Context

Electric vehicles (EV) are significantly more expensive than comparable internal combustion engine (ICE) vehicles. EVs have higher upfront costs than ICE vehicles and reducing this cost is crucial in making them more attractive to buyers. Different forms of financial incentives are being provided by national and sub-national governments in India to make EVs more affordable. The key mechanisms have been listed below.

Purchase incentives

A purchase incentive is a direct discount provided to the user on the cost of the EV. Such incentives are commonly used across the world to make EVs more affordable. The financial support may be given either to the user or the manufacturer. The incentive may also be linked to the battery cost. In many cases, there is an upper ceiling to the amount of support provided.

Purchase incentives are provided to EVs in India by the central government and state governments. These may be as consumer capital subsidies, user subsidies, or demand generation incentives.

Coupons

Financial incentives in the form of government coupons may also be provided to EV buyers. The amount will be reimbursed by the government later. Coupon amounts may vary according to the vehicle category or the price of the car. In addition, coupons may also be available only in specified periods.

An example of this is the Haryana state government's financial coupon on the purchase of an EV within the first six months of the policy term. This ranges from INR 50,000 to INR 1 lakh.1

Interest subventions

Interest subventions are discounts offered on the interest rate applicable on availing of a loan. These subventions are borne by the government when proposed through a policy. The user thus receives a waiver on the interest rate paid by her/him.

The Delhi EV policy provided an interest subvention of 5 per cent on all loans taken to finance EVs.2

Road tax exemption

All vehicle owners in India need to pay a road tax at the time of purchase to the state government.3 This varies across Indian states. These also vary according to the usage of the vehicle – personal or commercial. The state road tax is further differentiated into slabs, depending on the vehicle's cost and fuel needs. For instance, the road tax in Delhi ranges from 4–15 per cent.4 Most Indian states with EV policies provide a road tax waiver for EVs.

States like Andhra Pradesh, Delhi, Kerala, and Telangana provide this benefit.

Registration fee exemption

A one-time registration fee is applicable for any new vehicle purchase.5 Like the road tax, this is also paid at the time of purchase of a vehicle. This amount varies depending on the usage of the vehicle – commercial or personal.

Most Indian states exempt EVs from paying registration fees.

Income tax benefit

Income tax (IT) benefits are commonly used to incentivise EV purchases. This is provided as a deduction on the tax amount payable by an individual to the government.

In 2019, the central government announced an IT benefit of INR 1.5 lakh on interest paid on loans taken to finance EVs.6

Scrapping incentives

Scrapping incentives are used to disincentivise the use and ownership of old ICE vehicles. In India, these are provided upon de-registering old ICE vehicles. A scrap value is provided – which may be a fixed amount, a share of the ex-showroom price, or a rebate on the road tax and registration fee of a new vehicle.7

SGST reimbursement

The goods and service tax (GST) in India is shared equally by the central government as a central goods and services tax (CGST) and the state government as a state goods and services tax (SGST). States may offer SGST reimbursements on the purchase of an EV.

States like Andhra Pradesh offer this benefit – a 100 per cent reimbursement of the SGST paid by a buyer.8

Others

Several other financial incentives, such as interest-free loans, top-up subsidies, special incentives on electric three-wheelers, etc., have also been provided under state EV policies.

