Suggested Citation: Tyagi, Bhawna, and Neeraj Kuldeep. 2023. Community Solar for Advancing Power Sector Reforms and the Net-Zero Goals. New Delhi: Council on Energy, Environment and Water.

The study examines the role of the utility-led community solar model in accelerating rooftop solar adoption and in the financial turnaround of distribution companies. Discoms face challenges such as billing and metering inefficiencies, T&D losses, high cross-subsidy burden and under-recovery of costs. Low-paying consumers also contribute to the discoms’ financial and operational challenges. The adoption of distributed renewable energy (DRE) systems can provide an opportunity to address these challenges. Further, the study highlights how a community solar model can aggregate demand and install a larger system on community premises to meet this demand. These systems can be owned by the utility, developer or the community.

Decarbonising the power sector is critical to achieving India’s net-zero goal by 2070. The electricity sector is the most carbon emission-intensive sector, contributing to ~40 per cent of total carbon emissions in India. However, to meet national climate and renewable energy goals, there is a need to infuse operational and financial efficiencies in the distribution sector. The discoms in India struggle with under-recovery of cost, billing and metering inefficiencies, high cross-subsidy burden, higher transmission and distribution (T&D) losses, legacy power purchase agreements (PPAs), and underinvestment in infrastructure. These inefficiencies in the distribution sector impact the financial health of the overall power sector.

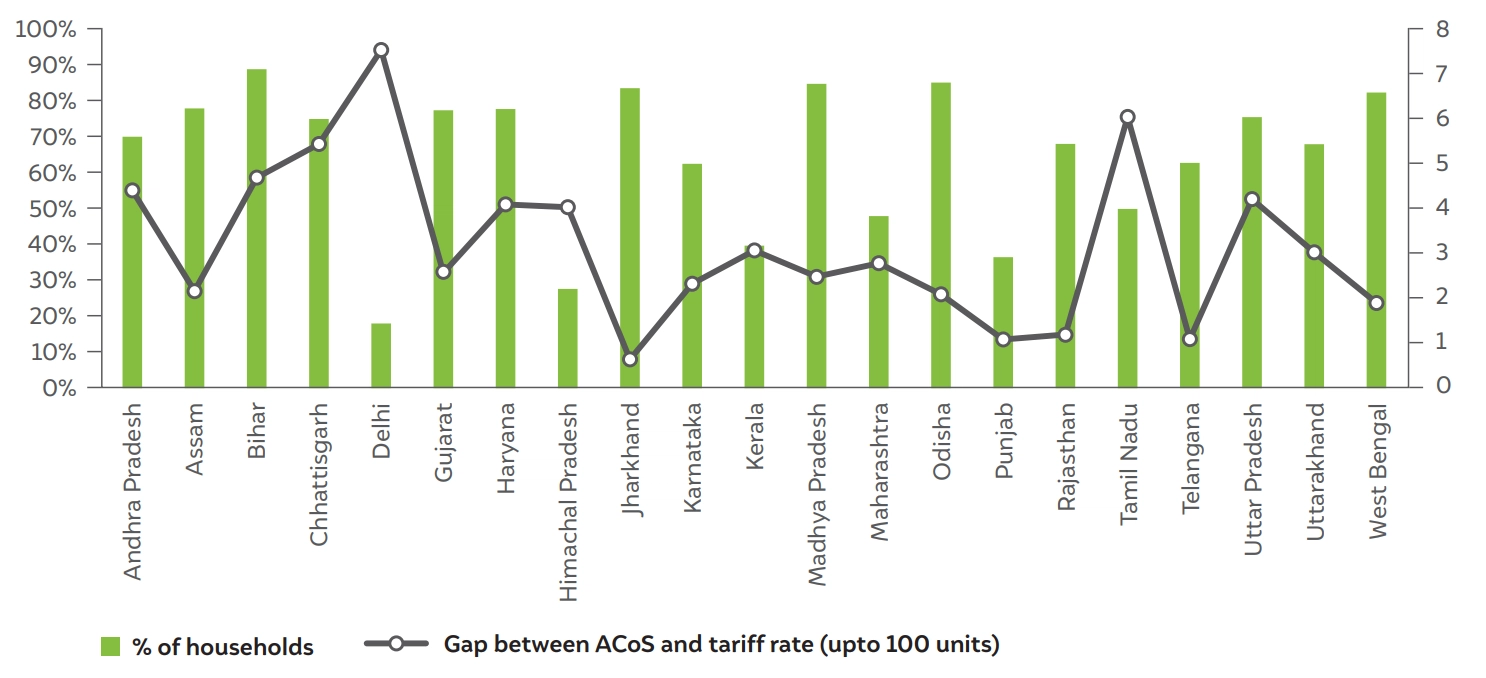

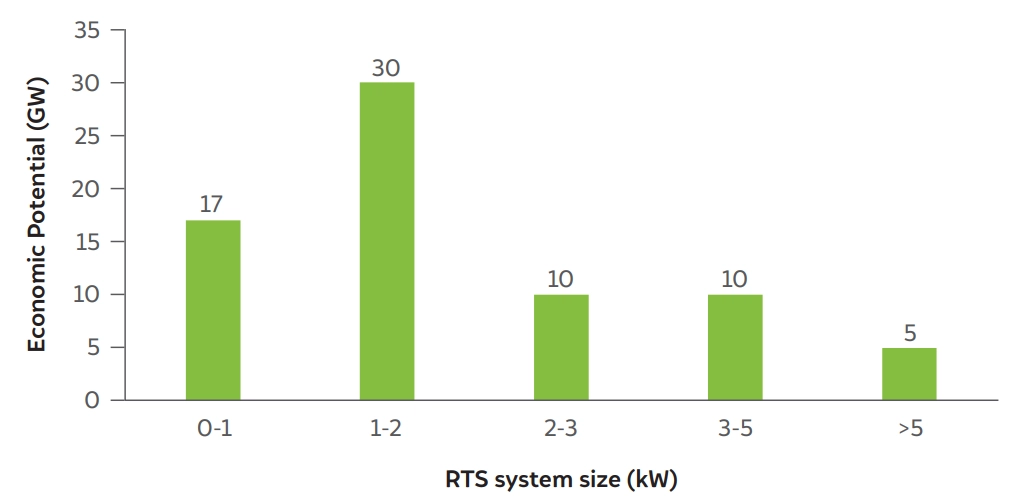

Residential consumers are at the core of challenges faced by the distribution companies. More than 70 per cent of households consume less than 100 kWh a month (Agrawal et al. 2020a). These consumers receive electricity at highly subsidised rates that are non-cost reflective, thereby resulting in under-recovery of cost and impacting the financial health of discoms. Distributed solar can play a catalytic role in the financial turnaround of the distribution sector by injecting low-cost solar to serve the subsidised consumers, which helps reduce the average cost of supply. These consumer segments also have the highest share in terms of economic potential, with 80 per cent of the total economic potential lying between the 0–3 kW system size. However, the uptake of rooftop solar in the residential segment has been marginal over the years, particularly among the low-consumption consumers. Several perceived risks such as low payment security, smaller and fragmented demand, and higher operational costs, hinder its adoption in the residential sector.

Innovative business models such as community solar would be essential to overcome these risks and support accelerated rooftop solar deployment. Community solar models aggregate demand and propose installing a more extensive system on the community premises owned by the utility, developer or community. These units connect at the distribution level, providing more comprehensive and controllable power supplies than household units. Utility-driven community solar models are also an attractive proposition for discoms. It benefits discoms in avoiding power purchase costs, meeting renewable energy obligations, reducing transmission and distribution loss, and transmission and generation capacity procurement.

Community solar models driven by discoms also provide different grid services compared to utility-scale installations. Solar units sited at feeders and substations provide power where users locally consume power, and mitigate grid inefficiencies that are currently present in the traditional model of pushing power out from a centralised generation source. Community solar models offer the discoms greater operational control at the community level, to serve the local load. The distributed nature of these systems adds to grid reliability and system benefits. The locally situated and load matched distributed resource reduces pressure on the grid by bringing down congestion and avoiding distribution system upgrades required to accommodate unidirectional power that larger resources might push. Community solar models also solve the grid stability challenges arising from rooftop solar’s fragmented and haphazard penetration, such as reverse power flow, voltage fluctuations, and power loss (Uzum et al. 2020).

