Report

Cost-effectiveness of Discom Operations in Uttar Pradesh

Impact of UDAY, Power Purchase Planning and Dispatch

Prateek Aggarwal, Karthik Ganesan, Danwant Narayanaswamy

July 2020 | Power Markets

Suggested citation: Aggarwal, Prateek, Karthik Ganesan, and Danwant Narayanaswamy. 2020. Cost-effectiveness of Discom Operations in Uttar Pradesh: Impact of UDAY, Power Purchase Planning and Dispatch. New Delhi: Council on Energy, Environment and Water.

Overview

This study undertakes a qualitative and quantitative evaluation of the impact of the Ujwal Discom Assurance Yojana (UDAY) scheme in improving the financial and operational performance of UP’s state-owned discoms. The study also covers the challenges the state faces by way of high-cost electricity (accounting for 75-80 per cent of the total discom expenditure) that it is saddled with.

Taking cue from the ongoing situation, the need for paring power purchase expenditures is even more necessary now, as the impact of the COVID-19 pandemic is likely to last, continuing to affect demand recovery and the consumer’s ability to pay. The study focuses upon the financial implications of the current procurement practices in UP and provides several recommendations for key stakeholders to reduce power purchase costs by optimising power procurement from current contracted capacity.

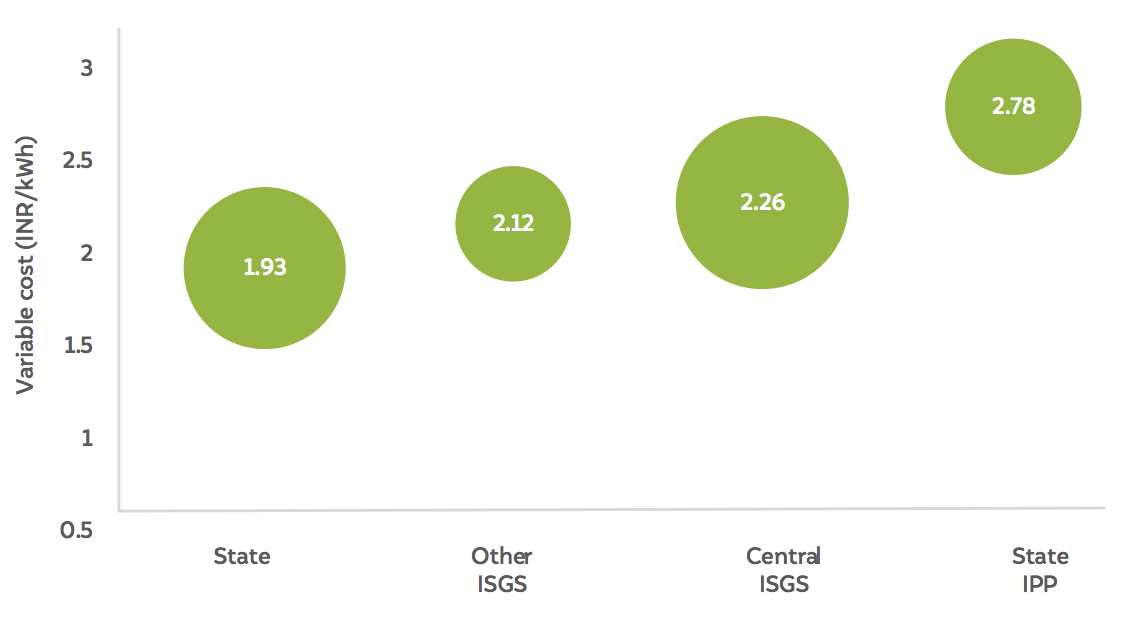

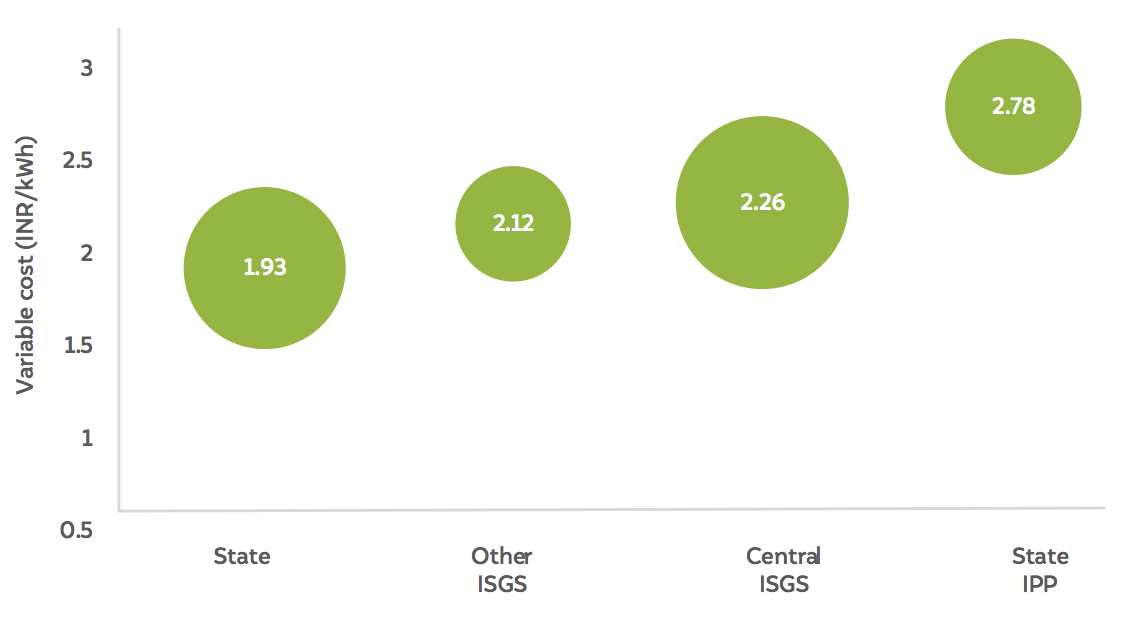

State IPPs are the costliest and central ISGS are the largest provider of electricity

Authors’ adaption from UPERC tariff orders; UPPCL tariff filings, merit portal and UPSLDC

Note: The bubble size represents the quantity of power procured

Key findings

Assessment of UDAY scheme – operational and financial improvement

- The persisting gap between the average cost of supply and average revenue realised could be attributed to skewed sale share of low-paying consumers, significant un-metered consumers, low billing, and collection efficiencies.

