Context

The decarbonisation of the global economy in pursuit of the objectives of the Paris Agreement requires all stakeholders, particularly countries and companies, to act urgently and effectively to address their respective carbon footprints. Addressing this carbon footprint is associated with a wide range of mitigation strategies, including investing in clean energy, improving energy efficiency, and avoiding deforestation.1 Stakeholders looking to mitigate emissions thus face the daunting task of selecting from a multitude of options. To make informed decisions on the allocation of resources, stakeholders can benefit from an understanding of the cost and impact associated with different mitigation alternatives. The marginal abatement cost curve (MACC), which represents both the cost and emissions abatement potential of mitigation options in a single chart, can be a valuable decision-making tool in this regard.

What is MACC?

The MACC is a graphical representation of the emissions abatement potential of different mitigation options and their corresponding marginal abatement costs. Both are calculated relative to a baseline2 option for the period of analysis.3 Since there is no commonly accepted definition of a baseline, its determination is a sensitive task as it relies on data and assumptions regarding future projections.4

A MACC can be developed to assess strategies for an organisation, a country, the global economy, or a specific sector.5 Building an economy-wide or global MACC is a complex exercise since there can be a wide variation in marginal abatement costs across sectors and countries.6

The MACC represents three aspects of mitigation strategies:

1. Emissions abatement potential is the quantity of emissions that can be reduced in the analysis period by implementing a mitigation option compared to a baseline option.

Emissions abatement potential = Total GHG emissions from baseline option – Total GHG emissions from mitigation option

An option’s mitigation potential depends on two factors:

- Technology and stakeholder constraints – for example, a stakeholder constraint may be the limited availability of land, which can support the installation of only a specific number of solar panels. A technology constraint can be that only 10 per cent of energy savings is possible using energy-efficient appliances compared to its respective baseline option.

- The stakeholder’s decarbonisation requirements

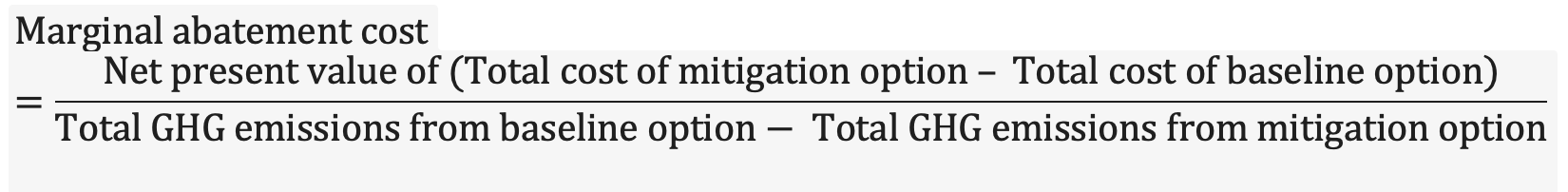

2. Marginal abatement cost is the present value of the net cost incurred in reducing one tonne of carbon dioxide equivalent (CO2e) over the alternative’s operational lifetime.7

Some options may be cheaper than the baseline option, leading to cost savings, while others may be expensive.8

3. The total cost of incorporating the mitigation option is the product of the option’s marginal abatement cost and emissions abatement potential.

An illustrative MACC in Figure 1 plots four mitigation options.

Source: CEEW-CEF analysis

In a MACC plot, the x-axis represents the abatement potential in the analysis period, expressed in tonnes of CO2. The y-axis represents the marginal cost of abatement and is measured in cost terms such as USD per tonne of CO2. The area of the bar, therefore, represents the total amount of capital required for incorporating the mitigation option. These options are ranked and plotted from least to most expensive, irrespective of the abatement potential.

Assuming an organisation has the above MACC and an annual decarbonisation budget of USD 1000, how can it utilise the MACC to reduce its carbon emissions?

- The organisation should first invest in option A to reduce emissions by 20 GtCO2e. In doing so, instead of incurring additional costs compared to the baseline option, it saves USD 540, thereby increasing the net decarbonisation budget to USD 1540.

- Next, it should invest in option B, which reduces emissions by 11 GtCO2e and incurs a net cost of USD 220. The remaining budget after incurring this cost is USD 1320.

- It should further invest in option C, incurring a net cost of USD 1320 and reducing emissions by 60 GtCO2e.

After implementing the third mitigation option, the organisation exhausts its decarbonisation budget while reducing 91 GtCO2e emissions in the year.

Who should care?

The MACC is valuable for policymakers and businesses as it helps identify the most cost-effective emissions reduction strategies.

References

- [i] Van Tilburg, X., L. Wuertenberger, and R. A. Rivera Tinoco. 2010. “Marginal Abatement Cost (MAC) Curve. Policy Brief.” Energy research Centre of the Netherlands. https://www.osti.gov/etdeweb/biblio/21423313.

- [ii] A baseline provides a plausible description of future developments in the analysis period if no new GHG mitigation policies are implemented. The emissions abatement potential for each technology is measured against its respective baseline option.

- [iii] United Nations Framework Convention on Climate Change (UNFCCC). 2021. “CGE Training Materials – Mitigation Assessment”. UNFCCC. https://unfccc.int/sites/default/files/resource/module-c-notes1_rev_2021%20%201.pdf.

- [iv] UNFCCC. 2021. “CGE Training Materials – Mitigation Assessment”.

- [v] UNFCCC. CGE Training Materials – Mitigation Assessment”.

- [vi] Nachtigall, D., J. Ellis, S. Peterson, and S. Thube. 2021. “The Economic and Environmental Benefits from International Coordination on Carbon Pricing: Insights from Economic Modelling Studies.” Organisation for Economic Co-operation and Development. www.oecd-ilibrary.org/deliver/d4d3e59e-en.pdf?itemId=%2Fcontent%2Fpaper%2Fd4d3e59e-en&mimeType=pdf.

- [vii] UNFCCC. 2021. “CGE Training Materials – Mitigation Assessment”.

- [viii] Van Tilburg, Wuertenberger, and Rivera Tinoco. 2010. “Marginal Abatement Cost (MAC) Curve. Policy Brief.”