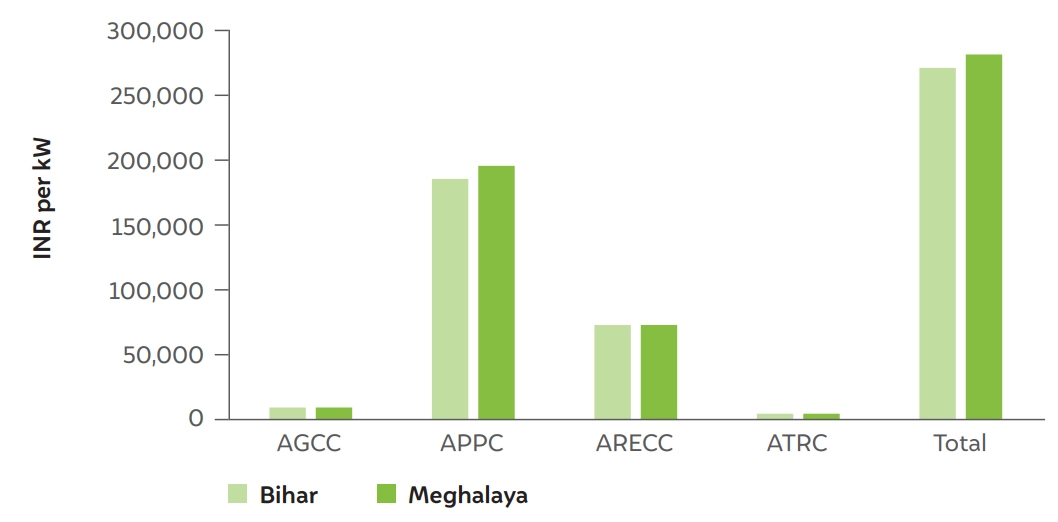

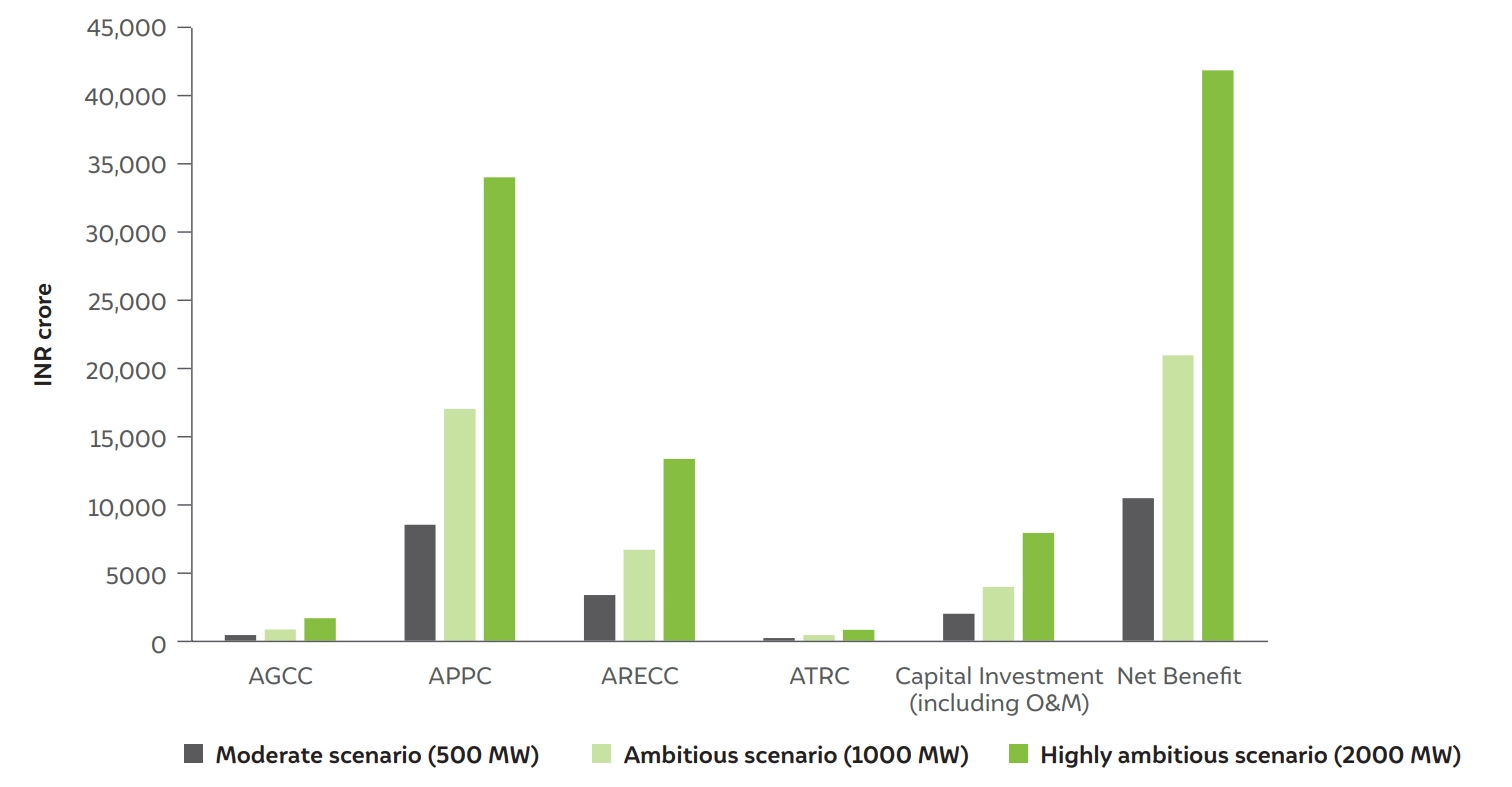

We present the case of utility-led community solar models in India and assesses the model’s feasibility for the states of Bihar and Meghalaya. To estimate the benefits to discoms from community solar, we adopted a framework developed by Kuldeep et al. (2019), called Valuing Grid-Connected Rooftop Solar (VGRS) framework. The findings from the analysis show that at the system level, 100 kW installation by North Bihar Power Distribution Company Limited (NBPDCL) and Meghalaya Energy Corporation Limited (MePDCL) saves INR 2.7 crore (or USD 3.5 million1 ) and INR 2.8 crore (or USD 4 million) during the lifetime of the project, respectively. Among other benefits, savings were highest from the avoided power purchase cost. In terms of per kW, Bihar saves INR 2.7 lakh (or USD 3,558) per kW and Meghalaya INR 2.8 lakh (or USD 3690) as shown in ES 1. The scaling up of community solar installation under different scenarios increases the benefits multifold. A total of 500 MW community solar systems’ installation in Bihar results in a projected system-level net benefit of INR 10,478 crore (or USD 1.4 billion) over 25 years. In the 500 MW installation scenario, the first-year benefits could reduce the subsidy requirement by 8 per cent (BERC 2022).

There are long-term benefits for discoms from scaled community solar installations. However, the current Indian ecosystem is not ready to adopt these models and is restricting their adoption. The key barriers include discom access to finance, absence of financial incentives, tedious tendering process, lack of interest among discoms, etc.

As these models have not been tested in India, a pilot of such a project will demonstrate the potential benefits to discoms with support from enabling policies. To support and scale up the community solar model in India, we propose the following recommendations:

The power sector in India has undergone a significant transformation, both at the central and state levels. Several efforts have been made in the last few decades to revamp the distribution sector, such as unbundling state electricity boards, allowing open access in distribution, and making regulatory bodies autonomous. However, the sector continues to face considerable challenges.

Distribution utilities (discoms) continue to struggle with challenges such as theft, billing and metering inefficiencies, high cross-subsidy burden, higher T&D losses, legacy PPAs, and underinvestment in infrastructure (Regy and Sarwal 2021). Ultimately, these challenges have led to a large number of discoms facing capital challenges and insolvency. The residential and agriculture consumers are at the heart of these financial challenges (Regy and Sarwal 2021). Under current conditions, electricity supplied to these consumers is highly subsidised across states, resulting in low revenues and leading to under-recovery of costs by discoms. The difference between cost and revenue is primarily compensated by imposing high tariff rates on commercial and industrial consumers, while the remaining revenue gap is supported through state subsidies and revenue grants under the Ujwal DISCOM Assurance Yojana (UDAY) scheme. In 2019–20, discoms recovered only 95 per cent of the total expenditure incurred on supplying electricity to consumers, after taking into account state subsidies, revenue grants, and other incomes (PFC 2021). Tariff subsidies constitute a significant portion of the total revenue, amounting to 17 per cent (PFC 2021). The cost of under-recovery by discoms impacts the overall financial health of the power sector (Garg and Shah 2020). This condition threatens the viability of the sector and handicaps the sector’s ability to contribute to meeting national climate and renewable energy goals.