- The financial assessment of the UDAY scheme on the performance of discoms suggests that on each unit sold, the discoms (at the consolidated level) have lost more than INR 80 paisa in recent years (based on the audited accounts).

- Undisbursed additional subsidies requested by discoms from the UP government play an important role in determining the financial health of discoms.

- There are significant variations between what is reported to the regulator (in true-up filings) and that reported through audited books on which the financing agencies rely.

- The audited books for FY 2016-17 suggest that on each unit being sold, the state has lost more than INR 56 paise while the trued-up order released by the regulator reveals that the discom has a net positive margin on each unit sold.

Power purchase planning, dispatch, and cost optimisation

- The average load in UP is expected to rise from 13,000 MW to 31,613 MW; peak load is estimated to increase from 22,000 MW to 40,690 MW by 2029–30.

- Given the tremendous challenges with augmenting revenue, the default option for the discom is cost reduction. The high cost of power purchase has a significant impact on retail tariffs. It becomes necessary to understand and weed out inefficiencies in the procurement process to address the more significant issue of the revenue gap for the discoms.

- There was an opportunity to save nearly INR 900 crore in each of the last three years (FY 2016-17 to FY 2018-19) by merely following the Merit Order Dispatch in utilising the cheap state-based generators (state-owned and state IPPs) to their fullest capacity.

- The reasons for deviating from MOD are a result of poor coal availability at some low-cost generating stations, poor operational scheduling, and perhaps an inherent preference to have state-owned generators dispatch on account of flexible payment terms.

