Context

World over, climate change adaptation and mitigation transitions require massive financial flows. For example, as per CEEW-CEF estimates, India would need about USD 10 trillion in capital expenses over the next five decades to achieve net-zero infrastructure development.1 Developing countries account for a minimal, often insignificant, contribution to the pool of historical emissions, but they bear the brunt of externalities from developed countries.2 They are also at a disadvantage geographically and economically as most of these countries are located around the equator (and thus have a hotter climate)3, large portions of their populations work in the informal sector or are dependent on agriculture, and they lack the financial resources needed to fund the transition.4

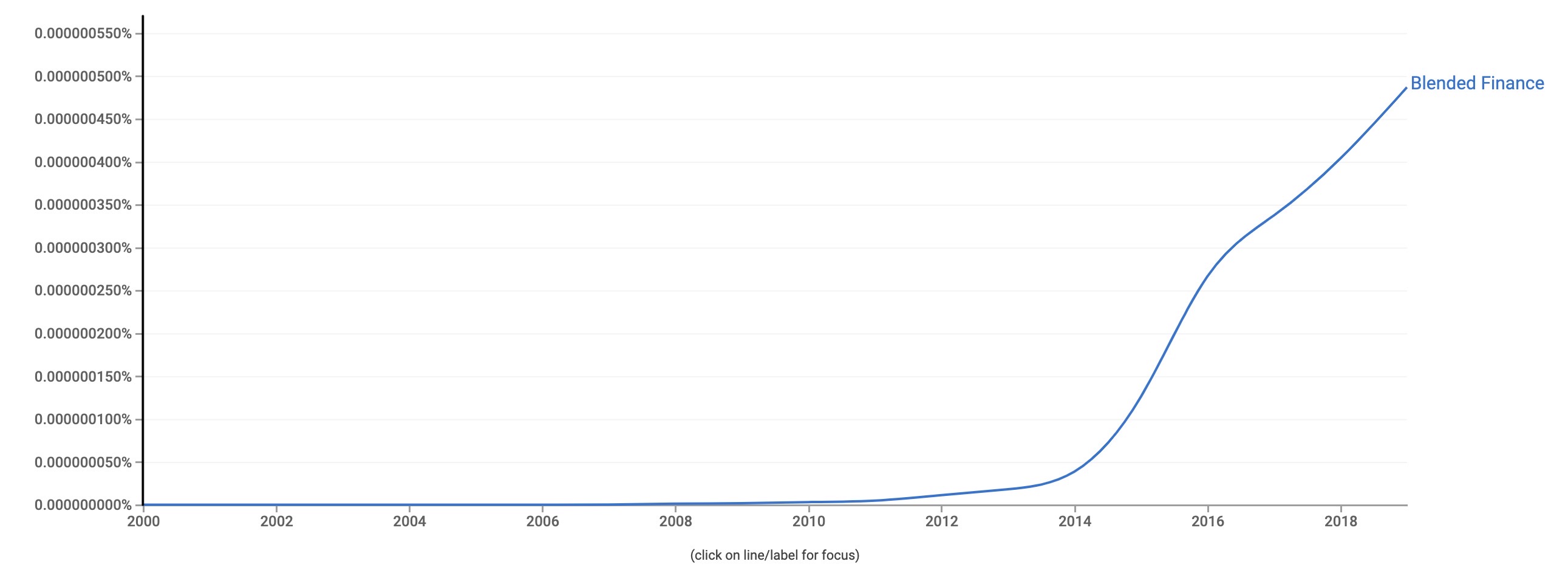

These countries urgently need affordable financing, which should ideally be a mix of domestic and foreign capital from developed countries in the form of grants, debt, equity, and so on. However, developed countries have underdelivered on their promise of providing USD 100 billion per year of climate finance to developing countries by 2020. Also, the type of finance offered – for example, grants or concessional loans – has been a matter of dispute.5 One such financing framework that could make available impactful climate finance is ‘blended finance’, a term that has gathered steam over the past decade, as is evident from Figure 1.

Figure 1: Frequency of the usage of the term ‘blended finance’ as per Google Ngram

Source: Google Ngram

What is blended financing?

Blended financing, as per the Organization for Economic Co-operation and Development (OECD), is the strategic use of development finance (i.e., capital from multilateral development banks, development finance institutions (DFIs), philanthropic organisations, and so on) to attract additional capital for sustainable development in countries that need it more than others.6

As public capital is limited, blended financing is used to attract private capital for critical developmental objectives – for example, setting up a Medical Credit Fund,7 supporting agriculture, or building climate-resilient infrastructure in urban areas.8

Forms of blended finance instruments

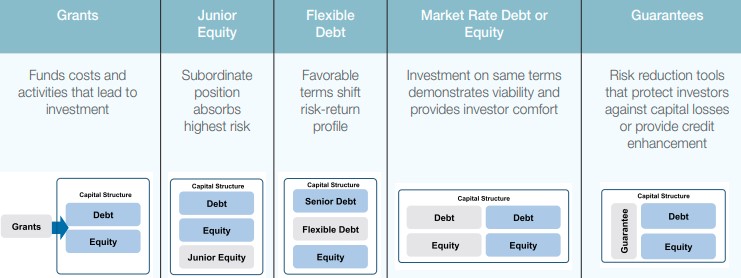

Grants, technical assistance and guarantees, concessional/subordinate debt, and junior equity are widely used blended finance instruments, especially in new sectors characterised by uncertainties, high risks, foggy rewards, and no assurance.,9,10 The form of blended finance deployed will vary with the context and as per the instrument’s suitability, the country’s legal structure, the deal size, and the comfort and expertise of the institution extending the blended finance instrument, among others (Figure 2).

Figure 2: Different types of blended finance instruments and the rationale behind them

Source: World Economic Forum

Why blended financing for climate mitigation?

