Context

India requires significant infrastructure investments for overall economic development, and the infrastructure financing gap is estimated to exceed 5 per cent of GDP.1 Increasing the flow of finance is therefore critical to achieving incremental infrastructure deployment. Releasing capital that is locked in operational assets by transferring ownership to investors who desire predictable cash flows but do not wish to take development risks can be an effective way of increasing such flows. Infrastructure investment trusts (InvITs) are one example of structures that can unlock capital in the above manner, thereby helping developers access fresh capital for incremental project development.

What are InvITs?

An InvIT is a pooled investment vehicle that raises funds from investors by issuing units and invests the proceeds in infrastructure assets.2 It invests in eligible infrastructure projects either directly, or in the form of equity and debt in special purpose vehicles (SPVs) or even holding companies (ibid). Investments aim to generate revenue in the form of predictable cash flows.3 Until December 2022, InvITs could be set up as listed as well as unlisted, and both types are registered with and regulated by the Securities and Exchange Board of India (SEBI).2 However, effective January 01, 2023, unlisted InvITs are no longer permitted.4 As on April 17, 2023, there were 20 registered InvITs in India.5

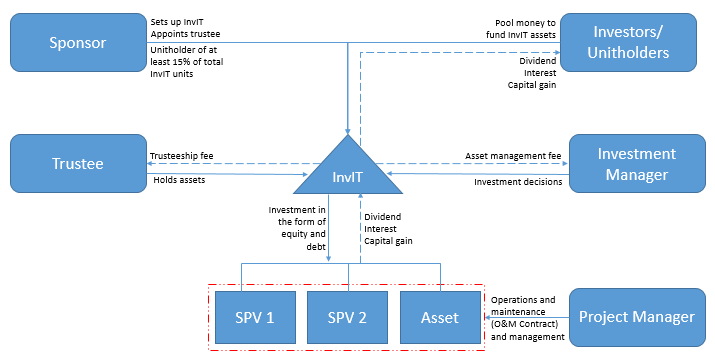

A sponsor sets up an InvIT and then appoints a trustee to hold the assets in the name of the InvIT.2 Further, the trustee appoints and oversees an investment manager and a project manager. The mechanism of an InvIT is as follows:

- Raising funds from investors: An InvIT raises funds by issuing units to investors via public offer or private placement.2 A listed InvIT, unlike an unlisted InvIT, can also raise debt capital (ibid).

- Investing in infrastructure projects: The pooled funds can be invested in three forms (i) direct investments in physical assets (such as a solar PV plant), (ii) equity investments in infrastructure SPVs or holding companies (at least 51 per cent ownership in each case), and (iii) investments in the debt of, or the extension of loan to, infrastructure SPVs or holding companies in which the InvIT has made an equity investment. At least 80 per cent of the total assets of an InvIT are mandated to be invested in completed infrastructure projects.2 The investment manager is responsible for, inter alia, the investment decisions.

- Managing and operating projects: The project manager is mainly responsible for managing, operating, and maintaining InvIT assets.2

- Distributing cash flows: The InvIT is required to distribute at least 90 per cent of its net distributable cash flows to unitholders at least once every six months in the case of a listed InvIT and once every year in the case of an unlisted InvIT.2 Most importantly, the key advantage of an InvIT, owing to its pass-through status, is the absence of tax liability on the dividend and interest received from SPVs or holding companies in the hands of the Trust.6

Fig 1: Illustrative InvIT structure

Source: CEEW-CEF analysis

Who should care?

- Investors who could be interested in InvITs for diversification of portfolio and steady income.

- Infrastructure project developers who could use InvITs to recycle capital.

References

[1] Confederation of Indian Industry. 2022. “Infrastructure Financing: The Way Forward.” Accessed on April 20, 2023. https://www.ciiblog.in/infrastructure-financing-the-way-forward/

[2] SEBI. 2023a. “Securities and Exchange Board of India (Infrastructure Investment Trusts) Regulations, 2014 [Last amended on February 14, 2023].” Securities and Exchange Board of India. https://www.sebi.gov.in/legal/regulations/feb-2023/securities-and-exchange-board-of-india-infrastructure-investment-trusts-regulations-2014-last-amended-on-february-14-2023-_68062.html

[3] SEBI. n.d. “Introduction to REITs and InvITs.” Securities and Exchange Board of India. https://www.bseindia.com/downloads1/PPT10_REITs_InvITs%20Presentaion.pdf

[4] SEBI. 2022. “Securities and Exchange Board of India (Infrastructure Investment Trusts) (Second Amendment) Regulations, 2022.” Securities and Exchange Board of India. https://www.sebi.gov.in/legal/regulations/nov-2022/securities-and-exchange-board-of-india-infrastructure-investment-trusts-second-amendment-regulations-2022_64909.html

[5] SEBI. 2023b. “Registered Infrastructure Investment Trusts.” Securities and Exchange Board of India. https://www.sebi.gov.in/sebiweb/other/OtherAction.do?doRecognisedFpi=yes&intmId=20

[6] The Economic Times. 2023. “Govt proposes taxation changes related to REITs, InVITs.” The Economic Times. Accessed on April 20, 2023. https://economictimes.indiatimes.com/news/economy/policy/govt-proposes-taxation-changes-related-to-reits-invits/articleshow/97532637.cms