Operational performance of discoms across India lags behind performance of discoms in other modern countries. The T&D3 losses at the national level stand at ~20.66 per cent, with distribution losses amounting to INR 31,672 crore (or USD 4.17 billion4 ) (CEA 2022; PFC 2021). The aggregate technical and commercial (AT&C) losses have been improving, down to ~22 per cent, but are still considerably high as compared with performance in other countries such as Japan (4 per cent), China (5 per cent), the United States (6 per cent) (Regy and Sarwal 2021). The billing and collection efficiency of discoms has also improved but remains far from achieving 100 per cent and currently stands at 85 per cent and 92 per cent, respectively. The profitability gap continues to be positive, as demonstrated by the average cost of supply (ACS) being higher than the aggregate revenue requirement (ARR)5 and is currently at ~INR 0.6 per kWh (PFC 2021). The operational and financial performance varies considerably across states and between private and state discoms. The AT&C losses vary from more than 30 per cent in Madhya Pradesh, Jharkhand, and Bihar, to less than 15 per cent in Tamil Nadu, Kerala, Punjab, Gujarat, Andhra Pradesh, etc. (PFC 2021). A few states and union territories perform well and incur surplus instead of revenue losses per unit, such as Gujarat, Assam, Chandigarh, and Mizoram (PFC 2021). The inefficiencies in the distribution sector impact the financial health of discoms and result in massive overdue balances to generators. As of March 2022, the discoms’ overdue balance to generation companies at the national level is INR 92,184 crore (or USD 12 billion) (Ministry of Power n.d.).

Several central schemes have been introduced to fastrack the upgradation of distribution infrastructure and improve operational efficiencies, such as UDAY, Integrated Power Development Scheme (IPDS), and Deen Dayal Upadhyaya Gram Jyoti Yojana (DDUGJY) (Regy and Sarwal 2021). However, the distribution sector continues to face clear barriers. Transitioning to distributed renewable energy (DRE) is emerging as an opportunity that can also contribute to meeting various objectives envisioned in the above-mentioned schemes, and this can lead to improved discom performance such as making the residential consumer self-sufficient, reducing billing and collection issues, and reducing losses by co-locating the systems at the point of consumption, among others.

In most of the states in India, the electricity consumption is positively skewed, with more than 70 per cent of households consuming less than 100 kWh a month (Agrawal et al. 2020b). A large portion of these households resides in rural and semi-urban areas. These consumers’ usage characteristics and payment habits contribute significantly to financial and operational challenges faced by discoms. The linkage between low-income households and discom challenges is explained in detail below.

Figure 1 The difference between tariff rate and cost of supply is significant across states

Source: Agrawal et al. 2020b; PFC 2021

Distributed solar can play a pivotal role in the financial turnaround of the distribution sector by injecting low-cost solar to serve the subsidised consumers, and it helps to reduce the average cost of supply. It can also be instrumental in the decarbonisation of the residential sector, critical to achieving India’s renewable energy ambitions and net-zero goals. In addition, it offers several potential co-benefits such as job creation, better facilities for education and health, and improved power supply quality, among others (Purkayastha et al. 2021; Regy and Sarwal 2021; Tyagi et al. 2021). Distributed solar can come in many forms, from small modular rooftop units sited on consumers’ homes, to medium-sized units that serve the entirety of a multi-household building, to large units (e.g., 100kw) sited at a feeder or substation which pushes power to the grid and provides a variety of power and grid services.

Community solar models are a popular business model in the United States for deploying distributed solar technology. The model aggregates demand and proposes installing a larger system on the community premises owned either by the utility, developer or community. These units connect at the distribution level, providing larger and more controllable power supplies than household units. The medium-sized community solar model offers opportunities to solarise rural and semi-urban areas where consumers lack adequate roof space, in shaded areas, or face difficulties getting access to solar (such as low-income households). However, India’s discoms are not leveraging the benefits of distributed solar, and rather, many are opposing their adoption. Some discoms perceive the increased uptake of distributed solar as a disruption to their existing business model. The apprehensions among the discoms include the growing adoption of distributed solar by commercial and industrial consumers, further negatively impacting their revenues. Other key concerns include inequitable tariff mechanisms, the need to augment infrastructure, impact on the grid stability, increase in administrative responsibility, greater operations and maintenance, difficulty in recovery of fixed costs, etc. (Shakti and Deloitte 2016). The central government is pushing the deployment of rooftop solar through various schemes, such as a scheme for grid-connected rooftops and offering capital subsidies. However, the uptake of rooftop solar in the residential segment has been marginal over the years, particularly among low-consumption households in rural and semi-urban localities.

Within the residential segment, the early adopters so far are the high paying residential consumers and not rural and semi-urban households. While the opportunity exists in rural and semi-urban areas, there is significant inertia to move to rooftop solar due to limited awareness, high upfront costs, lack of financing, low paying capacity, etc. The consumer-centric challenges could be overcome through innovative models such as discom-owned community solar. This model also helps to overcome the discoms’ concerns over revenue loss, and supports accelerated distributed solar deployment.

Utility-driven community solar models are an attractive proposition for discoms. They enable the discoms to financially allocate the cheap, fixed price solar to the highly subsidised customers. It thereby benefits discoms in avoiding power purchase costs, meeting renewable energy obligations, reducing transmission and distribution loss, and transmission and generation capacity procurement. This will improve the financial health of the discoms by closing the gap between the cost of supply and revenue generated, resulting in reduced tariff rates in the long run. Over time, improvement to the financial health of the discoms by virtue of closing the gap between the cost of supply and collections will translate into savings for these consumers in the long run. These units can also provide balancing services and other grid needs. In addition, it helps them to contribute to the state’s solar energy goals through the accelerated deployment of distributed solar.

Community solar models are driven by discoms and also provide different grid services than utility-scale installations. Solar units sited at feeders and substations provide power where users locally consume power and mitigate grid inefficiencies that are currently present from the traditional model of pushing power out from a centralised generation source. It offers the discoms greater operational control at the community level, to serve the local load. The distributed nature of these systems adds to grid reliability and adds system benefits. The locally situated and load matched distributed resource reduces pressure on the grid by reducing congestion and avoiding distribution system upgrades, to accommodate unidirectional power that larger resources might push. It also solves the grid stability challenges arising from rooftop solar’s fragmented and haphazard penetration, such as reverse power flow, voltage fluctuations, and power loss (Uzum, et al. 2020). Community solar systems are also opportune sites for introducing battery storage solutions, creating further opportunities for grid support and other services.

Distributed solar holds an important place in India’s renewable energy ambitions. A 40 GW target was allocated to RTS out of the 175 GW target by 2022, to recognise its technical potential. However, the distributed sector has struggled to keep pace with utility-scale solar deployments.

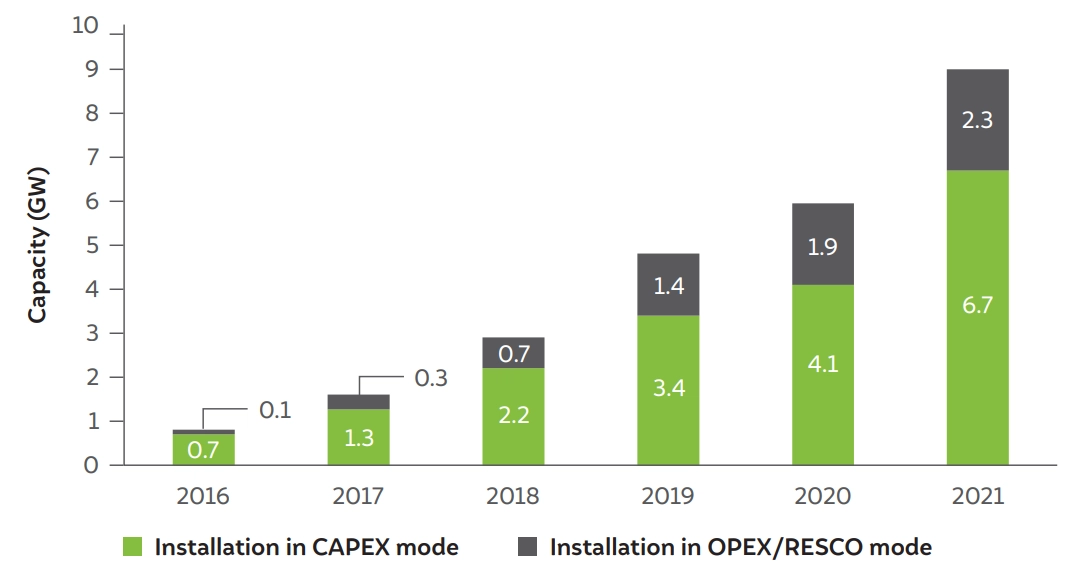

The share of RTS is minuscule and stands at 7.7 GW compared to the 37.5 GW capacity installed through utility solar, as on January 2022, as shown in Figure 2 (Bridge to India n.d.; MNRE n.d.).

