Context

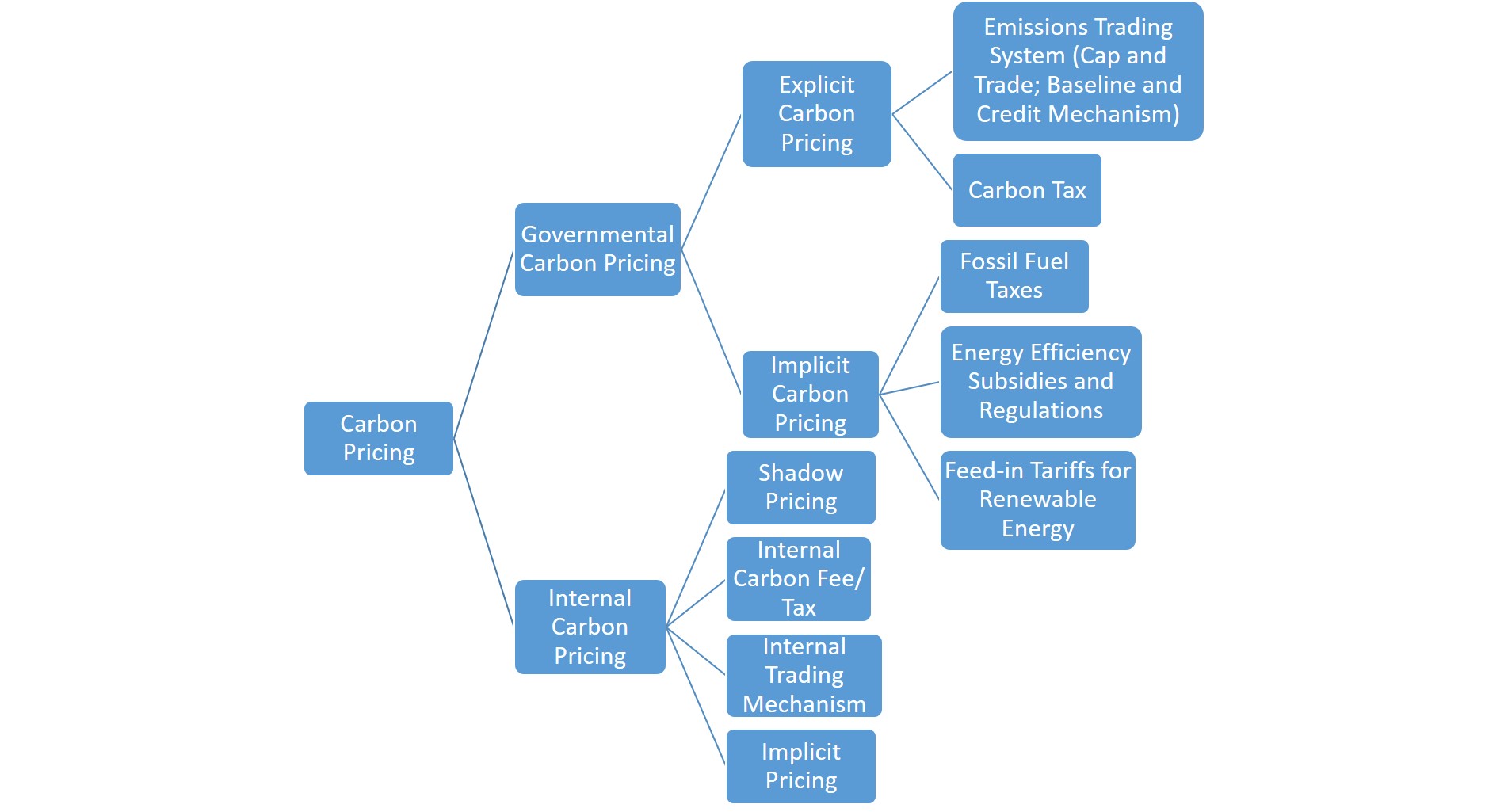

Carbon pricing refers to mechanisms that incentivise a shift towards a low-carbon economy by putting a price on greenhouse gas (GHG) emissions.1,2 Carbon pricing instruments can take many forms, but these can be broadly divided into two categories – governmental carbon prices and internal carbon prices (set internally by corporates themselves).

Figure 1: Categories of carbon pricing

Source: CEEW-CEF compilation based on UNESCAP (2020), ADB (2021), and World Bank (2022)

Governmental carbon prices can be implemented using various policy instruments, which are further categorised into explicit or direct carbon pricing and implicit or indirect carbon pricing. The former refers to policy measures that explicitly impose a price per unit of GHG emissions.2,3 These usually take the form of carbon taxes and emissions trading systems (ETS).4,5 The cost of carbon is determined either by a regulator (carbon tax) or the market (emissions trading systems). Please refer to the CEF Explains article on “Carbon Pricing" for more details. In implicit/indirect carbon pricing, policy instruments such as efficiency standards, subsidies, and fossil fuel taxes are used to indirectly assign a cost to carbon emissions.2,3,6 However, this article will be focusing on Internal Carbon Pricing (ICP).

