Transitioning to a low-carbon hydrogen-based economy is crucial for addressing concerns around climate change, reducing emissions, and accelerating decarbonisation efforts. Realising this, about 32 countries and the European Union have released national strategies/roadmaps aimed at increasing hydrogen production and use.1 With the recent announcement of the launch of the National Hydrogen Mission on 15th August 2021, in the Independence Day speech of the Prime Minister, India too plans to transition to a hydrogen-based economy.2

Based on the source material and production process, there are four main forms of hydrogen – brown/black hydrogen, derived from coal; grey hydrogen, derived from natural gas via the steam methane reforming process; blue hydrogen, derived from fossil fuels via carbon capture and sequestration process; and green hydrogen, derived from renewable energy including biomass via electrolysis.3 Among the different forms of hydrogen, green hydrogen is seen as a gamechanger as it eliminates the use of fossil fuels in the production process and enables the decarbonisation of hard to abate sectors such as heavy industries, heavy transport, and energy. At the same time, by boosting the demand for renewable energy (RE) generation, it facilitates the deepening of RE markets.

India’s Green Hydrogen Market

India’s green hydrogen market is currently in the nascent stages of development. This is because, at current production costs, green hydrogen is twice as expensive as grey and brown/black hydrogen – the dominant forms of hydrogen. In addition, there are no demand-side mandates to support its uptake. Catalysing the development of the green hydrogen market can help accelerate India’s decarbonisation as well as enable it to achieve its goals of energy independence and Atma Nirbharta in manufacturing. Besides enabling low-carbon economic growth and generating jobs, green hydrogen will have other macroeconomic benefits for the country. Reducing India’s reliance on fossil fuels in hydrogen production can help it reduce its dependence on liquified natural gas (LNG) imports and thereby rationalise its existing ~USD 6.7 billion (~INR 502.5 billion) annual import bill.4,5 By leveraging low-cost, domestic RE generation, India could produce green hydrogen for export and corner a portion of the annual global demand of 200 million tonnes by 2030.6

Realising India’s potential, a few global and Indian industry players have rolled out pilot and large-scale projects that can increase green hydrogen production and end-use in the future. On the production side, in August 2021, Ohmium International, a RE start-up headquartered in the US, opened India’s first green hydrogen electrolyser giga-factory with an initial manufacturing capacity of 500 MW per year, which can be scaled to 2 GW per year.7 Electrolysers are key equipment used in the production of green hydrogen. Reliance Industries, as part of its commitment to invest USD 10 billion (INR 750 billion) in new energy businesses, announced plans to build a giga-factory to manufacture electrolysers.8 Recently, the Solar Energy Corporation of India (SECI) announced a tender to set up a ‘green hydrogen’ pilot plant,9 and the Ministry of Petroleum and Natural Gas has tasked its oil and gas public sector undertakings (PSUs) to set up seven to eight green hydrogen pilot plants by the end of 2021.10 Further, the Indian Oil Corporation Ltd (IOCL) has stated that it will build the country’s first green hydrogen plant in its Mathura refinery.11

On the end-use side, NTPC Limited, as part of its Green Mobility Project in Leh, released a tender in July 2021 to set up India’s first green hydrogen fuelling station in Ladakh.12 Two such hydrogen fuelling stations, though not green are already in operation at the IOCL research and development centre in Faridabad and at the National Institute of Solar Energy in Gurugram.13 Beyond applications in mobility, a 10 per cent purchase obligation for green hydrogen in refineries and fertiliser plants is awaiting Cabinet approval.14 The proposed measure would boost the industrial use of green hydrogen.

Green Hydrogen Ecosystem - State of Play and Key Barriers

While these developments in the green hydrogen market are encouraging, the scaling up of green hydrogen production and its end-use in the country are limited by the high cost of production, the consequent lack of cost-competitiveness relative to fossil fuel-based hydrogen, and a lack of distribution infrastructure. Further, mobilising the scale of investments required for the production of green hydrogen is also a challenge (to the tune of USD 44 billion by 203015), particularly in the absence of an extensive technology performance track record. Targeted fiscal, financial, and non-financial support to improve commercial viability and measures to kickstart research and development can help accelerate the adoption of green hydrogen.16 In this analysis, we outline the state of play and the key barriers in the development of the green hydrogen ecosystem and suggest possible policy measures that can catalyse green hydrogen production in the country.