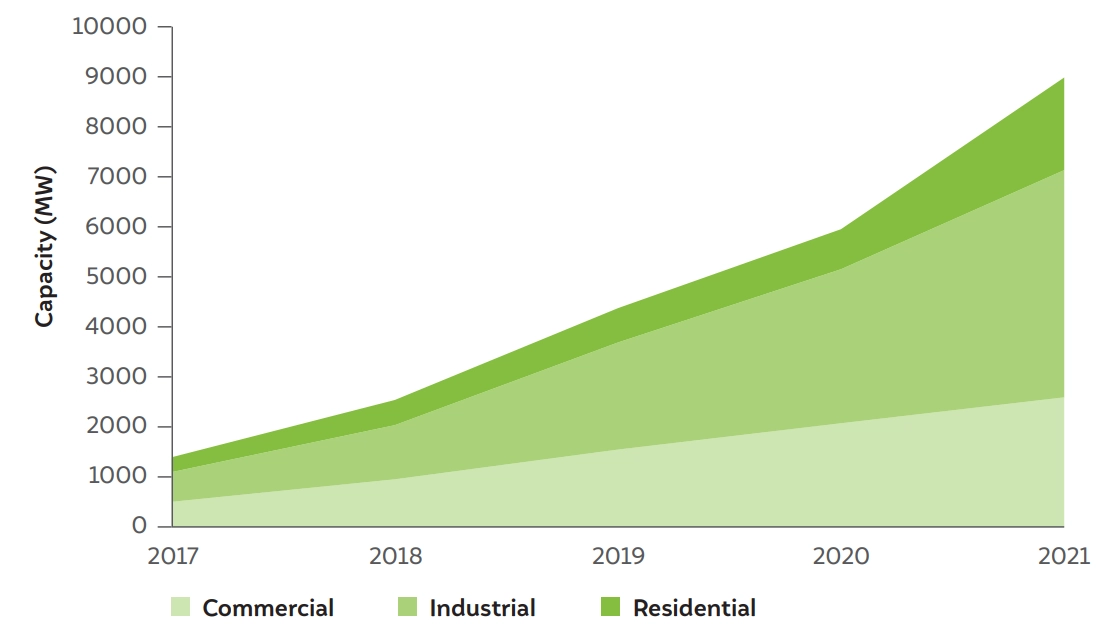

The RTS installations are primarily concentrated in two segments within the DRE sector – commercial and industrial (C&I). The residential sector only contributes 20 per cent of the total capacity, as shown in Figure 3. The high grid electricity tariff rates faced by C&I consumers make RTS adoption a value proposition. The solar developers also favour consumer segments that are most attractive economically and offer scale, such as C&I consumers. The CAPEX model is the preferred mode of installation by the developer, as shown in Figure 2, because the owner invests the upfront capital, and the developer is paid to install the system. Therefore, the developer/installer is not exposed to the consumer’s risk of default under the CAPEX model. For the OPEX/RESCO model, developers make the capital investment and mitigate their credit exposure to consumers by targeting high creditworthy consumers. The consumer credit exposure makes this model less preferred by developers. In addition, the RTS installations are primarily concentrated in industrial states such as Gujarat, Maharashtra, Haryana, and Rajasthan, which have become leaders in RTS for the C&I segment.

Figure 2 7.7 GW of rooftop solar installed against 40 GW of utility solar till June 2021

Source: Bridge to India, n.d.; MNRE, n.d.

Figure 3 Rooftop solar installations are highest in the industrial sector

Source: Bridge to India n.d.

Similar trends can be observed within the residential sector, where urban consumers with higher incomes and awareness of the benefits of solar are the leading adopters. These consumers also exhibit higher consumption characteristics and benefit from the market and economic benefits of adoption. At the same time, the role of RTS in rural areas is minimal and, in some cases, has limited access to electricity. Limited adoption in the rural semi-urban locality is also due to the challenges described in detail in Section 2.3. Barriers, such as financial constraints, policy uncertainties, restrictions on capacity installation by states, lack of uniformity in statutory approvals, and lack of consumer awareness, contribute to its limited adoption.

Improving the financial health of discoms is essential in decarbonising the high cost of service to low-income households. National and state decarbonisation goals require their inclusion. In order to include these segments, discoms must find opportunities to cover these costs but must do so in a way that meets the consumers’ and the utility’s needs. Under the current state, opportunities for these segments to decarbonise their consumption are non-existent and have not been the focus areas of policymakers. There is a need to switch gears and shift the focus to semi-urban and rural areas for three primary reasons:

Figure 4 Rooftop solar economic potential is highest in the 1–2 kW category

Source: Authors’ analysis based on IRES Survey data

The limited adoption of distributed solar in rural and semi-urban areas is due to several deterrents, both on the demand and supply sides. Some of the dominating factors are:

Traditional approaches to decarbonising these segments have not been successful so far. Therefore, we need to re-strategise and bring innovation in our approach to target the rural and semi-urban areas.