ICP is a cost voluntarily attached by businesses to their own GHG emissions to internalise climate risks in their investment decisions.7,8,9 It has the potential to aid in low-carbon transitions by directing investments toward clean technologies10 . The UN Economic and Social Commission for Asia and the Pacific (UNESCAP) outlines four broad categories of ICP.11

- Shadow pricing: A shadow price is a hypothetical cost assigned to each ton of carbon emissions to account for the climate risks in a business.5 It is used to assess business cases, procedures, and strategies to understand how emission costs impact businesses (ibid). Financial institutions may use it to make credit allocation decisions in favour of low-carbon businesses. In contrast, businesses could use it to assess the carbon-adjusted future profitability of a project.

- Implicit pricing: An implicit carbon price is an ex-post measure calculated based on the emissions abatement achieved by an existing project(s) and the cost associated with the same.12 This cost could be the investment associated with the cumulative emissions abatement achieved (ibid). Alternatively, companies sometimes determine implicit carbon prices based on the cost of carbon offsets purchased (ibid). This price is used while making new investment decisions.5,12

- Internal carbon tax/fee: An internal carbon tax/fee is a fee per tonne of carbon dioxide (tCO2) imposed on organisation-wide emissions.12,13 The revenue stream generated from the internal carbon tax is then used for financing low-carbon projects and activities.5,12

- Internal trading mechanisms: Internal trading mechanisms replicate external emissions trading systems such as the European Union ETS. The organisation sets a cap on the carbon emissions from each business unit, creates allowances, and allows the business units to buy or sell these allowances with each other.11,12

Incidence of ICP

In 2021, 1077 companies worldwide and 31 companies in India reported using ICP.10 Mahindra and Mahindra was the first Indian company to use ICP in 2016.14 Afterwards, many other companies, such as UltraTech Cement Ltd. and JSW Energy, announced ICP’s application in their businesses.10

As reported by several organisations, ICP exhibits considerable variability, ranging from USD 6 to 918 per tonne of carbon dioxide equivalent (tCO2).5 Since there are no universal guidelines on carbon pricing, and each company sets its own price depending on its own local context, the ICPs of organisations vary greatly.7

Who should care?

Corporations

Policymakers

Banking institutions

References

- [1] UNFCCC. N.d. “About Carbon Pricing.” United Nations Framework Convention on Climate Change. Accessed on December 16, 2022. https://unfccc.int/about-us/regional-collaboration-centres/the-ciaca/about-carbon-pricing#What-is-Carbon-Pricing?-

- [2] World Bank. 2022. “State and Trends of Carbon Pricing 2022.” World Bank Group. https://openknowledge.worldbank.org/handle/10986/37455

- [3] European Parliamentary Research Service. 2020. “Carbon Emissions Pricing: Some Points of Reference.” European Parliament. https://www.europarl.europa.eu/thinktank/en/document/EPRS_BRI(2020)649352

- [4] Asian Development Bank. 2021. “Carbon Pricing.” Asian Development Bank. https://www.adb.org/sites/default/files/institutional-document/691951/ado2021bn-carbon-pricing-developing-asia.pdf

- [5] World Bank. 2021. “State and Trends of Carbon Pricing 2021.” World Bank Group. https://openknowledge.worldbank.org/entities/publication/7d8bfbd4-ee50-51d7-ac80-f3e28623311d

- [6] UNEP FI. 2022. “Position Paper on Governmental Carbon Pricing.” United Nations Environment Programme Finance Initiative. https://www.unepfi.org/wordpress/wp-content/uploads/2022/06/NZAOA_Governmental-Carbon-Pricing.pdf

- [7] Energy Studies Institute. 2022. “Corporate Internal Carbon Pricing: Global Trends and Challenges.” Energy Studies Institute, National University of Singapore. https://esi.nus.edu.sg/docs/default-source/esi-policy-briefs/corporate-internal-carbon-pricing_global-trends-and-challenges.pdf

- [8] UN Global Compact Network. 2018. “Internal Carbon Pricing in Companies.” UN Global Compact Network. https://www.unglobalcompact.org/library/5653

- [9] World Bank. 2019. “State and Trends of Carbon Pricing 2019.” World Bank Group. https://openknowledge.worldbank.org/entities/publication/0a107aa7-dcc8-5619-bdcf-71f97a8909d6

- [10] CDP and CPLC. n.d. “What Is Internal Carbon Pricing and How Can It Help Achieve Your Net-zero Goal?” Carbon Disclosure Project and Carbon Pricing Leadership Coalition. Accessed on December 16, 2022. https://cdn.cdp.net/cdp-production/cms/reports/documents/000/006/374/original/ICP_White_paper_Final_%281%29.pdf?1653572442

- [11] UNESCAP. 2020. “Businesses Move Forward with Carbon Pricing.” United Nations Economic and Social Commission for Asia and the Pacific. https://www.unescap.org/sites/default/d8files/knowledge-products/xPB109_Businesses%20move%20forward%20with%20carbon%20pricing.pdf

- [12] WRI. 2018. “4 Ways Companies Can Price Carbon: Lessons from India.” World Resources Institute. Accessed on December 16, 2022. https://www.wri.org/insights/4-ways-companies-can-price-carbon-lessons-india

- [13] Center for Climate and Energy Solutions. n.d. “Internal Carbon Pricing.” Accessed on December 16, 2022. https://www.c2es.org/content/internal-carbon-pricing/

- [14] Aggarwal, Mayank. 2016. “Mahindra Announces Internal Carbon Price of $10 Per Tonne of Emissions.” Live Mint. https://www.livemint.com/Companies/4i1kgS45VZiiNIHuO1mWFN/Mahindra-announces-internal-carbon-price-of-10-per-tonne-of.html