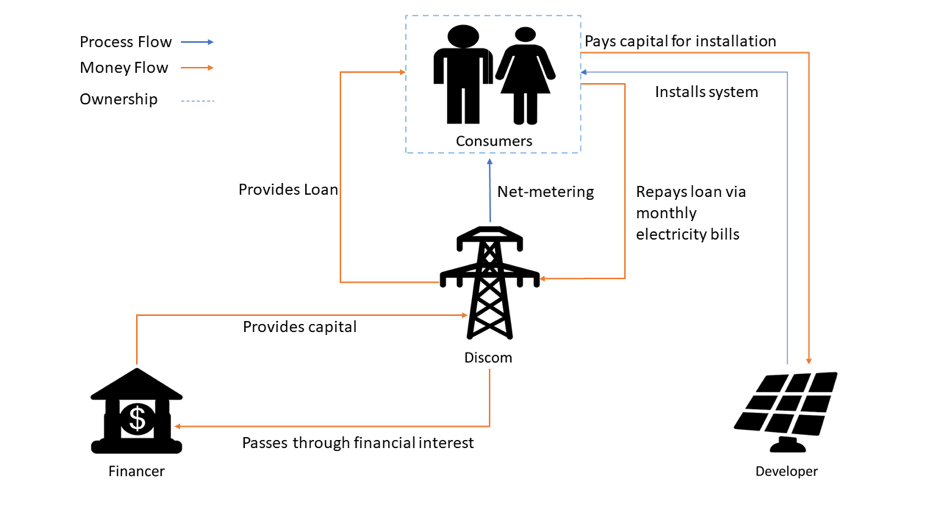

In on-bill loan financing model, the consumers are provided with the capital required for the solar rooftop system as a loan by the discom.

Benefits to discoms

- Higher adoption of rooftop solar by consumers in the lower consumption slabs can lead to reduced cross-subsidy burden for the discoms.

Benefits to consumers

- Consumers who did not have access to cheap credit are able to install systems under the model.

- Aggregated procurement by the discom can ensure better quality of installation.

Benefits to developers

- Developers get access to new customer segments who could not afford rooftop solar system otherwise.

- Identification and aggregation of consumers by the discoms leads to reduced customer acquisition and business development costs for the developers.

Source : Utility-centric Business Models for Rooftop Solar Models (USAID, 2008)

-

Target Consumer SegmentConsumers with exclusive roof access and cannot bear the upfront cost of solar system installation

-

LocationConsumer rooftops

-

Asset OwnershipCosumer

-

Metering ArrangementNet-metering

-

Role of DiscomFinancing, aggregated procurement

-

Level of involvement by utilityLow

-

Need for partnershipsHigh

-

Revenue to DISCOMLow

-

Skill RequirementLow

-

Risk to UtilityHigh