Overview

India is undergoing a major energy transition. However, constraints on access to capital — both in terms of adequacy and affordability — are impeding the pace and efficiency of this transition. This report published in collaboration with the Climate Bonds Initiative focuses on the potential of green bonds as an effective instrument to finance India’s switch from fossil fuels to renewable resources. The bond market could complement traditional sources of debt – banks and non-bank financial institutions – through the refinancing of primary debt. Key regulatory and market developments could accelerate the development of India’s corporate bond markets, and facilitate capital raising through the bond route. Green bonds have the potential to be used as a tool to address the capital raising needs of both the private sector, as well as sub-sovereign government (in this case state governments), for the renewable energy (RE) and electric mobility sectors.

As part of its Nationally Determined Contribution under the United Nations Framework Convention on Climate Change, India aims to generate 40 per cent of its power from non-fossil fuel sources by 2030. To achieve this, it needs an annual investment of USD 30 billion over the period 2018 – 2030, The government is also increasingly endorsing the electric mobility sector. However, the current sales of electric vehicles (EV) are only 0.1 per cent of the total vehicle sales against a target of 30 per cent by 2030.

The report also presents a toolkit, which provides a step-by-step guide of the green bond issuance process for prospective issuers.

Key Highlights

- India has become the 12th largest green bond issuer in the world, with total cumulative issuance of USD 7.15 billion between February 2015 and December 2018.

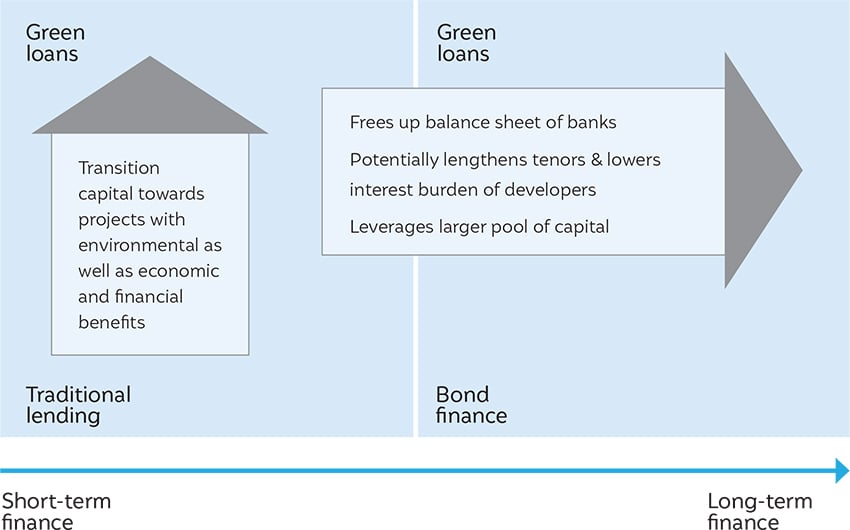

- Refinancing through bonds presents several advantages, including the lowering of the cost of capital and access to institutional investors such as insurance, pension, and mutual funds, which potentially can provide access to long term debt financing suited for RE and electric mobility projects. Further, the bond markets also provide access to fixed-rate debt.

- RE project developers have been using green bonds to refinance existing loans. Banks and non-bank financial institutions have been using them to raise capital for lending to RE projects.

- In the electric mobility sector, auto financiers could use the green asset-backed securities (ABS) route to free up their balance sheets for further lending. Large original equipment manufacturers (OEMs) could issue green bonds on the strength of their general creditworthiness, and the scope of potential issuers is likely to increase with the establishment of a longer technology performance track record and viable business models.

- Key regulatory and market developments could enhance the liquidity and depth of India’s corporate bond market. These include the introduction of the insolvency and bankruptcy code (IBC), the introduction of market instruments for liquidity management (tri-party repo), regulations mandating large corporations to tap the bond market and the lowering of minimum credit rating requirements for investments by pension funds.

- States could also issue green bonds to finance investments undertaken by state entities to support the scaling up of RE and electric mobility. These could take the form of either green sub-sovereign bonds or those issued by a state-backed corporate entity.

- In the RE sector, the range of present end uses for the deployment of green bond proceeds by states could extend to planned investments in green transmission infrastructure, development of solar parks, and working capital loans for utilities for meeting renewable portfolio obligations (RPOs).

- In the mobility sector, the range of end uses for green bond proceeds by states could extend to the acquisition of EVs by state transport undertakings, the deployment of public charging infrastructure, and investments in setting up EV manufacturing clusters.

Refinancing loans with green bonds

Source: Adapted From “New markets for green bonds: A guide to understanding the building blocks and enablers of a green bond market” by Williams et al

Key Recommendations

- Adopt a national investment strategy aligned with a transition to low-carbon and climate-resilient development that will lay down the building blocks for scaling up green finance.

- Spell out performance standards and thresholds as part of a green taxonomy to strengthen the current Securities and Exchange Board of India (SEBI) guidelines on disclosure of green bonds issuances.

- Enhance awareness about financial and non-financial benefits of green bonds amongst issuers, investors, and policy makers.

- Strengthen and optimise the use of credit-enhancement structures, catalytic mechanisms such as blended financing, and securitisation to broaden the scope of green bonds in India.

- Use tools such as green tagging to create visibility for green projects on the books of financial institutions and government budget, hence building project pipelines that can underlie future green bond issuances.

- Examine the slew of recommendations proposed by a host of agencies to make the enabling environment for green issuances more conducive.

- States could drive the next phase of clean energy and electric transport financing, and accelerate the inflow and deployment of green capital.