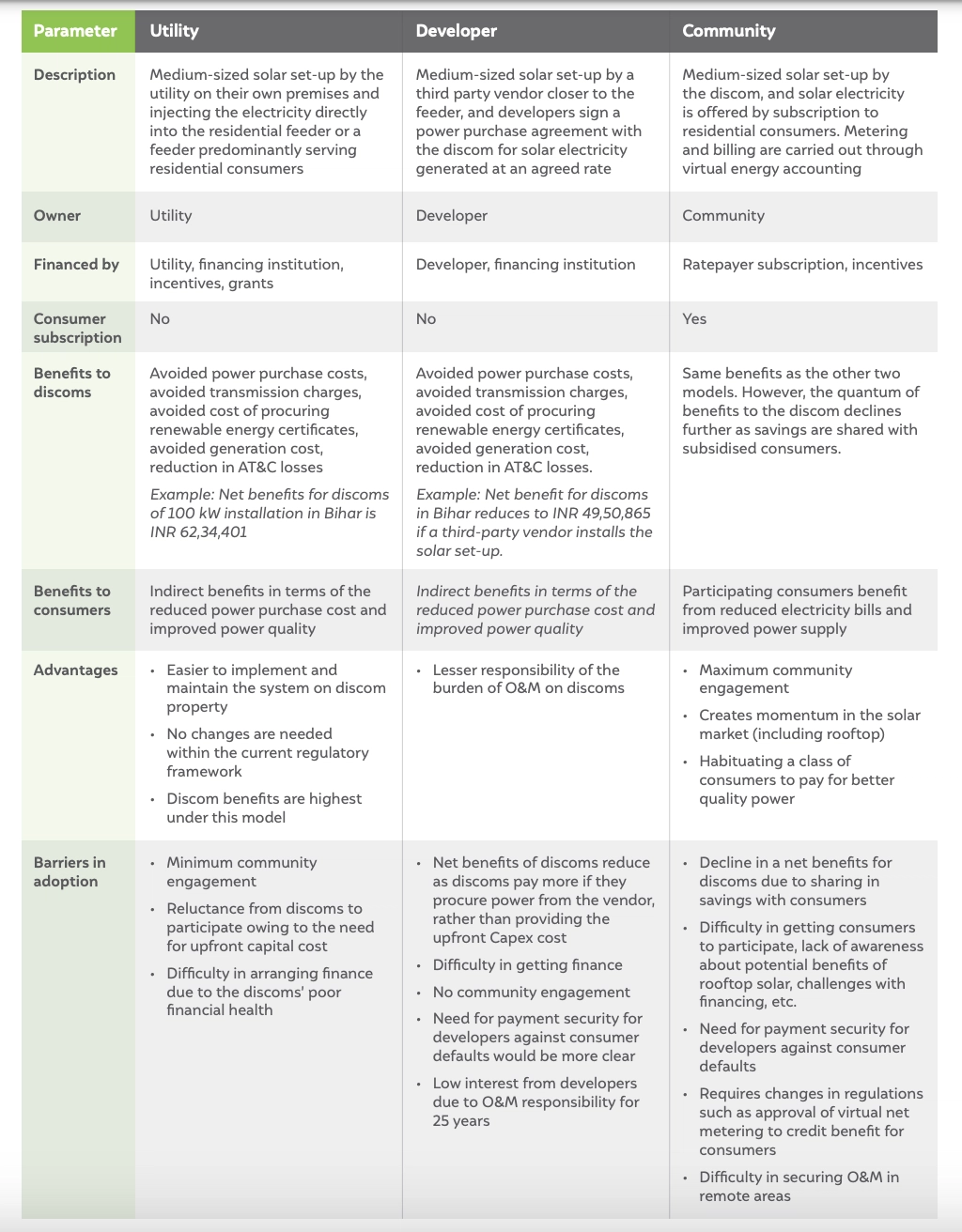

Community solar as a concept helps overcome market barriers in serving residential households in rural and semi-urban localities, such as lack of awareness, access to finance, and inadequate roof space. It provides an opportunity to community members to be part of the energy transition by sharing the benefit of solar power. The deployment of community solar models in the United States has been done primarily in three ways – utility-owned-and-operated, developer-ownedand-operated, and community-owned-and-operated (Coughlin et al. 2010). However, each ownership mode presents its own set of challenges. In the case of the community-owned-and operated model, major barriers are the need to sensitise consumers about the potential benefits, lack of access to upfront capital by consumers, and the need for bringing about regulatory changes to facilitate such a model (such as introducing virtual net metering regulations, updating billing and metering mechanisms, etc.).

Considering the low success of RESCO models in India for RTS, developers will have similar apprehension for RESCO-based community solar models, such as the risk of consumer default, policy uncertainty, and burden of maintaining the system for 25 years, etc. Therefore, in the case of India, utility-led community solar models are more promising. This is because discoms are best placed to overcome these challenges (operations and maintenance, upfront cost, billing and metering, virtual net-metering, etc.) and could also achieve scale.

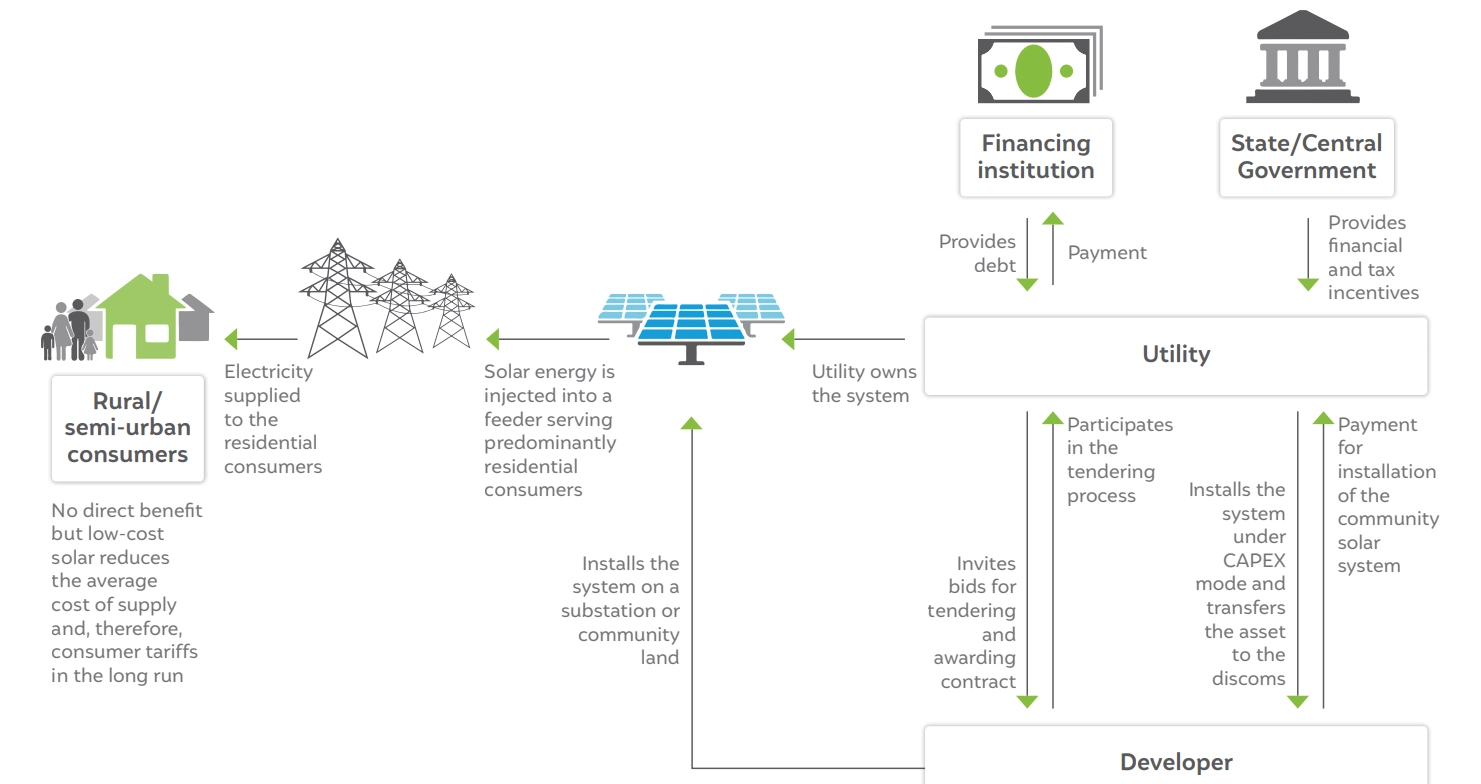

Under the discom-owned-and-operated model, the discom deploys a medium-sized solar PV system (100– 150 kW). The installation is carried out either on the discom’s substation land or on community land, in close proximity to a residential feeder. In the case of nonsegregated feeders, the feeder serving predominantly residential consumers is targeted. The energy generated by these systems is directly fed into the feeder supplying the residential load. The system will be set up by a solar developer/EPC company selected through a tendering process. The responsibility of operating and maintaining the system lies with the discoms.

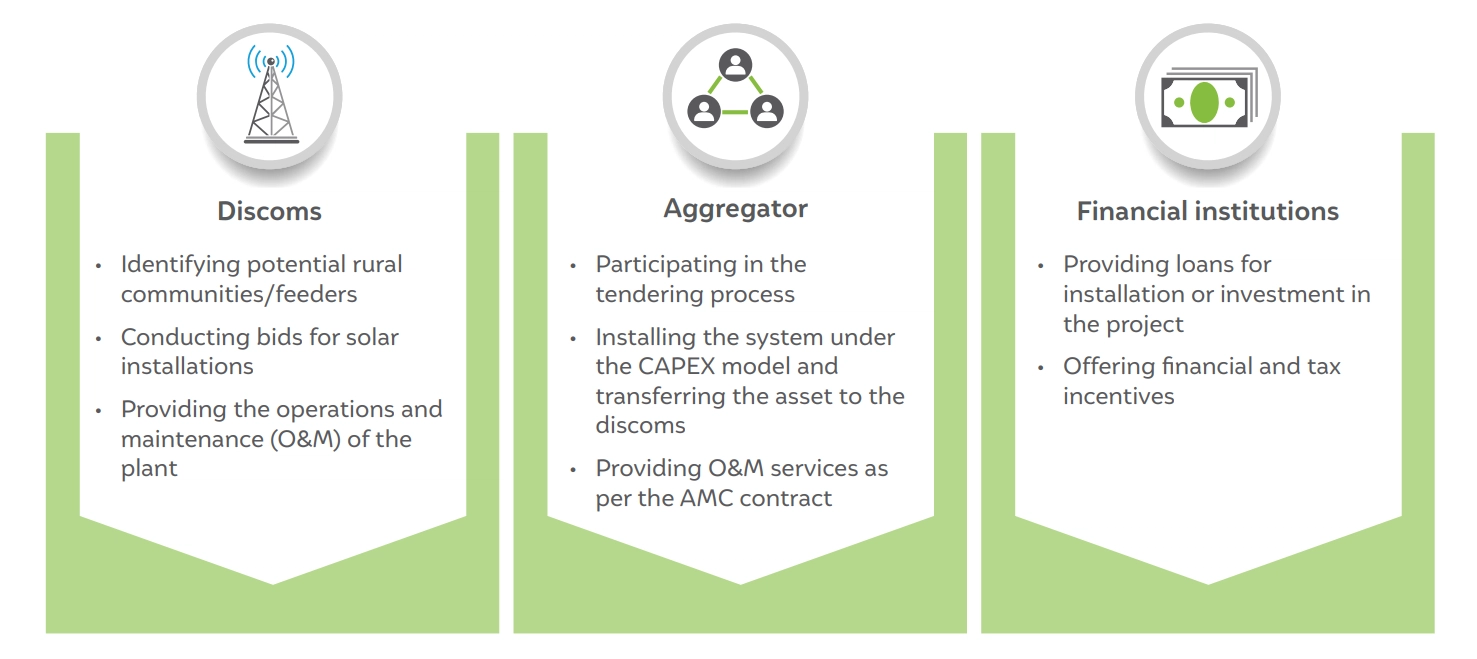

In this model, discoms benefit from the reduced cost of providing electricity to sparsely distributed rural consumers. This model involves no direct community engagement but provides indirect benefits to consumers. That is, the overall savings under this model improve the discoms’ financial health and reduce supply costs. This translates into a reduction in tariff rates in the long run for consumers. In addition, the quality of power supply also improves for consumers with the co-location of the generating station closer to the feeder. The responsibilities of different stakeholders are described as follows, and shown in Figure 6.

