Overview

This policy brief analyses the effects of the implementation of the Goods and Services Tax (GST) in India, especially on solar tariffs, and makes recommendations to offset the negative impact of the new tax regime on the Indian solar sector.

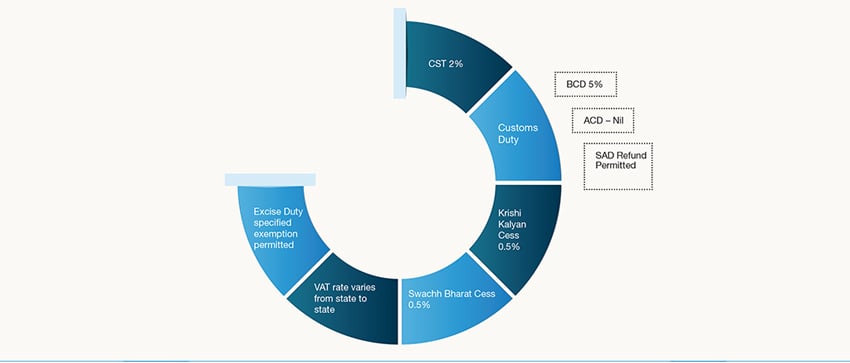

Applicable taxes in the Solar Energy Sector

Source: CEEW compilation

Key Findings

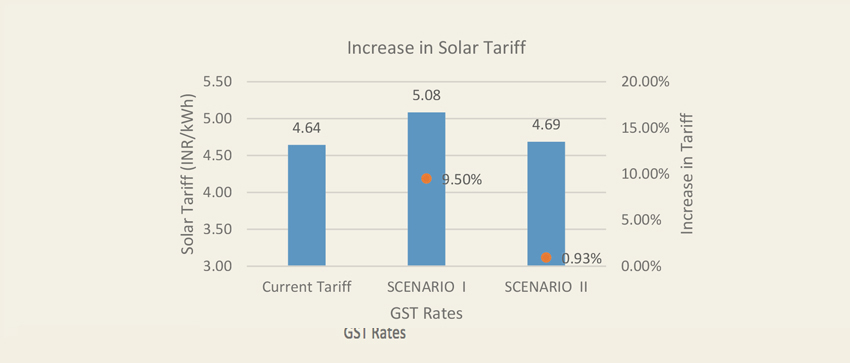

- A ten per cent increase in tariffs is projected if current tax exemptions were to be curtailed in the roll out of GST.

- An increase in tariffs would be observed due to an increase in operations and maintenance costs, panel costs, and financing costs.

- The increase in solar tariffs would be higher for states (such as Rajasthan) where VAT and Entry Tax exemptions are currently provided for solar equipment, as opposed to states (such as Gujarat) where exemptions are not provided.

- If tax exemptions are curtailed, GST could increase capital cost of a solar project by INR 4.5 million per megawatt and set the sector back by 18 months in terms of cost competitiveness.

Comparing existing solar tariff with solar tariff in GST regime

Source: CEEW Analysis

- GST could impact the pace on the second phase of the solar park development to add an additional 20,000 MW capacity.

- GST will boost the ‘Make in India’ initiative and improve the competitiveness of Indian manufacturers of solar cells, panels and modules.

- The increased competitiveness will eliminate the cascading effect of the existing tax structure and introduce an input tax credit. It could also create an additional 37000 new jobs in the solar manufacturing sector by 2022.

Solar tariffs and the estimated acceleration in deployment required for the solar sector in 2017 will largely depend on the manner of implementation of the Goods and Services Tax regime.

Key Recommendations:

- Clarify the revision of solar tariff bids under GST and provide clear guidelines regarding the applicable GST slab for solar power projects.

- Provide government mechanisms to offset the negative impacts of GST (if any), as and when it is implemented.

- Asses potential increase in capital investment and consider provisions to revise bid tariffs.

- Ensure that the current exemptions applicable to the solar sector continue as a temporary measure.

- Offset increase in solar tariffs by increased Accelerated Depreciation benefits.

- Provide a revised Viability Gap Funding (VGF) to offset the increased capital costs due to the implementation of GST.

0 People Liked

For queries reach out to author

Posted On

17 January 2017

Tags

Solar

Custom Duty

ALMM

Solar Manufacturing

Energy Transition

Share

PUBLICATIONS

Renewable Energy

+ 1 More

July 2019

2 mins read

Arjun Dutt

CEF EXPLAINS

Renewable Energy

+ 1 More

June 2019

2 mins read

Nikhil Sharma

CEF ANALYSIS

Instruments & Regulations

+ 1 More

June 2019

1 mins read

Sugandha Somani

PUBLICATIONS

Instruments & Regulations

November 2024

3 mins read

Arjun Dutt

PUBLICATIONS

Instruments & Regulations

September 2023

6 mins read

Arjun Dutt

PUBLICATIONS

Electric Mobility

March 2023

3 mins read

Meghna Nair

CEF ANALYSIS

Instruments & Regulations

+ 1 More

March 2020

4 mins read

Nikhil Sharma

CEF ANALYSIS

Others

+ 1 More

October 2021

2 mins read

Saloni Jain

CEF ANALYSIS

Electric Mobility

December 2020

7 mins read

Meghna Nair