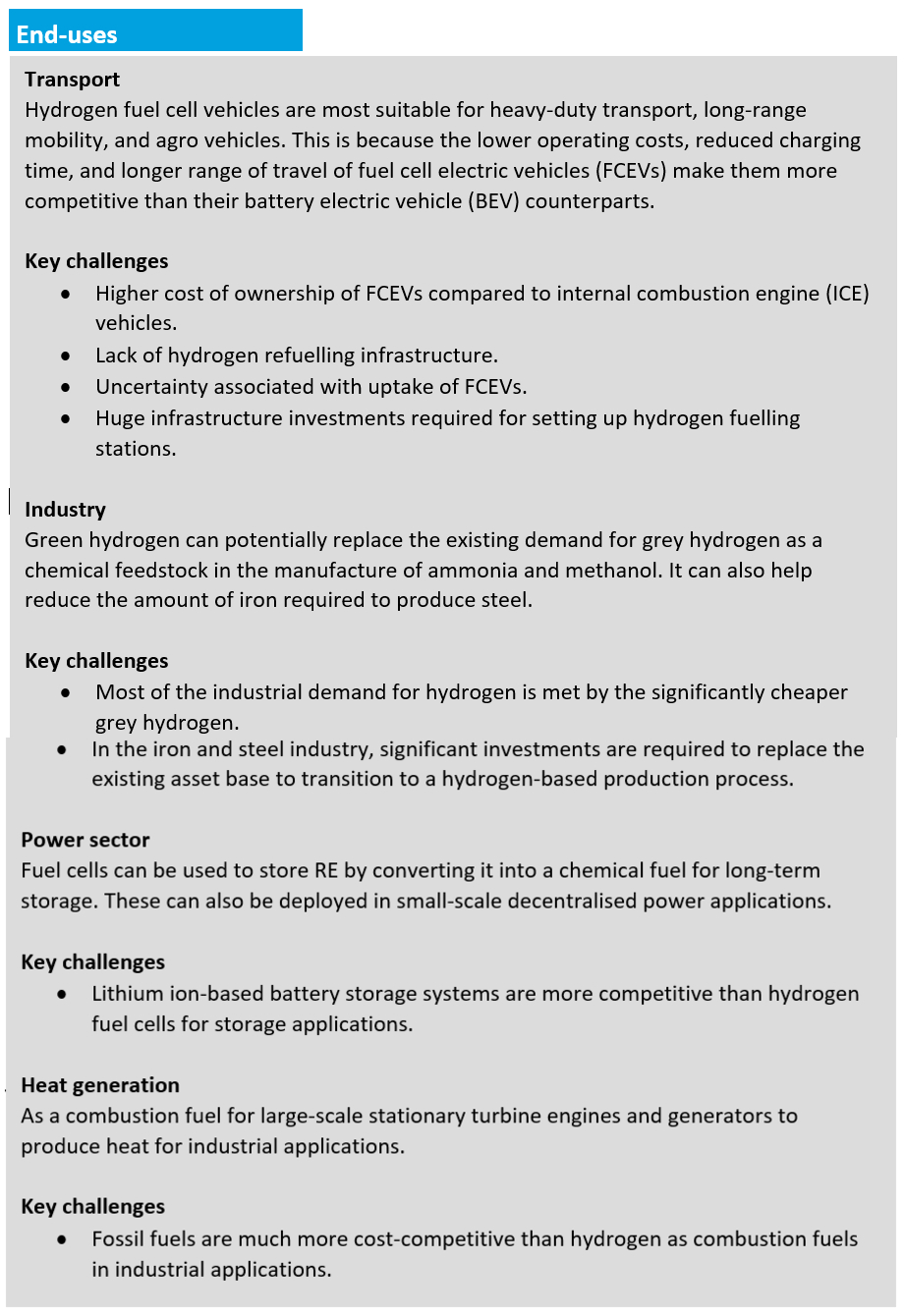

Figure 1: The green hydrogen (H2) value chain – state of play and challenges

Source: CEEW-CEF compilation based on data from Biswas, Tirtha, Deepak Yadav, and Ashish Baskar Guhan. 2020. “A Green Hydrogen Economy for India – A Green Hydrogen Economy Production Cost.” New Delhi: Council on Energy, Environment and Water.

Source: CEEW-CEF compilation based on data from International Energy Agency. 2019. “The Future of Hydrogen – Seizing Today’s Opportunities.” Paris: IEA.

Source: CEEW-CEF compilation based on market reports.17, 18, 19, 20

Policy Support for Transforming India into a Global Hub for Green Hydrogen Production

In his Independence Day speech, the Prime Minister outlined his vision to transform India into a global hub for green hydrogen production and export to achieve self-reliance in energy and unlock green growth and jobs in the years to come.21 Scaling up cost-competitive green hydrogen production in line with this objective requires policy support. Based on our analysis of the barriers to market entry and commercialisation of green hydrogen across the value chain, policy makers could consider some of the following interventions to catalyse green hydrogen production in the country. Additional measures would be necessary to address challenges in distribution and end use.

