Policy Brief

Agenda for a Reformed Power Sector in India

Risk, Resource, Relay, and Restructuring

Karthik Ganesan, Abhishek Jain, Sudatta Ray, Mohit Sharma, Arunabha Ghosh

December 2014 | Power Markets

Suggested Citation: Karthik Ganesan, Abhishek Jain, Sudatta Ray, Mohit Sharma, and Arunabha Ghosh. 2014. Agenda for a Reformed Power Sector in India: Risk, Resource, Relay, and Restructuring. New Delhi: Council on Energy, Environment and Water.

Overview

This policy brief deep dives into India’s power sector and provides an overview of the issues that have necessitated reforms in the sector. It identifies four key areas that needed attention: the risks entailed in banks’ exposure to the power sector; the resource crunch i.e. limited availability and low quality of coal supplies; the challenges in operationalising open access in the transmission of electricity; and the eventual imperative of restructuring power distribution companies (DISCOMs), improving the state of their finances and the efficiency of their operations. Further, it provides a time-bound suite of recommendations, which may set future developments on the right course.

Key Highlights

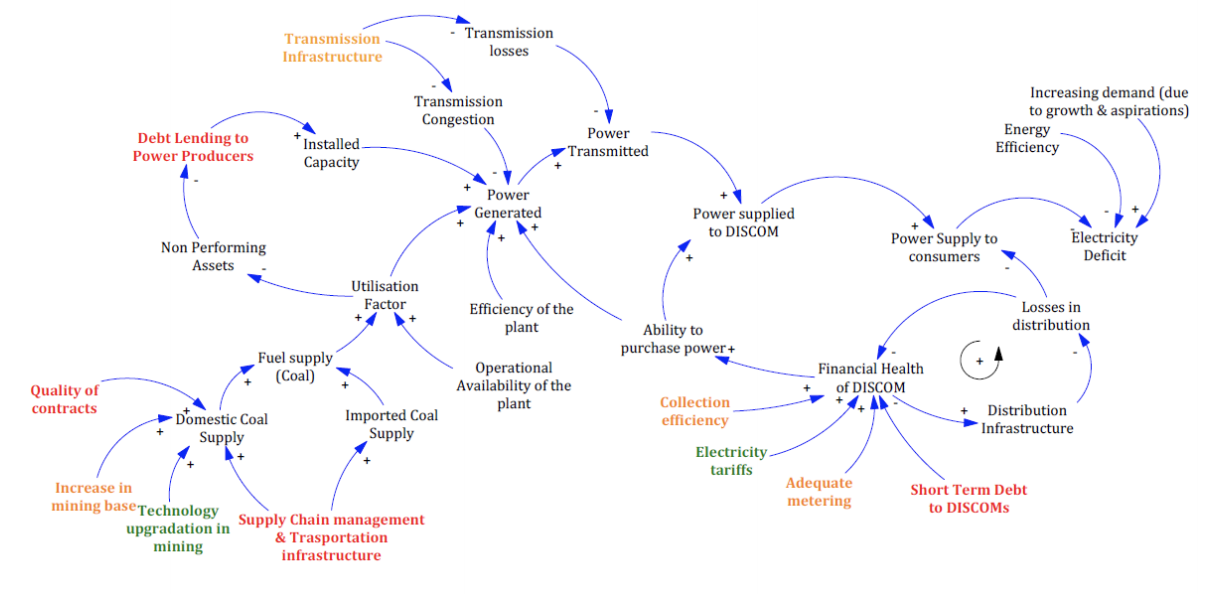

- The power sector challenges include the poor financial state of DISCOMs, the shortfall in domestic coal supplies, insufficient transmission infrastructure, and rising inventory of non-performing assets (NPAs).

- The power sector consumes 70 per cent of domestically produced coal, yet dependence on imported coal (20 per cent in 2013-14) is rising year on year.

- A growing base of NPAs leads to credit shortfalls in the power sector, which severely hampers new investments.

Casual loop diagram of India’s power sector challenges

Challenges in fuel supply

- Challenges in fuel challenges include unequal contractual provisions, inadequate supply, and poor transport logistics.

- In case of a shortfall from the original source, supply from alternate sources is arranged entirely on terms specified by the seller, including the delivery point.

- To increase the supply of coal, improve the efficiency of existing mines through advanced technology, increase the quantum of imported coal at competitive prices, and spur the new supply base's development.

- More than 450 MT of coal was carried on the railways' network in 2011-12 with an average distance travelled of 639 kilometres. But such long haulage leads to increased delivery costs, thefts and life-cycle energy consumption.

Challenges to open access

- While all states in India have notified open access, only 19 have determined all the charges (cross-subsidy charges, wheeling charges, transmission charge) on open access.

- Separating distribution (the physical infrastructure) and retail supply (the service) could be pivotal for open access in the retail electricity market.