Given that the majority of climate mitigation infrastructure is yet to be built, with no or little track record, blended finance instruments offer manifold benefits. For instance, consider the capital-intensive electric vehicles sector, where the lack of charging infrastructure presents a key barrier to higher adoption. Private players, based purely on their interests, may not invest in the sector because of the risk-reward skewness and lack of history and information. At the same time, financial institutions might require large collaterals and charge high interest rates, making the project commercially unviable. Such projects, irrespective of their importance, may never see the light of day.

However, DFIs11 such as the World Bank, donors, philanthropists, and such others have a higher tolerance for risk and can chip in here. For instance, they can issue concessional debt to private institutions or governments to bring down the cost of capital and improve the risk-reward ratio, making such projects more attractive to banks and private investors. It will also instil confidence in investors and financial institutions and nudge them towards funding risky but crucial projects necessary for long-term sustainable development that may not seem commercially viable today. At the same time, DFIs can also provide first-loss guarantees to absorb risk or can provide technical know-how and assistance.12 The key role of this approach is to drive social and environmental progress by playing the role of guarantor or facilitator in sectors that are yet to reach commercial scale. Additionally, blended financing reduces information barriers for private players and lets them have skin in the game in new sectors.

The way ahead

Blended financing is primarily aimed at providing support to a new industry till it becomes commercially viable. However, for it to work, we need cooperation, collaboration, the free flow of information, and the goodwill of all the stakeholders involved. It requires smooth transactions, conducive legal systems as well as efficient domestic institutions. In the future, blended financing may play a vital role in sectors such as clean energy,13 sustainable agriculture,14 urban infrastructure, transportation, and so on.

Who should care?

Blended financing would be of interest to utilities, original equipment manufacturers (OEMs) and developers, domestic financial institutions and investors.

References

- [1]Sidhu, Gagan, and Vaibhav Pratap Singh. 2021. “Investment Sizing India's 2070 Net-Zero Target.” CEEW-CEF, November 18, 2021. https://www.ceew.in/cef/solutions-factory/publications/investment-sizing-india-s-2070-net-zero-target.

- [2]United Nations Conference on Trade and Development. 2021. “Smallest Footprints, Largest Impacts: Least Developed Countries Need a Just Sustainable Transition.” October 1, 2021. https://unctad.org/topic/least-developed-countries/chart-october-2021.

- [3]Greenstone, Michael. 2021. “Valuing the Global Mortality Consequences of Climate Change Accounting for Adaptation Costs and Benefits.” BFI, April 1, 2021. https://bfi.uchicago.edu/working-paper/valuing-the-global-mortality-consequences-of-climate-change-accounting-for-adaptation-costs-and-benefits.

- [4]Aviles, Anna Maria, and Sergio Schmukler. 2019. “Why Domestic Capital Markets Can Benefit Developing Countries: The Case of East Asia.” World Bank Blogs, October 22, 2019. https://blogs.worldbank.org/psd/why-domestic-capital-markets-can-benefit-developing-countries-case-east-asia.

- [5]Mulhern, Owen. 2021. “The Broken $100 Billion Promise.” Earth.Org, October 25, 2021. https://earth.org/data_visualization/the-broken-100-billion-promise/.

- [6]Organization for Economic Co-operation and Development. “The OECD DAC Blended Finance Guidance.” May 31, 2021. https://www.oecd-ilibrary.org/development/the-oecd-dac-blended-finance-guidance_ded656b4-en.

- [7] United States Agency for International Development. “Blended Finance Landscape Review.” January 1, 2020. https://linclocal.org/wp-content/uploads/2020/03/EXTERNAL_CAPx-Landscape-Review-FINAL.pdf.

- [8]Jena, Labanya Prakash. 2021. “Financing Climate-Resilient Infrastructure in Cities.” Emerging Economy Studies 7, no. 2: 107–14. https://doi.org/10.1177/23949015211070393.

- [9]Organization for Economic Co-operation and Development, World Economic Forum. 2015. “Blended Finance Vol. 1: A Primer for Development Finance and Philanthropic Funders.” September 2015. https://www3.weforum.org/docs/WEF_Blended_Finance_A_Primer_Development_Finance_Philanthropic_Funders.pdf.

- [10] Initiative for Blended Finance. n.d. “Blended Finance: When to Use Which Instrument?” https://ibf-uzh.ch/wp-content/uploads/2022/02/Blended-Finance_When-to-Use-Each-Instrument_Digital-Version.pdf

- [11] DFIs are organisations formed by governments or a coalition of countries that provide low-cost, risky capital for economic development projects, for example, the World Bank.

- [12]Organization for Economic Co-operation and Development, World Economic Forum. 2015. “Blended Finance Vol. 1: A Primer for Development Finance and Philanthropic Funders.” September 2015. https://www3.weforum.org/docs/WEF_Blended_Finance_A_Primer_Development_Finance_Philanthropic_Funders.pdf.

- [13]Climate Policy Initiative. 2018. “Blended Finance in Clean Energy: Experiences and Opportunities.” January 2018. https://climatepolicyinitiative.org/wp-content/uploads/2018/01/Blended-Finance-in-Clean-Energy-Experiences-and-Opportunities.pdf.

- [14]Apampa, Andrew, Chris Clubb, Bethany E. Cosgrove, Gretel Gambarelli, Hans Loth, Richard Newman, Vanesa Rodriguez Osuna, Joke Oudelaar, and Angele Tasse. 2021. “Scaling Up Critical Finance for Sustainable Food Systems through Blended Finance.” CCAFS, 2021. https://financeincommon.org/sites/default/files/2021-11/Scaling%20up%20critical%20finance%20for%20sustainable%20food%20systems%20through%20blended%20finance.pdf.