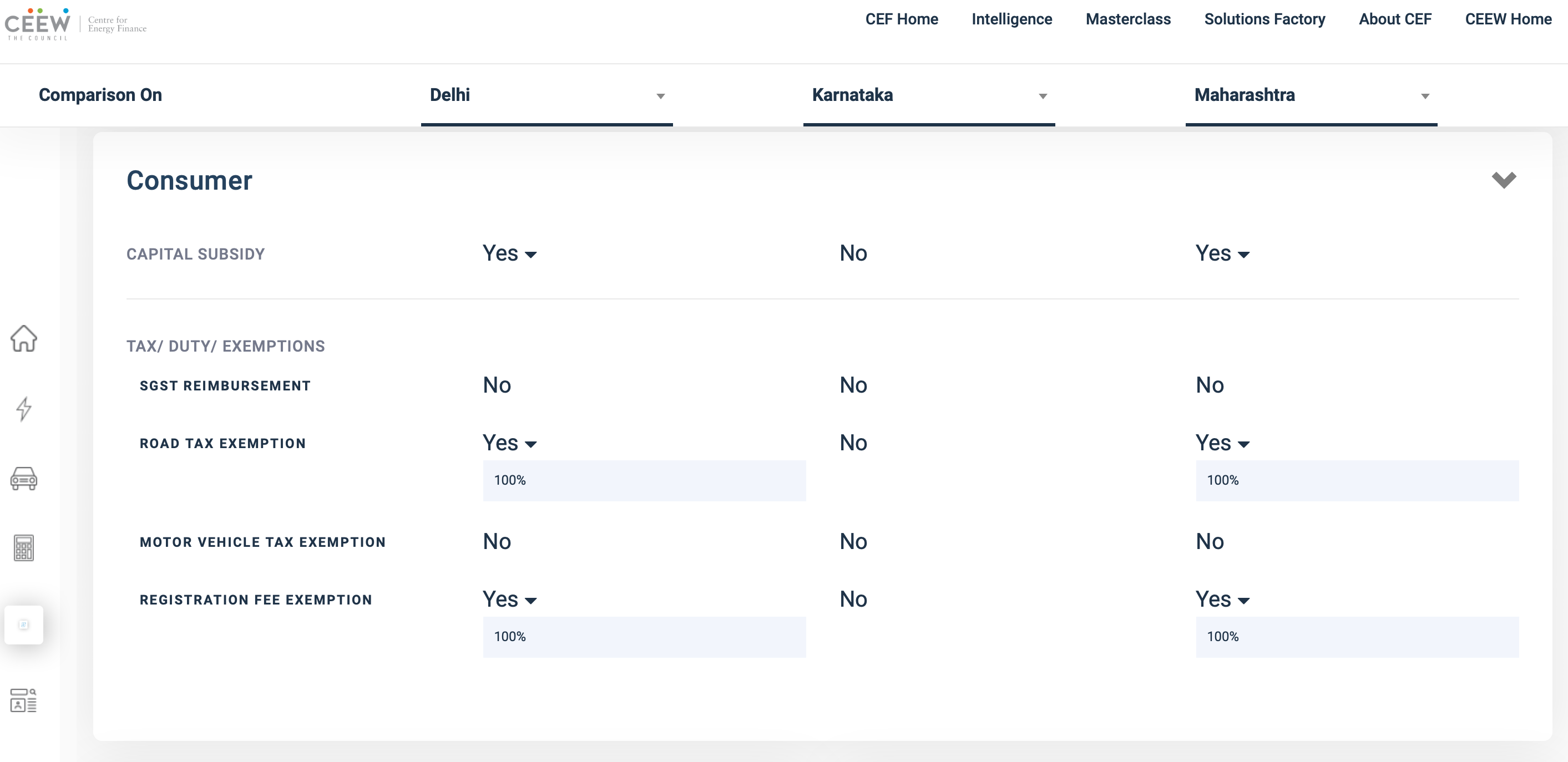

Our Electric Mobility Dashboard encapsulates and compares all such incentives provided by state EV policies.

Figure 1: CEEW-CEF policy comparison tool

Financial incentives available in EV markets across the world:9

- Purchase incentives

- Tax credits

- Import tax exemptions

- Value-added tax (VAT) exemptions

- Battery tax bonus

- Scrappage policies

Who should care about these financial incentives?

- Individuals EV buyers

- Fleet operators – freight and transport

- Public transportation providers

- Government departments with a mandate to scale up EVs

References

- [1] Government of Haryana, “Electric Vehicle Policy Draft,” 2019, https://haryanatransport.gov.in/sites/default/files/Electric Vehicle Policy_2.pdf.

- [2] Government of Delhi, “Delhi Electric Vehicles Policy, 2020,” 2020

- [3] Aditya Birla Capital, “Rules And Regulations Related To Road Tax In India,” 2020

- [4] Bank Bazaar, “Rules & Regulations to Road Tax in India,” n.d.

- [5] Gagan Modi, “Car Registration Charges in India. RTO Road Tax, Fees on New Car Purchase,” 2021, https://www.mycarhelpline.com/index.php?option=com_easyblog&view=entry&id=155&Itemid=91.

- [6] Revati Krishna, “How Much Income Tax You Can Save on Buying an Electric Car,” Mint, 2019.

- [7] Ashutosh Kumar, “Modi Govt’s Vehicle Scrappage Policy: All You Need to Know,” 2021.

- [8] Government of Andhra Pradesh, “Electric Mobility Policy 2018–23,” 2018.

- [9] Volkswagen, “How Electric Car Incentives around the World Work,” accessed April 9, 2021, https://www.volkswagenag.com/en/news/stories/2019/05/how-electric-car-incentives-around-the-world-work.html#.