summarise the costs and benefits under various simulation scenarios. As is evident, the Viet Nam Grid Integration Guarantee can unlock many multiples in benefits for every dollar that capitalises it. It does so via two levers. First, by enabling investors to factor in higher revenue projections, and second, by giving comfort to debt and equity financiers to offer superior terms of finance.

*The cost mentioned corresponds to the case in which curtailment of 10% in year 1 and 5% in year 2 actually occurs. This cost is lower if lower levels of curtailment are realised.

Note: The underlying technology considered in this analysis is onshore wind. Similar analyses can be conducted for other RE technologies.

Source: Authors’ analysis

*The cost mentioned corresponds to the case in which curtailment of 20% in year 1 and 10% in year 2 actually occurs. This cost is lower if lower levels of curtailment are realised.

Note: The underlying technology considered in this analysis is onshore wind. Similar analyses can be conducted for other RE technologies.

Source: Authors’ analysis

- To empirically demonstrate the value of the V-GIG in realising competitive tariffs, CEEW-CEF proposes a pilot demonstration of the facility as the next step in this report. The proposed pilot would ideally take the form of an auction of onshore wind capacity, with the V-GIG providing cover against curtailment risk. Price discovery through auctions is recommended as a practical approach to gauge the effectiveness of the guarantee in mitigating risk perceptions and realising lower tariffs. Our analysis finds that a pilot of 50–100 MW may be operationalised by a facility that is funded to the tune of USD 1.4-5.7 million.