Figure 5 Responsibilities of different stakeholders under the community solar model

Source: Authors’ analysis

Figure 6 Schematic of a utility-owned community solar model

Source: Authors’ analysis

The project is supported by the US-India Clean Energy Finance (USICEF) task force which is a coalition between the Ministry of New and Renewable Energy and the US Department of State. Bihar and Meghalaya were selected as the potential states under the project, to assess the utility-led community solar model’s feasibility in targeting residential communities. Both states are predominantly comprised of rural households, with more than 80 per cent of households living in rural areas (Census 2011). In Bihar, more than 60 per cent of energy is sold to domestic consumers, whereas their share in the revenue is 31 per cent, resulting in a revenue gap (BERC, 2022; PFC 2021). A similar trend is observed in the case of Meghalaya, with a share of about 26 per cent in energy sold and about 24 per cent in revenue (MSERC 2021; PFC 2021). To compensate for the revenue gap, Bihar and Meghalaya discoms received a subsidy of INR 5,193 crore (or USD 0.7 billion) and INR 10 crore (or USD 1 million), respectively (PFC 2021).

In terms of per-unit basis, Bihar received a tariff subsidy of INR 1.63/kWh and Meghalaya INR 0.04/kWh, to cover up for the revenue gap of more than INR 4/kWh (PFC 2021). Therefore, both states became suitable candidates for the installation of utility-owned community solar models to improve the discoms’ financial health.

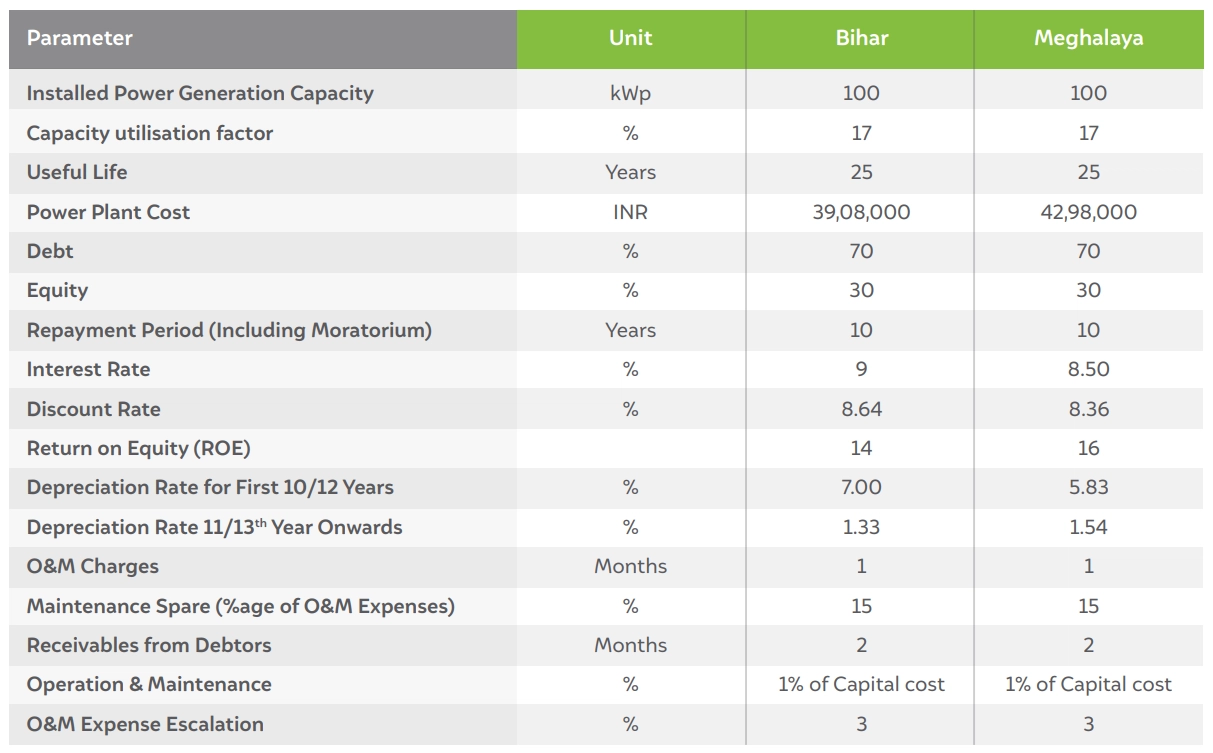

For the feasibility assessment, we adopted the approach developed by Kuldeep et al. (2019) to estimate the value of a grid-connected rooftop solar system, the VGRS framework. The approach estimates the direct benefits to discoms of installing distributed solar such as savings in terms of the average power purchase cost (APPC), avoided generation capacity costs (AGCC), avoided transmission charges cost (ATRC) and avoided renewable energy certificate cost (ARECC). These benefits are compared with overall capital investment to estimate the return on investment. The detailed methodology of the VGRS framework and assumptions are discussed in the annexures. APPC savings refers to the discoms savings in terms of the variable component of the power purchase cost. AGCC captures the saving in terms of avoiding fixed expenses of signing a new PPA as generation from the solar plant can decrease the contracted capacity for a new PPA. An increase in distributed solar capacity within a discom’s distribution network reduces its overall energy requirement. This reduces the need for additional transmission capacity, and these savings constitutes the ATRC benefit. The ARECC refers to the cost of avoiding the purchase of renewable energy certificates by discoms to meet their renewable purchase obligations. The findings from the benefit analysis are presented here:

Overall, the return on investment is positive for discoms if they own and operate the model with net benefits11 of INR 62 lakh (or USD 81,709) in the case of Bihar. For Meghalaya, the net benefits of a 100 kW community installation are INR 61 lakh (or USD 80,391). Therefore, there is a significant role utility-owned community solar could play in improving the financial health of discoms.

Figure 7 Significant system-level benefits if a 100 kW community solar system is installed by NBPDCL and MePDCL

Source: Authors’ analysis using the VGRS framework developed by Kuldeep et al. (2019)

Figure 8 System-level benefits of community solar system installation in Bihar are positive under three scenarios

Source: Authors’ analysis using the VGRS framework developed by Kuldeep et al. (2019)