Financial incentives/measures to improve the commercial viability of green hydrogen production.

- Introduce measures such as CAPEX subsidies or viability gap funding to improve the commercial viability of green hydrogen production. Deeper analysis is necessary to identify the most impactful measure.

- Improve the ease of doing business by lowering operating costs.

- Provide waivers on open-access charges to lower the cost of power (the single-largest component of LCOH) for green hydrogen production.

- Kickstart the flow of debt capital by providing guarantees.

- Provide financial guarantees to allay debt financiers’ risk perceptions of the nascent green hydrogen segment.

Introduce measures to create demand-side certainty.

- Set policy targets for green hydrogen production at the national level similar to those for RE to improve investor confidence by creating greater certainty over uptake.

- Include green hydrogen in the existing renewable purchase obligation (RPO) mandate. Such an initiative has already been included in the Draft Electricity (Promoting Renewable Energy through Green Energy Open Access) Rules, 2021.

Support research and development to improve commercial viability.

- Create a dedicated research and development fund, jointly funded by the government and industry, aimed at achieving technological breakthroughs and improving the commercial viability of green hydrogen.

Create measures to promote electrolyser manufacturing.

- Secure long-term supplies of key minerals used in electrolyser manufacturing and fuel-cell manufacturing via government-to-government agreements, supply contracts with companies, or greenfield/brownfield investments in mines abroad.

- Develop manufacturing parks (to provide manufacturers access to sites for setting up facilities) in RE resource-rich regions to simplify investments and improve the competitiveness of electrolyser manufacturing.

- Introduce targeted financial incentives such as extending the proposed production-linked incentive (PLI) scheme to electrolysers manufacturing.

Conclusion

Hydrogen demand is expected to increase almost five-fold across sectors by 2050 from the current demand of 6 million tonnes per annum.22 Given the cost-competitiveness of black/brown hydrogen compared to green hydrogen, 95 per cent of this demand is met by fossil fuel–derived hydrogen.23 However, this is not an environmentally sustainable option given the high emissions footprint of black/brown hydrogen.24 Green hydrogen produced from RE has the potential to not only cater to the rising demand for hydrogen, but it can support the growth of RE as well. Accelerating green hydrogen deployment can both accelerate economy-wide decarbonisation as well as unlock new jobs and growth opportunities.

References

- [1]Ghosh, Arunabha and Sanjana Chhabra. 2021. Speed and Scale for Disruptive Climate Technologies: Case for a Global Green Hydrogen Alliance. New Delhi: Council on Energy, Environment and Water. https://www.ceew.in/sites/default/files/ceew-study-on-a-global-green-hydrogen-alliance-for-clean-energy.pdf. Accessed 20 September, 2021.

- [2]Prime Minister's Office. 2021. “English Rendering of the Text of the PM's Address from the Red Fort on 75th Independence Day.” PIB Delhi. https://pib.gov.in/PressReleseDetail.aspx?PRID=1746062. Accessed 14 September, 2021.

- [3]CEEW-CEF. 2021. “What Is Green Hydrogen?” Centre for Energy Finance. https://cef.ceew.in/masterclass/explains/what-is-green-hydrogen. Accessed 20 September, 2021.

- [4]MoPNG. 2020. Energising India’s Progress: Annual Report, 2019–20. New Delhi: Ministry of Petroleum and Natural Gas, Government of India. http://petroleum.nic.in/sites/default/files/AR_2019-20E.pdf. Accessed 14 September, 2021.

- [5] A conversion rate of USD 1 = INR 75 is used in the analysis.

- [6]International Energy Agency. 2019. The Future of Hydrogen – Seizing Today's Opportunities. Paris: International Energy Agency. https://www.iea.org/reports/the-future-of-hydrogen. Accessed 20 September, 2021.

- [7]PTI. 2021. “Ohmium Launches Green Hydrogen Electrolyser Gigafactory.” Times of India, August 25. https://timesofindia.indiatimes.com/business/india-business/ohmium-launches-green-hydrogen-electrolyzer-gigafactory/articleshow/85618551.cms. Accessed 20 September, 2021.

- [8]Bullard, Nathaniel and Bloomberg. 2021. “Why Reliance Industries Giga-factory for Hydrogen Could Be a Game Changer.” Live Mint, 1 July. https://www.livemint.com/companies/news/why-reliance-industries-giga-factory-for-hydrogen-could-be-a-gamechanger-11625137566394.html. Accessed 01 July, 2021.