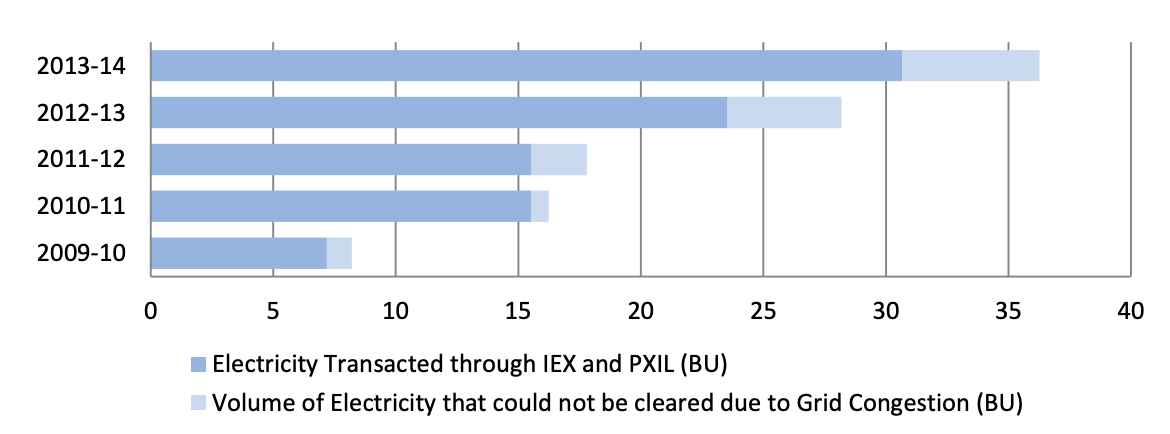

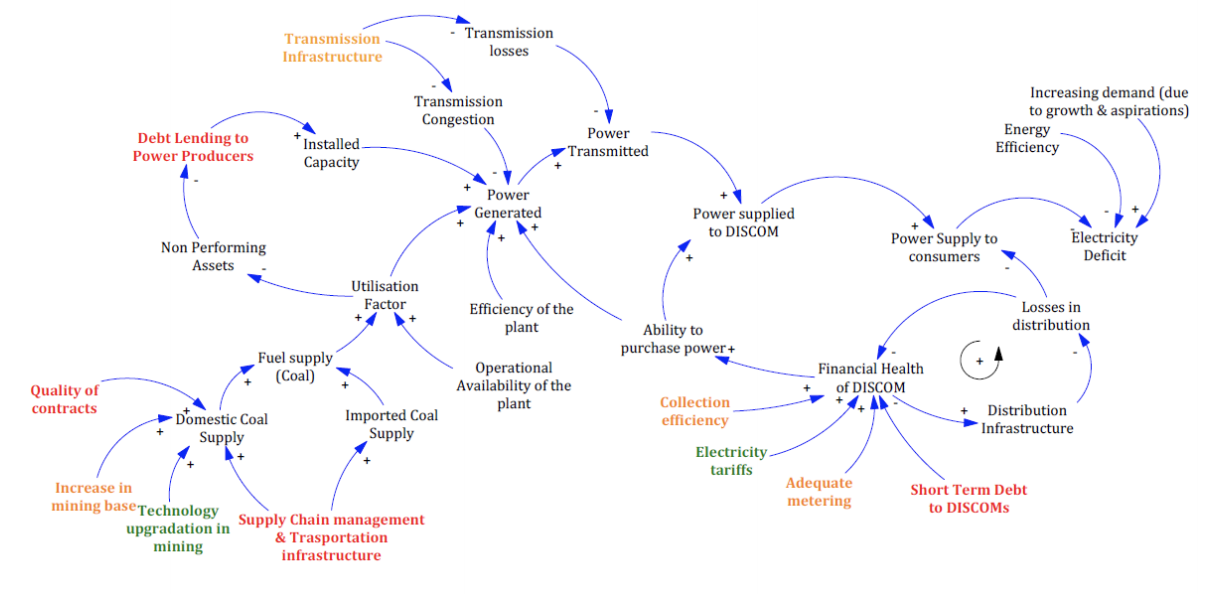

- In 2013-14, grid congestions prevented 15 per cent of available power from being transacted at the two leading power exchanges, IEX and PXIL.

Lost transactions in power markets due to grid congestion

Source: CEEW analysis based on IEX & PXIL reported data

Poor financial health of DISCOMS

- The increasing pile of ‘Regulatory Assets’ (RAs) with the DISCOMs is adversely affecting utilities' financial health. The overall accumulated RAs have grown to INR 70,000 crore (USD 11 billion) in 2014.

- In Uttar Pradesh and Rajasthan, the negative spread between the procurement price and the average tariff has been larger than 25 per cent in recent years. This points to one of the core reasons for the financial unsustainability of DISCOMs.

- The main causes of aggregate and commercial losses (AC&T) include unmetered consumption, low collection efficiency, and high technical losses due to insufficient capital expenditure on up-gradation of existing infrastructure.

- The extent of commercial losses of DISCOMS across India increases by over 50 per cent in the absence of subsidy.

Key Recommendations

- Set up a coal regulator and an appellate body. The coal regulator would be the key driver of the reforms on the contracting process and enforcement. The appellate body can decide on matters of non-performance.

- Focus on improving supply chains in importing coal and delivering coal to power plants and other end consumers.

- Establish an e-auction platform dedicated to imported coal, focusing on achieving 100 per cent import procurement through this entity in the next three years.

- Standardise coal quality (post-washing) from all mines as this will make it easier to find and swap opportunities in times of need.

- Implement smart grid technologies to improve the monitoring and management of grid operations.

- The RBI should outline prudential norms for the power sector, discouraging exposure to groups with poor credit, many unfinished projects, or little cash flow from existing ones.

- Revise the present structure of DISCOMS to include multiple retail businesses and a centralised distribution network.

The extent of commercial losses of DISCOMS across India increases by over 50 per cent in the absence of subsidy.