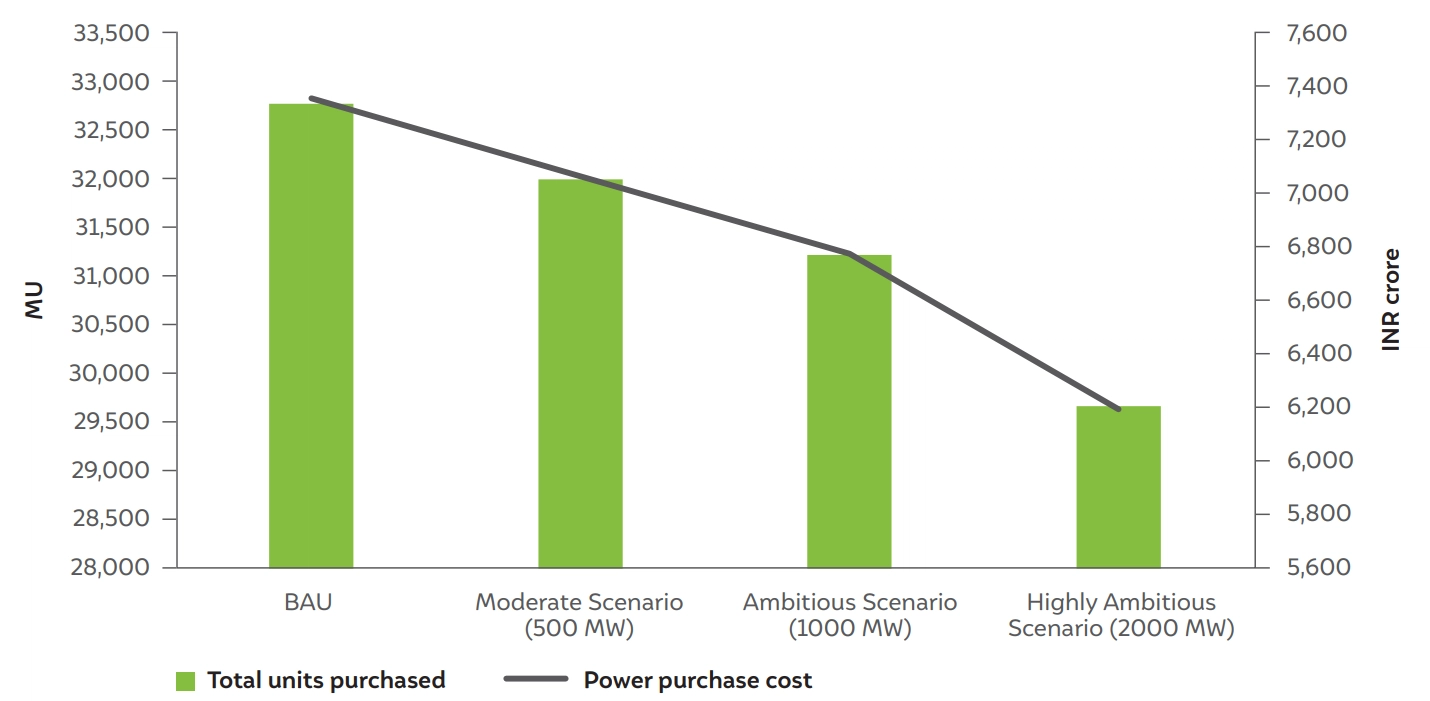

Figure 9 Significant decline in power purchase requirement and cost under three scenarios for NBPDCL

Source: Authors’ analysis using the VGRS framework developed by Kuldeep et al. (2019)

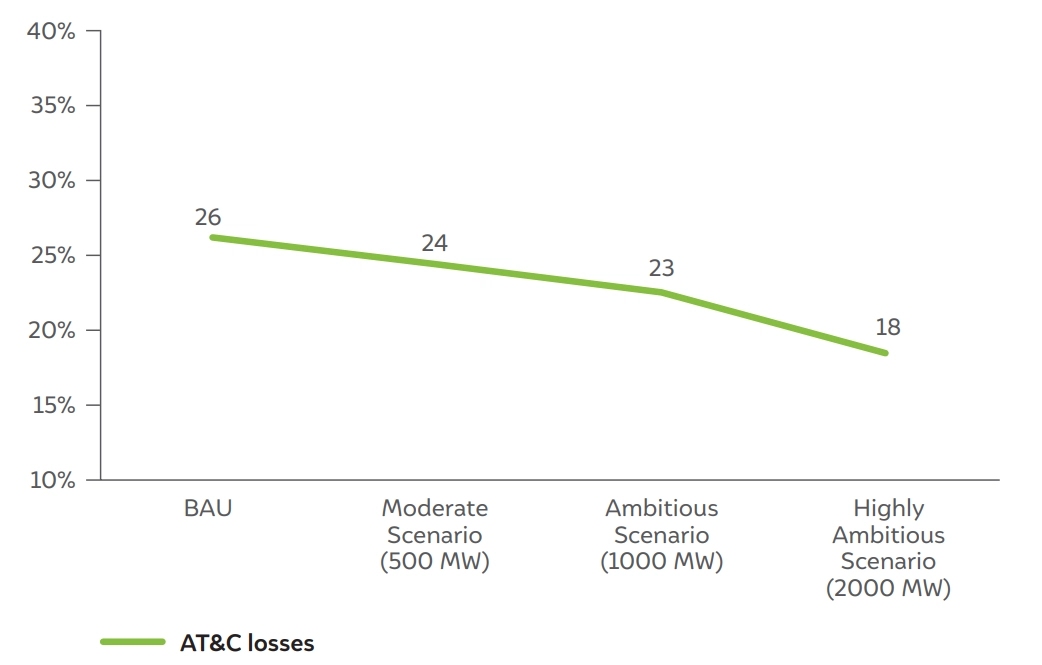

Figure 10 Scaled community solar installation increases the pace of decline of AT&C losses

Source: Authors’ analysis using the VGRS framework developed by Kuldeep et al. (2019)

Source: Coughlin et al. 2010; Heeter et al. 2021

Discom financial benefits are highest in the utility-owned community solar model, with no sharing of direct savings either with consumers or developers. Considering the operational challenges, it is easier to implement the utility-led model as it is a new concept for India. Other ownership models could be tested later on, as the utility-owned installation proves the validity of its concept and scales.

Despite the significant potential to scale up, the Indian ecosystem faces real barriers to adopting community solar in the described context. There are several challenges faced by discoms, restricting its adoption in India.

As Section 3.2 shows, there are long-term benefits for discoms from scaled community solar installations. However, these models have not been tested so far in India. A pilot of such a project will demonstrate the potential benefits to discoms, as supported by enabling policies. Community solar installations in the United States have been supported by enabling regulations and policies, which contributed significantly to scaleup (Heeter et al. 2021). Therefore, there is a need to create a supportive ecosystem that would require persistent efforts to nudge the discoms into undertaking community solar installations.

This section suggests key recommendations to support and scale up the community solar model in India. Each recommendation highlights the key beneficiaries, main actors, and the proposed intervention’s envisioned impact.

The MNRE Phase II scheme provides a capital subsidy for RTS installation in the residential sector and encourages discoms to play a pivotal role in the process (MNRE 2019). However, the progress has been limited so far with minimal utilisation of funds. Utility-led community solar serves both these purposes, with discoms cost-effectively undertaking the charge to solarise the residential feeders. There is a need to modify the existing provisions under component A of the MNRE phase II scheme to incorporate community systems that are not installed on consumer premises but nonetheless serve or benefit residential consumers. The current financial assistance is available to the system installed within the consumer premises, with residential consumers being the direct beneficiaries. Further, delinking the subsidy from consumers’ contract account (CA) numbers (meter/consumer identification code) would enable utilities to avail of the capital subsidy for aggregated community solar installations. In addition, the utility-led community solar model benefits from economy of scale and requires lower subsidies compared to residential consumers. Therefore, they would help to drive the market away from subsidies quickly, while continuing to replace residential electricity with solar.

Utilising capital subsidy under the existing MNRE scheme would help to initiate the deployment of community solar installation. However, to keep a targeted focus on community solar in the long run, a dedicated scheme for community solar could be proposed by MNRE or the states. The focus of the scheme would be low-paying consumers in rural and semi-urban areas. The scheme could target residential feeders if segregated, or feeders serving predominantly residential consumers, and the system would be installed closer to the feeder. The scheme could include provision for capital subsidy for community installations with a share from both central and state governments. Discoms would be encouraged to select the feeder with high T&D losses or theft issues and lower bill payments to help them minimise the cost to serve these consumers and improve their financial health. Siting within communities may increase the local community’s sense of ownership in the system, improve the project’s visibility, or allow local communities’ engagement through voluntary labour and/or job trainees.

Getting finance is a challenge for debt-laden utilities due to their poor credit rating, and discoms would face a similar challenge for community solar installations. In the present scenario, state governments bear a large portion of the cross-subsidy burden to provide electricity to residential consumers at a lower rate. The state subsidy amount from the state government could be utilised in two ways. First, the state government could extend such funds directly to utilities to set up community solar installations. Second, such funds could be allocated to create a payment security mechanism to help discoms raise cheap capital in local currency. This is the most preferred route that would help drive the market away from subsidies in the long run. This will also ring-fence the returns to investors by providing security against payment defaults. Utilities could explore seeking finance directly or creating an off-balance sheet special purpose entity (SPV) with no recourse to the utility’s balance sheet. Creating such an SPV would enable utilities to secure finance at lower interest rates. However, separation in the cash flows of SPV and the utility is necessary to ensure transparency. Community solar could also be presented as a green network investment by utilities for network optimisation and can thereby secure finance at a lower rate. In addition, utilities could also explore concessional loans through the existing line of credit under the clean technology fund from the World Bank and Asian Development Bank for community solar installation.