- [9]SECI. 2020. “Setting up of 25 kW Green Hydrogen Based Pilot Project at SNM Hospital, Leh, UT of Ladakh.” Solar Energy Corporation of India. https://www.seci.co.in/whats-new-detail/2183. Accessed 07 July, 2021.

- [10]Sharma, Shalini. 2021. “Oil & Gas PSUs to Set Up 7-8 Green Hydrogen Pilot Plants by 2021-end: Petroleum Secretary.” PSUWATCH, April 16. https://psuwatch.com/oil-and-gas-psus-to-set-up-7-8-green-hydrogen-pilot-plants-by-fy21-end-petroleum-secretary. Accessed 20 September, 2021.

- [11]FE Bureau. 2020. “Indian Oil Corporation to Build Green Hydrogen Plant at Mathura Refinery.” Indian Express, July 24. https://www.financialexpress.com/industry/indian-oil-corporation-to-build-green-hydrogen-plant-at-mathura-refinery/2296759/. Accessed 14 September, 2021.

- [12]NTPC. 2021. “NTPC REL Signs MoU with Union Territory of Ladakh to Set Up Country’s First Green Hydrogen Mobility Project.” https://www.ntpc.co.in/en/media/press-releases/details/ntpc-rel-signs-mou-union-territory-ladakh-setup-country%E2%80%99s-first-green-hydrogen-mobility-project. Accessed 14 September, 2021.

- [13]MNRE. 2021. “New Technologies – Hydrogen Energy.” Ministry of New and Renewable Energy. https://mnre.gov.in/new-technologies/hydrogen-energy. Accessed 14 September, 2021.

- [14]PTI. 2021. “Cabinet Nod Sought for Setting Green Hydrogen Purchase Obligations for Refineries, Fertiliser Plants: RK Singh.” Economic Times, September 8. https://economictimes.indiatimes.com/industry/renewables/cabinet-nod-sought-for-setting-green-hydrogen-purchase-obligation-for-refineries-fertiliser-plants-rk-singh/articleshow/86041929.cms. Accessed 14 September, 2021.

- [15] Financial Express. 2021. “Policy Must Pave the Path for a Green Hydrogen Economy in India.” July 21. https://www.financialexpress.com/opinion/a-green-hydrogen-economy-for-india/2294481/. Accessed 20 September, 2021.

- [16]Biswas, Tirtha, Deepak Yadav, and Ashish Baskar Guhan. 2020. A Green Hydrogen Economy for India: Policy and Technology Imperatives to Lower Production Cost. New Delhi: Council on Energy, Environment and Water. https://www.ceew.in/publications/green-hydrogen-economy-india. Accessed 07 July, 2021.

- [17]Max Ludwig, Martin Lüers, Markus Lorenz, Esben Hegnsholt, Minjee Kim, Cornelius Pieper, and Katharina Meidert. 2021. “The Green Tech Opportunity in Hydrogen.” https://www.bcg.com/en-in/publications/2021/capturing-value-in-the-low-carbon-hydrogen-market. Accessed 27 October, 2021.

- [18]IRENA. 2018. Hydrogen from renewable power: Technology outlook for the energy transition. Abu Dhabi: International Renewable Energy Agency. https://www.irena.org/publications/2018/sep/hydrogen-from-renewable-power. Accessed 27 October, 2021.

- [19] IRENA. 2019. Hydrogen: A renewable energy perspective. Abu Dhabi: International Renewable Energy Agency. https://irena.org/publications/2019/Sep/Hydrogen-A-renewable-energy-perspective. Accessed 27 October 2021.

- [20]Hall, Hall, Thomas Spencer, G Renjith, and Shruti Dayal. 2020. The Potential Role of Hydrogen in India: A Pathway for Scaling-up Low Carbon Hydrogen across the Economy. New Delhi: The Energy and Resources Institute (TERI). https://www.teriin.org/sites/default/files/2020-12/Report%20on%20The%20Potential%20Role%20of%20Hydrogen%20in%20India%20%E2%80%93%20%27Harnessing%20the%20Hype%27.pdf. Accessed 20 September, 2021.

- [21]Prime Minister's Office. 2021. “English Rendering of the Text of the PM's Address from the Red Fort on 75th Independence Day.” PiB Delhi.

- [22]Hall, Spencer, Renjith, and Dayal. 2020. The Potential Role of Hydrogen in India.

- [23]Hall, Spencer, Renjith, and Dayal. 2020. The Potential Role of Hydrogen in India.

- [24]Emissions footprint of different forms of hydrogen: black/Brown – 15–26 kg of CO2/kg of H2; grey – 9.3–15 kg of CO2/kg of H2; blue – 10.7 kg of CO2/kg of H2; green – nil.