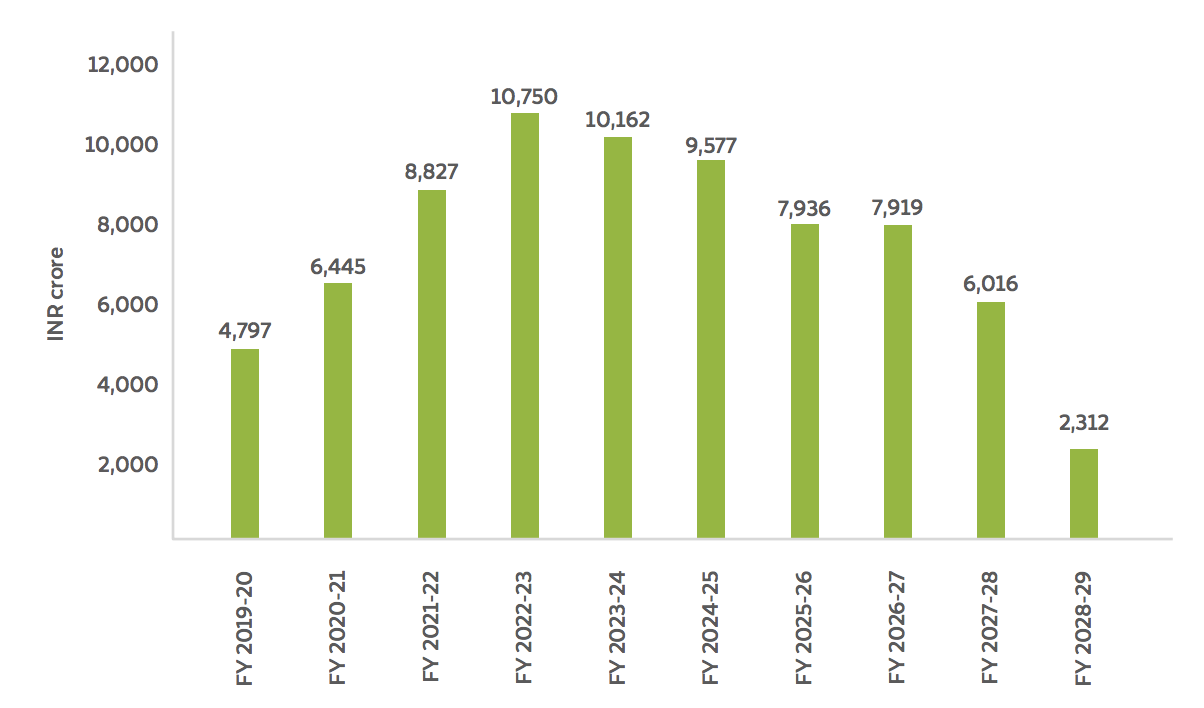

- The UP discoms are paying nearly 6 per cent (INR 3,000 crore) of their total cost of procurement to a few generators just as fixed charges as their utilisation is poor. The regulator has approved a new capacity addition programme that will spike up the total ‘stranded’ fixed cost payments to about INR 10,000 crore by FY 2023.

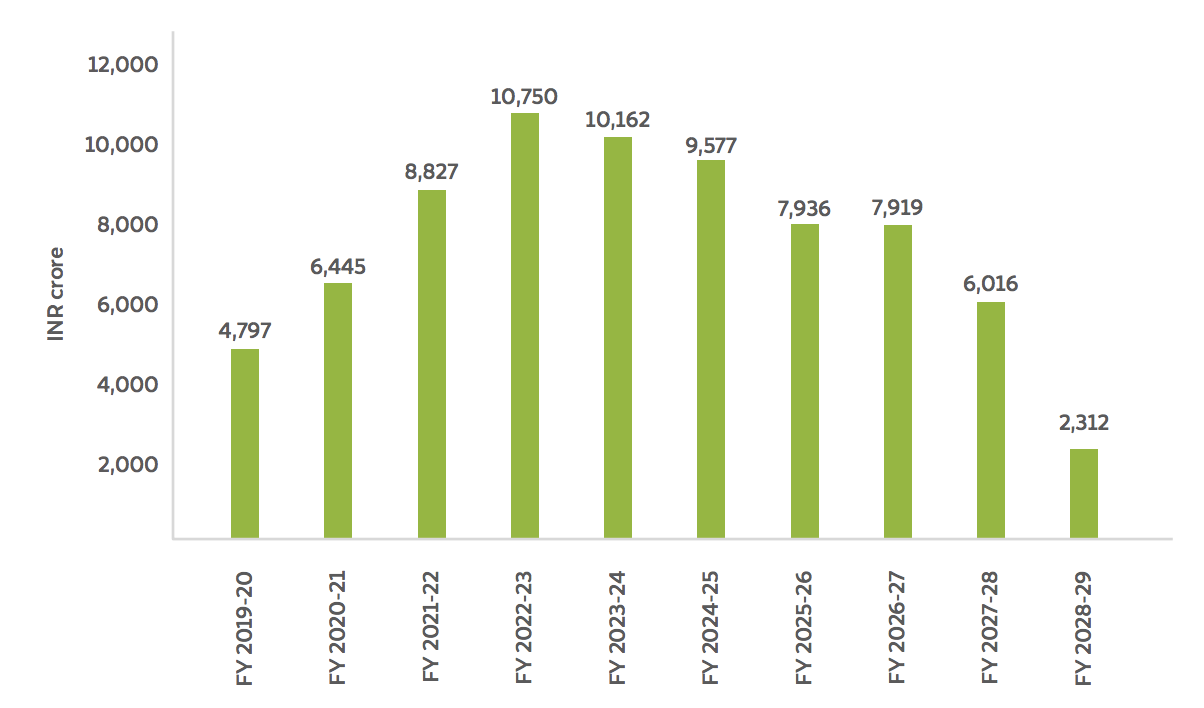

Stranded capacity charges will be highest in FY 2022–23

Source: Authors’ adaption from UPPCL filings

Key recommendations

Operational and Financial Improvement

- Call for creating a more transparent system for the exposition of costs involved in the discom operations and for the regulators to recognise costs and losses appropriately.

- Develop a robust billing and collection mechanism to recover the cost of supply when cross-subsidising consumers have a low base and, more importantly, to cultivate commercial and industrial segments in the long run.

Power purchase planning, dispatch, and cost optimisation

- Adopt a whole-of-sector approach combining long-term electricity demand forecast with power procurement options beyond contracting or commissioning new capacity. This would not only help discoms economise their overall cost of power procurement but also alleviate supply risks, especially with the growing share of renewable energy sources.

- Conduct a full cost-benefit analysis of alternatives before making any long-term procurement decisions.

- For the short-term, discoms can use the unutilised generation of nearly 20,000 MU that the currently contracted plants can provide each year, after leveling the load curve in UP, thereby finding a balance between demand seasons.

- Target the maximum procurement from the cheapest generators among the current contracted capacity and address barriers that prevent discoms from doing so.

- Reallocate coal between the various plants from which the state procures to ensure that the most efficient plants are generating as much as technically possible.

The need for paring power purchase expenditures is even more necessary now, as the impact of the ongoing COVID-19 pandemic is likely to last, continuing to affect demand recovery and the consumer’s ability to pay.