The RDSS aims at improving the quality, reliability and affordability of power supply and improving the financial performance of the discoms by reducing the AT&C losses and reducing the ACS-ARR gap (MoP 2021). Community solar installation driven by utilities can potentially be used for network optimisation and could contribute significantly to the objective of the RDSS scheme by reducing the cross-subsidy savings, habituating bill payment, reducing T&D losses, and lowering investment in infrastructure, thereby improving the utilities’ financial health. A 100 kW system saves INR 2.7 lakh per kW during the lifetime of the project for a discom, with a significant reduction in the power purchase cost. Therefore, to encourage utilities to undertake community solar installation, the MoP could impose a criterion under the RDSS by linking the incentive of improved power performance by achieving x percentage of sales through community solar in rural and semi-urban localities. This could be potentially linked with component II, ‘Distribution Infrastructure Works’, of the scheme, focusing on loss reduction. This will improve system-wide benefits and potential future losses related to cross-subsidy burden, which could significantly impact the performance of discoms.

Discoms, in general, face low participation from solar companies for distributed solar tenders. This is largely driven by multiple challenges and tendering for community solar might encounter similar challenges. To smoothen the process of implementation, a model tender document could be prepared by MNRE/SECI with key elements, such as simplification of the process, rationalisation of the timeline, including buffers for external shocks, standardisation of performance ratios, detailed information on benchmark rate (scope of work, their use as an indicative cost rather than ceiling rate, adjusting for external shocks, creating rationalisation of tiers), revisiting the amount of EMD and performance security to facilitate ease in deployment, linking performance bank guarantee with performance evaluation criteria, among others.

Introducing battery storage will have additional benefits for discoms, such as peak shaving with a subsequent impact on the cost of supply. A battery storage component could be introduced later on, as the community solar installation picks up. Therefore, existing community solar sites would become potential candidates for introducing storage, increasing the manifold benefits of community solar. However, a cost-benefit analysis needs to be carried out to identify net benefits to the discom by introducing storage. To finance battery storage for community solar, incentives available under the battery storage scheme could be explored.

The community solar model could be extended further in the long run to encourage consumer subscription. Community solar provides an opportunity for consumers to participate in the energy transition process and offers multiple benefits such as improved quality of supply even in the the remotest of places, increased livelihood opportunities, and improved access to other facilities such as health and education. Presently, there are several challenges to the consumer subscription model, such as lack of awareness, subsidised electricity tariffs, restrictive metering provisions, and lack of finance. However, after the communities become accustomed to the concept of community solar, incentives could be introduced, such as rebates for timely payment in the form of energy credits, to encourage consumer participation, similar to what has been offered in the United States.

Table A1 Assumptions for levelised cost of energy (LCoE) calculations

Source: (BERC, 2017, 2022; MNRE, 2021; MSERC, 2014, 2021)

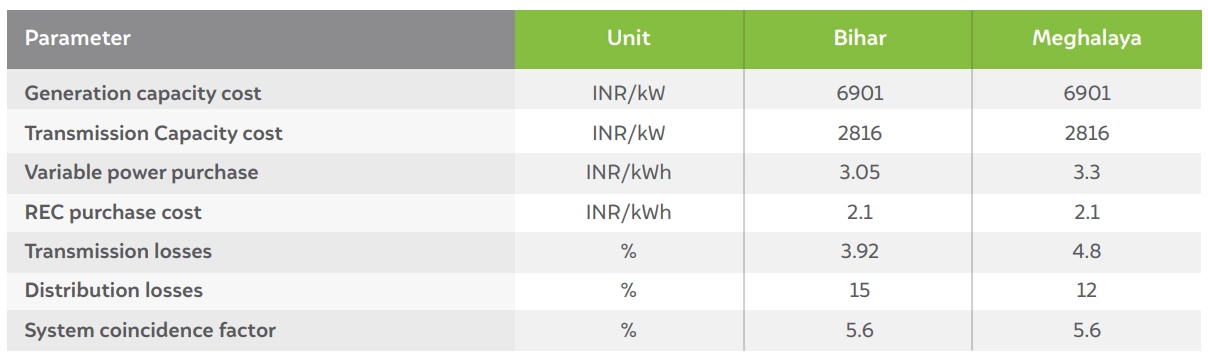

Table A2 Assumptions for cost-benefit analysis

Source: (BERC, 2017, 2022; MNRE, 2021; MSERC, 2014, 2021)

The methodology to calculate cost and benefit are derived from Valuing grid-connected rooftop solar study (Neeraj et. al, 2019).

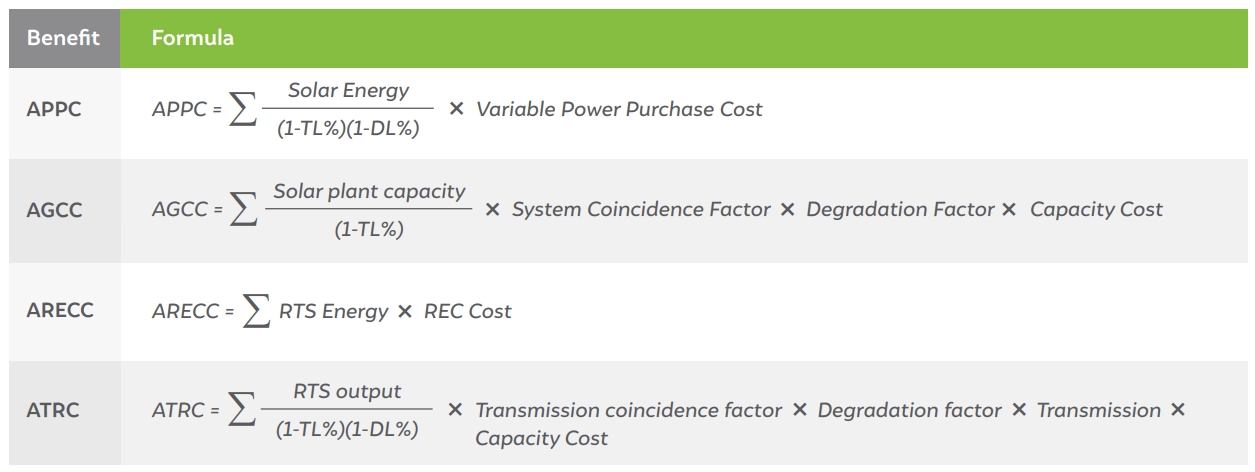

Table A3 Formulas for estimation of different benefits

Source: (Kuldeep et al., 2019)

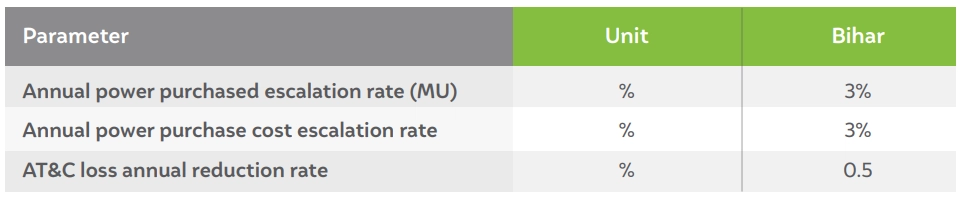

Table A4 Assumptions for state-level analysis

Source: Authors' analysis

The community solar model aggregates electricity demand and installs a larger solar PV system on community premises to meet this demand. These systems can be owned by the utility or the developer or the systems can be jointly owned by the community.

The main difference between local solar and community solar is the ownership of the solar PV system. Local solar is characterised by individual ownership whereas community solar involves multiple participants who own the system or subscribe to it.

MNRE and the US Department of State signed a statement of intent (dated 15 November 2018) on the utility-led, community-based demand aggregation business model. As part of this work, Bihar and Meghalaya have been studied to estimate the feasibility of implementing utility-led community solar models. The community solar model has also been included in solar policies of states such as Jharkhand, Uttarakhand and Delhi (draft).

The community solar model helps address challenges faced by discoms such as access to finance, lack of economic incentives, challenges in the tendering process and so on. It also addresses the barriers faced by consumers such as low levels of awareness, high upfront costs, lack of financing options, lack of adequate roof space, etc. In addition, the utility-led community solar model enables discoms to allocate cheap, fixed-price solar to highly subsidised customers and offers discoms greater operational control at the local level.

Enabling a Circular Economy in India’s Solar Industry

Mapping India’s Residential Rooftop Solar PotentialA bottom-up assessment using primary data

Promoting the Use of LPG for Household Cooking in Developing Countries